Question

Suppose you are a trader on a derivatives desk and you have sold 5000 call options to a client. You engage in transactions in

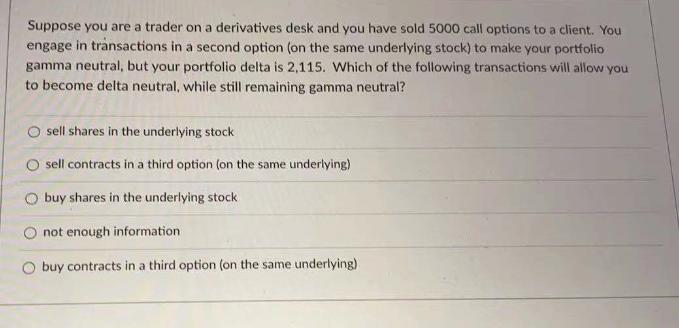

Suppose you are a trader on a derivatives desk and you have sold 5000 call options to a client. You engage in transactions in a second option (on the same underlying stock) to make your portfolio gamma neutral, but your portfolio delta is 2,115. Which of the following transactions will allow you to become delta neutral, while still remaining gamma neutral? sell shares in the underlying stock sell contracts in a third option (on the same underlying) O buy shares in the underlying stock not enough information O buy contracts in a third option (on the same underlying).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App