Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are a Financial Controller of Y Ltd, in order to maximize firm value you decide to invest in Double Tree by Hilton

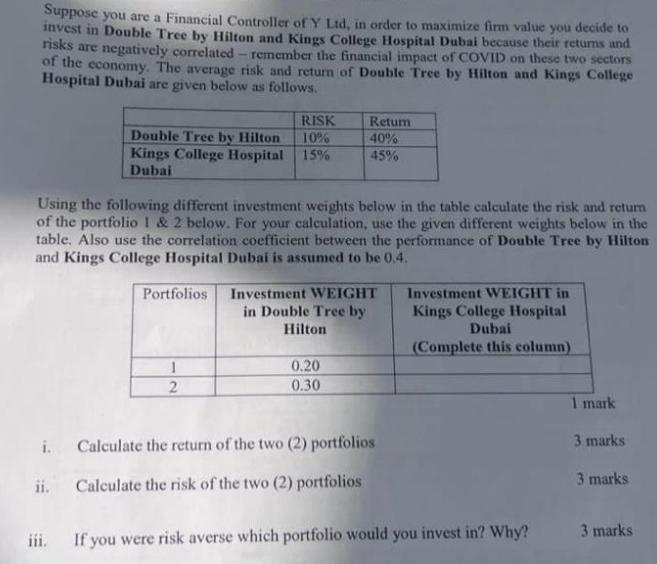

Suppose you are a Financial Controller of Y Ltd, in order to maximize firm value you decide to invest in Double Tree by Hilton and Kings College Hospital Dubai because their returns and risks are negatively correlated - remember the financial impact of COVID on these two sectors of the economy. The average risk and return of Double Tree by Hilton and Kings College Hospital Dubai are given below as follows. RISK Double Tree by Hilton 10% Kings College Hospital 15% Dubai Using the following different investment weights below in the table calculate the risk and return of the portfolio 1 & 2 below. For your calculation, use the given different weights below in the table. Also use the correlation coefficient between the performance of Double Tree by Hilton and Kings College Hospital Dubai is assumed to be 0.4. Portfolios 1 2 Return 40% 45% Investment WEIGHT in Double Tree by Hilton 0.20 0.30 i. Calculate the return of the two (2) portfolios ii. Calculate the risk of the two (2) portfolios Investment WEIGHT in Kings College Hospital Dubai (Complete this column) iii. If you were risk averse which portfolio would you invest in? Why? 1 mark 3 marks 3 marks 3 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the return and risk of the portfolios well use the given investment weights and the pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started