Answered step by step

Verified Expert Solution

Question

1 Approved Answer

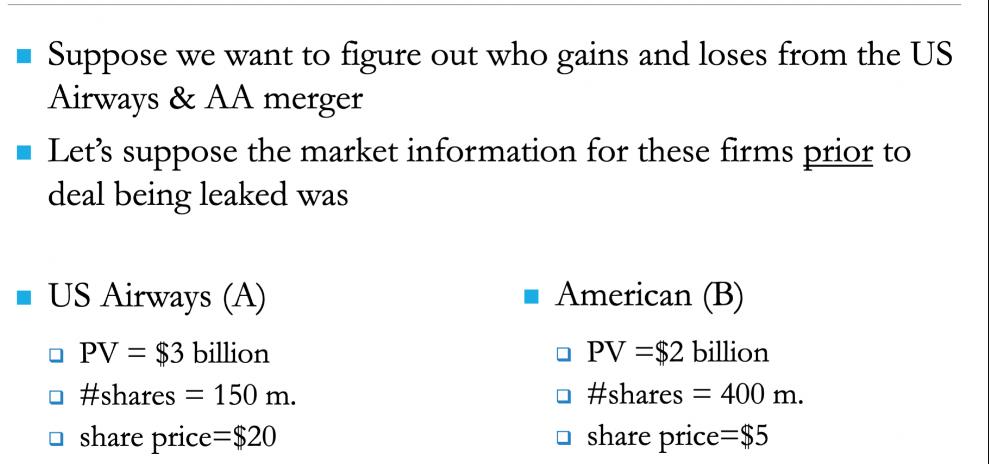

Suppose we want to figure out who gains and loses from the US Airways & AA merger Let's suppose the market information for these

![US Airways & AA- Example [Part 2] Furthermore, suppose US Airways estimates that the merger will O Generate](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/01/6594ee7b9b757_1704305991889.jpg)

![US Airways & AA- Example [Part 3] If US Airways offers to pay a $1 premium per share to the AA](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/01/6594ee8307a1d_1704305999449.jpg)

Suppose we want to figure out who gains and loses from the US Airways & AA merger Let's suppose the market information for these firms prior to deal being leaked was US Airways (A) PV = $3 billion #shares 150 m. share price=$20 - American (B) PV =$2 billion #shares = 400 m. share price=$5 US Airways & AA- Example [Part 2] Furthermore, suppose US Airways estimates that the merger will O Generate additional $5 m./year in FCF from AA's operations because of efficiency gains It will generate additional $10 m. per year in FCF from economies of scale Assume US Airways r = 10% A Assume AA's r = 11% A US Airways & AA- Example [Part 3] If US Airways offers to pay a $1 premium per share to the AA shareholders... How much value is created? What will be value of the combined firm [ignoring how the deal is paid for]? How much value goes to AA? How much value goes to US Airways?

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution To determine the value created by the merger we need to calculate the present value of the expected synergies and compare it to the premium o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started