Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose, you are a CEO of a company and you just made a big investment in a new production facility. Your Chief Risk Officer

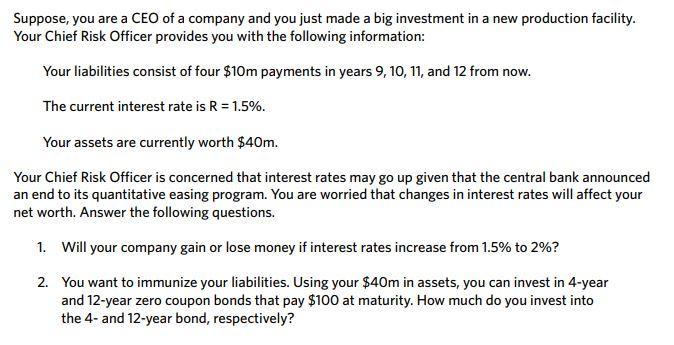

Suppose, you are a CEO of a company and you just made a big investment in a new production facility. Your Chief Risk Officer provides you with the following information: Your liabilities consist of four $10m payments in years 9, 10, 11, and 12 from now. The current interest rate is R = 1.5%. Your assets are currently worth $40m. Your Chief Risk Officer is concerned that interest rates may go up given that the central bank announced an end to its quantitative easing program. You are worried that changes in interest rates will affect your net worth. Answer the following questions. 1. Will your company gain or lose money if interest rates increase from 1.5% to 2%? 2. You want to immunize your liabilities. Using your $40m in assets, you can invest in 4-year and 12-year zero coupon bonds that pay $100 at maturity. How much do you invest into the 4- and 12-year bond, respectively?

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 As the liabilities are in future Present value of Liabilities 10 million 10159 10 million 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started