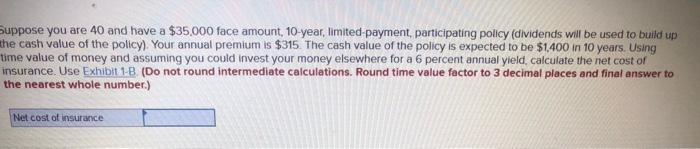

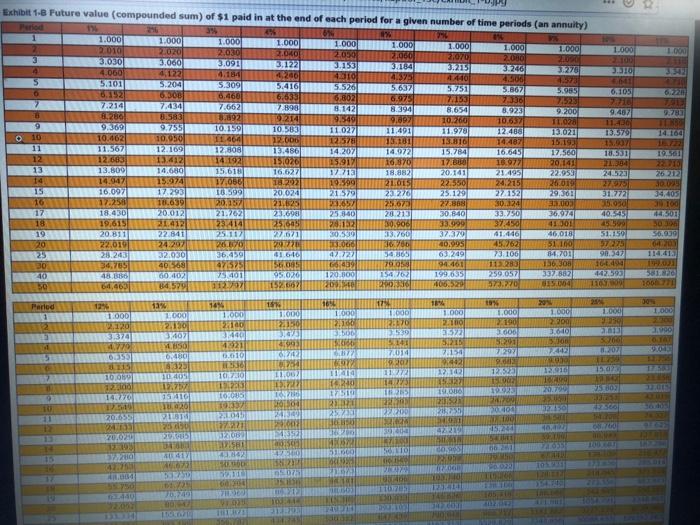

Suppose you are 40 and have a $35,000 face amount, 10-year, limited payment, participating policy dividends will be used to build up the cash value of the policy). Your annual premium is $315. The cash value of the policy is expected to be $1,400 in 10 years. Using time value of money and assuming you could invest your money elsewhere for a 6 percent annual yield, calculate the net cost of insurance. Use Exhibit 1B (Do not round intermediate calculations. Round time value factor to 3 decimal places and final answer to the nearest whole number.) Netcost of insurance 1.000 9.783 14 164 19.561 2210 30.0 34,405 100 144.501 30 OC0195 Exhibit 1-8 Future value (compounded sum) of $1 paid in at the end of each period for a given number of time periods (an annuity) Period 1 1.000 1.000 6 1.0001 1.000 1.000 1.000 1.000 2010 2020 2.030 1.000 2050 1.000 27.040 2.000 3.0303.060 2,070 2.000 2200 3.091 2100 3.122 3.153 3184 4.060 3215 4.184 3.276 1,200 4910 2.375 440 4.300 5.101 5.204 5.3091 5.416 5.526 5.652 5.751 6152 6.308 5.867 16.105 6,460 6,633 6.802 6.973 713 2336 2323 17.214 7.434 7.662 7898 8.142 8394 8.6541 9 200 8.200 8.923 9.467 192 9214 9540 9.092 10.260 10.637 11.020 11.43 9 9.309 9.7551 10.1591 10.583 11.027 11.491 11.9781 12.480 1370231 13.579 o 10 10.462 10.950 11.064 12000 12578 131811 13810 14.487 15.193 11 11.567 12.109 12.808 13.480 14.207 14.072 15.784 16.645 17,560 18.5311 12 12.003 13.12 14192 15020 15.917 16.370 17 BO 16.077 20.141 71304 13 13.800 14.680 15.6181 16.627 12713 18.882 20.141 21.4951 22.955 24523 14 14.00 153974 17.066 18.202 19.09 21.05 22.550 24.215 26.019 27979 15 16.097 17293 107399 20.024 21579 23:270 25.129 27/152 29.01 31.772 16 17.250 10.6391 20.132 21628 216 25673 27. 30.224 33.00 35.00 18.430 20.012 21,762 2.000 25 340 28.213 30.640 33.750 36.974 40.545 18 197615 1412 23.414 235.643 2012 30.900 33.999 37459 41301 455 19 20.811 22.8411 25.11 W.67 50.500 33.760 37379 41.446 46.018 51.159 20 22.010 2207 WO 12920 20.995 45.262 51.no 97225 25 23.2031 32.030 36.459 016-10 42722 50303 62491 73106 84.700 90.347 30 34,789 403 47323 56.00 Go 39 79205 94.461 112280 130.00 116499 40 48.306 60.402 75401 950 120.000 154 104 199655 259,057 337.882 442593 50 4579 64,469 11/07 1562 20 FERONTOL 106.520 GES 373.270 1101 13 Period 1344 14 18 17 1000 1.000 1 1.000 1000 1.000 1.000 1.000 1.000 22.120 2 TO 27190 2100 2.130 22.30 2.100 12.200 2013 3.374 3490 600 SHOOT 3,407 3:00 1572 4:52 50 03 521 50200 15. 57001 7.014 23158 7291 101 12402 3207 15 20 2 112721 1017010 12102 127523 1002 12.10 100159 15.72 1223 1971 125 12 TO 20.700 154 25 1977 to.005 19.00 2015 D 100 201 02337 22 11 13 2.1.048 100 4 2525 7722 5244 42219 So 05 120 20.0 15 HIS BA SCO TO do LOGO TE TOH PS 1125 00011 0001 OG OLA CSCO LA k! GI HO 0 DLL RE ROOL IERSE ILE CORSA BOGOR RIA ORKA LOR 20 SU THE OH DO SOLEIL COSE LA CE CR AG TERRA CA OS Jummon