Answered step by step

Verified Expert Solution

Question

1 Approved Answer

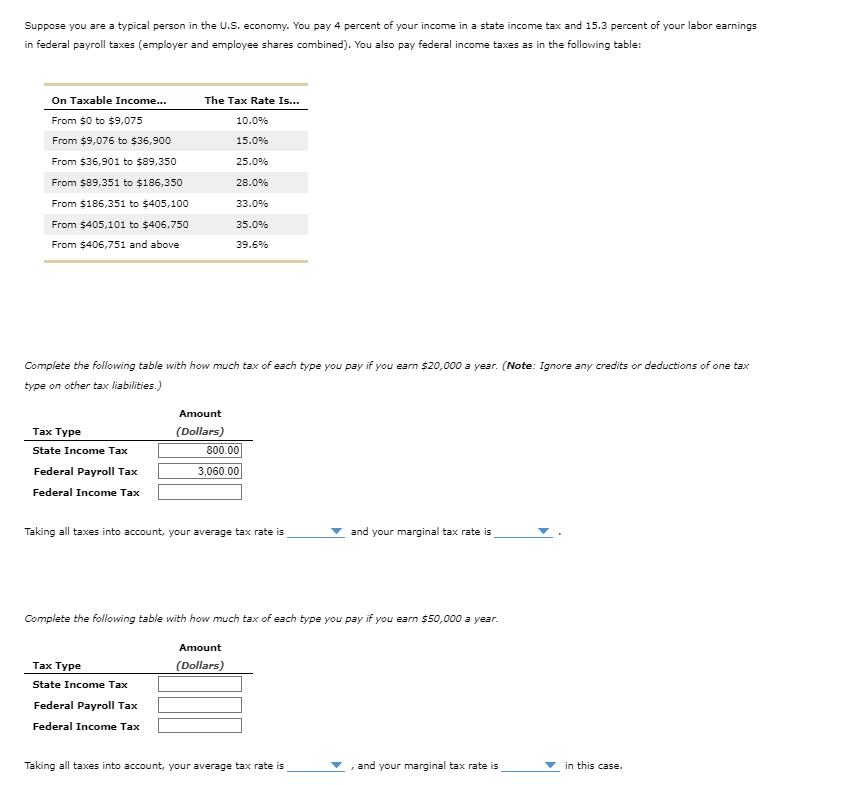

Suppose you are a typical person in the U.S. economy. You pay 4 percent of your income in a state income tax and 15.3

Suppose you are a typical person in the U.S. economy. You pay 4 percent of your income in a state income tax and 15.3 percent of your labor earnings in federal payroll taxes (employer and employee shares combined). You also pay federal income taxes as in the following table: On Taxable Income... From $0 to $9,075 From $9,076 to $36,900 From $36,901 to $89,350 From $89,351 to $186,350 From $186,351 to $405,100 From $405,101 to $406,750 From $406,751 and above Complete the following table with how much tax of each type you pay if you earn $20,000 a year. (Note: Ignore any credits or deductions of one tax type on other tax liabilities.) Tax Type State Income Tax Federal Payroll Tax Federal Income Tax The Tax Rate Is... 10.0% 15.0% 25.0% 28.0% 33.0% 35.0% 39.6% Amount (Dollars) Tax Type State Income Tax Federal Payroll Tax Federal Income Tax 800.00 3,060.00 Taking all taxes into account, your average tax rate is Complete the following table with how much tax of each type you pay if you earn $50,000 a year. Amount (Dollars) and your marginal tax rate is Taking all taxes into account, your average tax rate is 3 and your marginal tax rate is in this case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image provided shows a tax calculation exercise It contains a tax rate table for federal income tax and also mentions a state income tax rate of 4 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started