Answered step by step

Verified Expert Solution

Question

1 Approved Answer

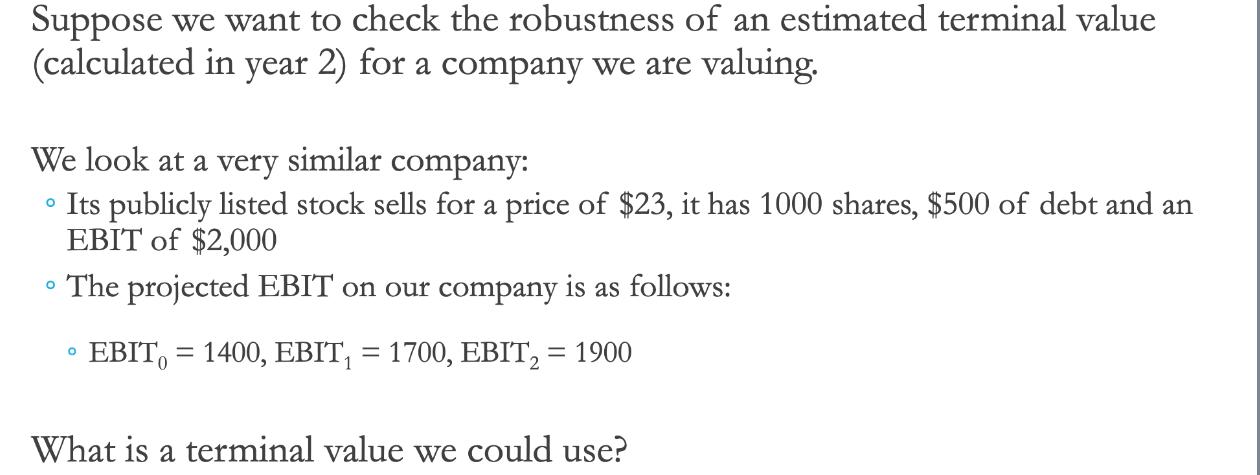

Suppose we want to check the robustness of an estimated terminal value (calculated in year 2) for a company we are valuing. We look

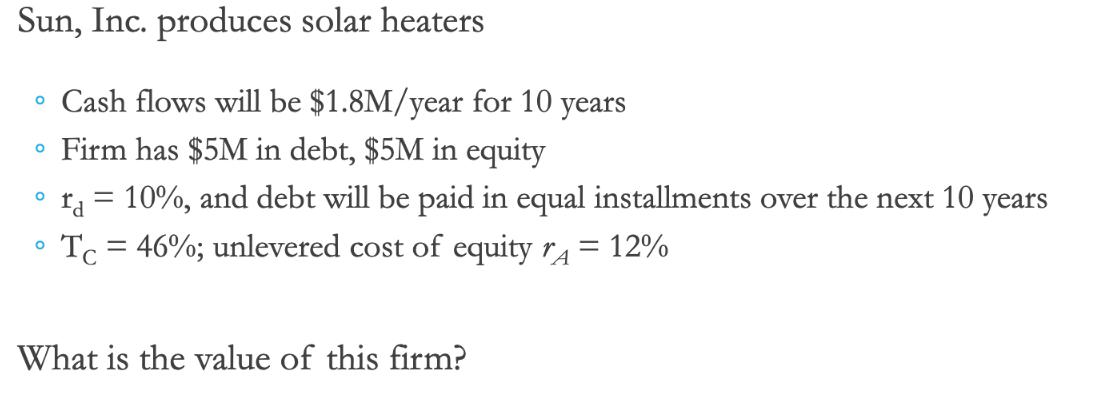

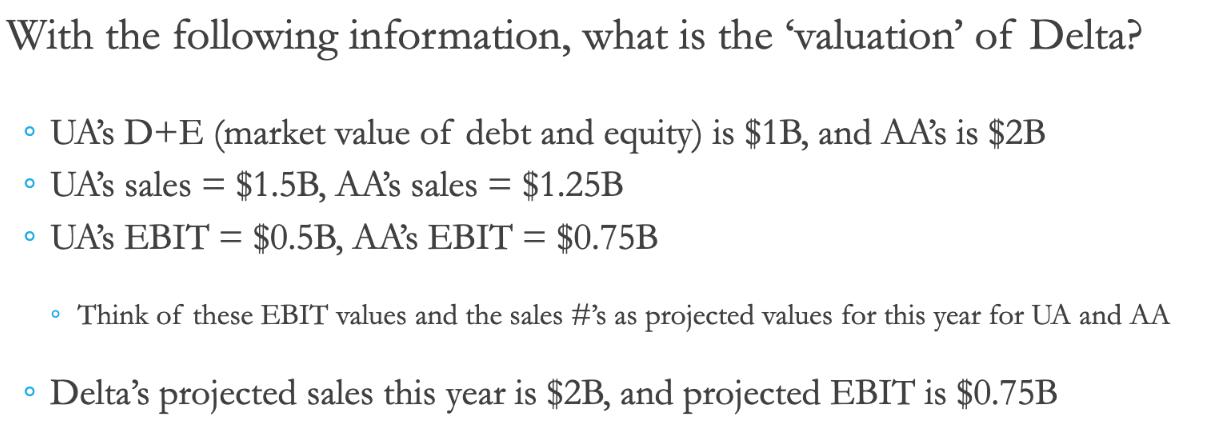

Suppose we want to check the robustness of an estimated terminal value (calculated in year 2) for a company we are valuing. We look at a very similar company: Its publicly listed stock sells for a price of $23, it has 1000 shares, $500 of debt and an EBIT of $2,000 The projected EBIT on our company is as follows: O O EBIT = 1400, EBIT = 1700, EBIT = = 1900 What is a terminal value we could use? Sun, Inc. produces solar heaters Cash flows will be $1.8M/year for 10 years Firm has $5M in debt, $5M in equity O r = 10%, and debt will be paid in equal installments over the next 10 years Tc = 46%; unlevered cost of equity r = 12% O What is the value of this firm? With the following information, what is the 'valuation' of Delta? UA's D+E (market value of debt and equity) is $1B, and AA's is $2B UA's sales = $1.5B, AA's sales = $1.25B UA's EBIT = $0.5B, AA's EBIT = $0.75B Think of these EBIT values and the sales #'s as projected values for this year for UA and AA Delta's projected sales this year is $2B, and projected EBIT is $0.75B O

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Estimate the terminal value using the EBIT multiples method For the comparable company EBIT 2000 Market value of equity 23 1000 23000 Enterprise val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started