Question

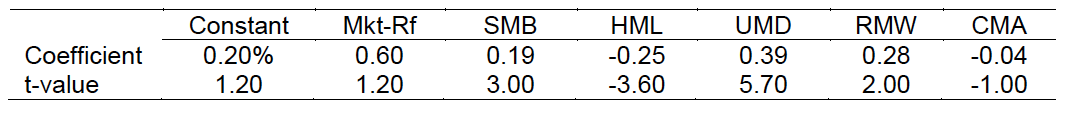

Suppose we run a six-factor model, including market, size, value, momentum, profitability (RMW) and investments (CMA). The regression results are as below: Compare the six-factor

Suppose we run a six-factor model, including market, size, value, momentum, profitability (RMW) and investments (CMA). The regression results are as below:

Compare the six-factor alpha with the four-model alpha and discuss the difference in the context of active fund management.

Constant Mkt-Rf SMB HML UMD RMW CMA Coefficient t-value 0.20% 0.60 0.19 -0.25 0.39 0.28 -0.04 1.20 1.20 3.00 -3.60 5.70 2.00 -1.00

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

In the context of active fund management comparing the alpha generated by different models can provide insights into the effectiveness of the addition...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Economics and Business Strategy

Authors: Michael Baye, Jeff Prince

9th edition

9781259896422, 1259290611, 1259896420, 978-1259290619

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App