Question

The table below contains the implied volatility and option price for a series of call options of varying strike prices and varying time to

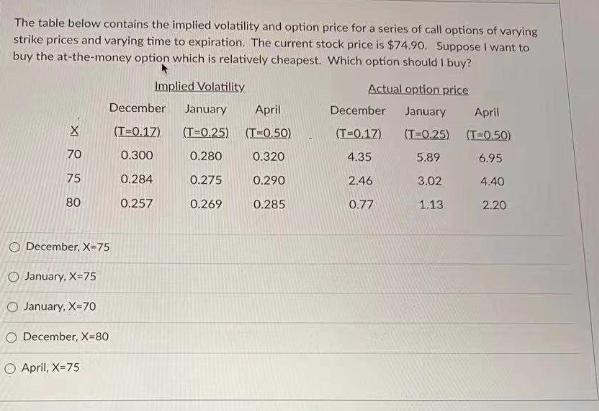

The table below contains the implied volatility and option price for a series of call options of varying strike prices and varying time to expiration. The current stock price is $74.90. Suppose I want to buy the at-the-money option which is relatively cheapest. Which option should I buy? Implied Volatility December January April (T=0.17) (T-0.25) (T-0.50) 0.300 0.280 0.320 0.284 0.275 0.257 0.269 X 70 75 80 December, X-75 January, X-75 January, X-70 O December, X=80 O April, X-75 0.290 0.285. Actual option price December January (T-0,17) (T-0.25) 4.35 5.89 2.46 3.02 0.77 1.13. April (T-0.50) 6.95 4.40 2.20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To find the atthemo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Modeling

Authors: Simon Benninga

4th Edition

0262027283, 9780262027281

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App