Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are a financial planner and you have been tasked with helping a client with their retirement planning. The client has said they would

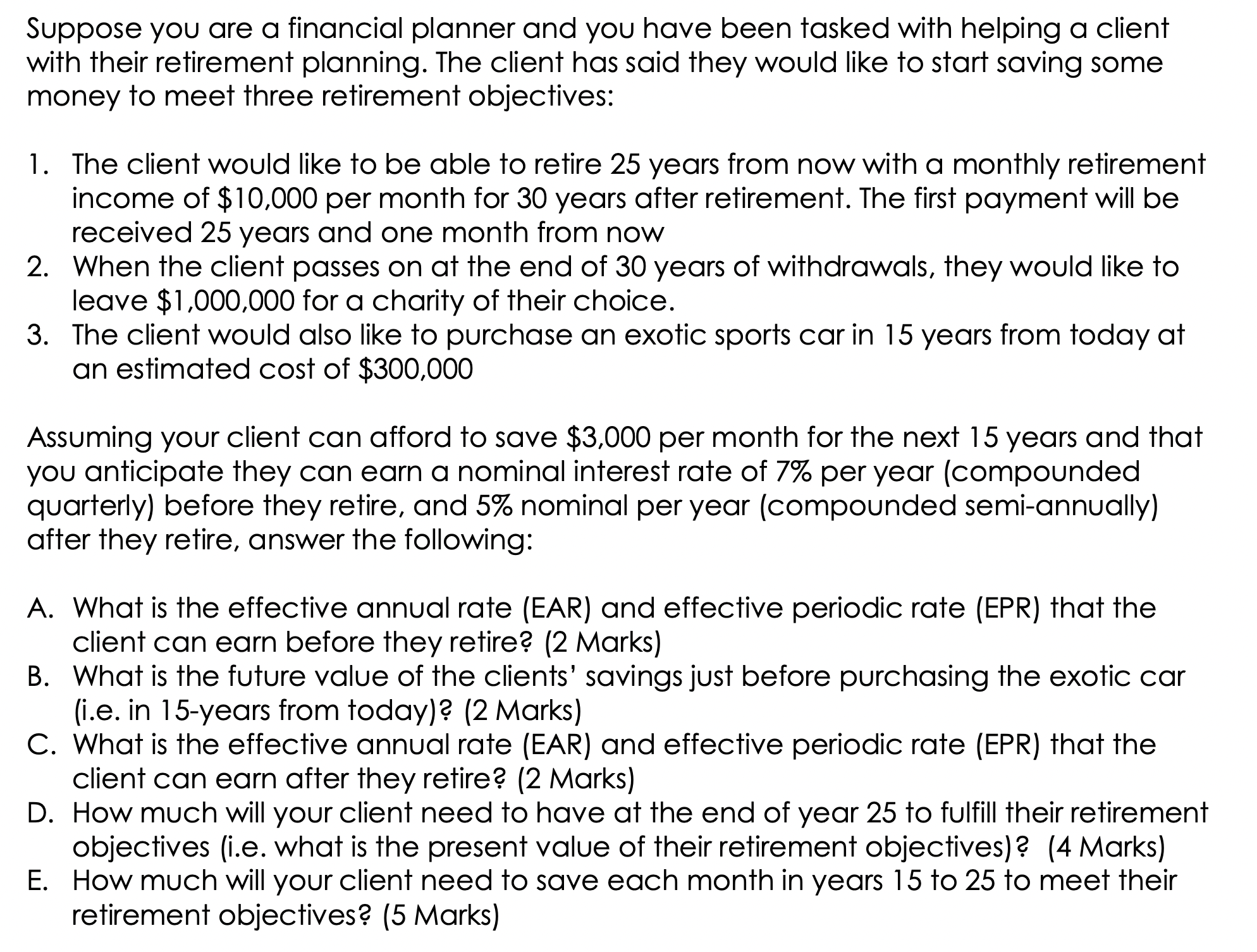

Suppose you are a financial planner and you have been tasked with helping a client with their retirement planning. The client has said they would like to start saving some money to meet three retirement objectives: 1. The client would like to be able to retire 25 years from now with a monthly retirement income of $10,000 per month for 30 years after retirement. The first payment will be received 25 years and one month from now 2. When the client passes on at the end of 30 years of withdrawals, they would like to leave $1,000,000 for a charity of their choice. 3. The client would also like to purchase an exotic sports car in 15 years from today at an estimated cost of $300,000 Assuming your client can afford to save $3,000 per month for the next 15 years and that you anticipate they can earn a nominal interest rate of 7% per year (compounded quarterly) before they retire, and 5% nominal per year (compounded semi-annually) after they retire, answer the following: A. What is the effective annual rate (EAR) and effective periodic rate (EPR) that the client can earn before they retire? (2 Marks) B. What is the future value of the clients' savings just before purchasing the exotic car (i.e. in 15-years from today)? (2 Marks) C. What is the effective annual rate (EAR) and effective periodic rate (EPR) that the client can earn after they retire? (2 Marks) D. How much will your client need to have at the end of year 25 to fulfill their retirement objectives (i.e. what is the present value of their retirement objectives)? (4 Marks) E. How much will your client need to save each month in years 15 to 25 to meet their retirement objectives

Suppose you are a financial planner and you have been tasked with helping a client with their retirement planning. The client has said they would like to start saving some money to meet three retirement objectives: 1. The client would like to be able to retire 25 years from now with a monthly retirement income of $10,000 per month for 30 years after retirement. The first payment will be received 25 years and one month from now 2. When the client passes on at the end of 30 years of withdrawals, they would like to leave $1,000,000 for a charity of their choice. 3. The client would also like to purchase an exotic sports car in 15 years from today at an estimated cost of $300,000 Assuming your client can afford to save $3,000 per month for the next 15 years and that you anticipate they can earn a nominal interest rate of 7% per year (compounded quarterly) before they retire, and 5% nominal per year (compounded semi-annually) after they retire, answer the following: A. What is the effective annual rate (EAR) and effective periodic rate (EPR) that the client can earn before they retire? (2 Marks) B. What is the future value of the clients' savings just before purchasing the exotic car (i.e. in 15-years from today)? (2 Marks) C. What is the effective annual rate (EAR) and effective periodic rate (EPR) that the client can earn after they retire? (2 Marks) D. How much will your client need to have at the end of year 25 to fulfill their retirement objectives (i.e. what is the present value of their retirement objectives)? (4 Marks) E. How much will your client need to save each month in years 15 to 25 to meet their retirement objectives Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started