Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are an investment manager, and you are explaining the risk of holding just a single stock ( ex . NVIDIA Corp, NASDAQ. Ticker:

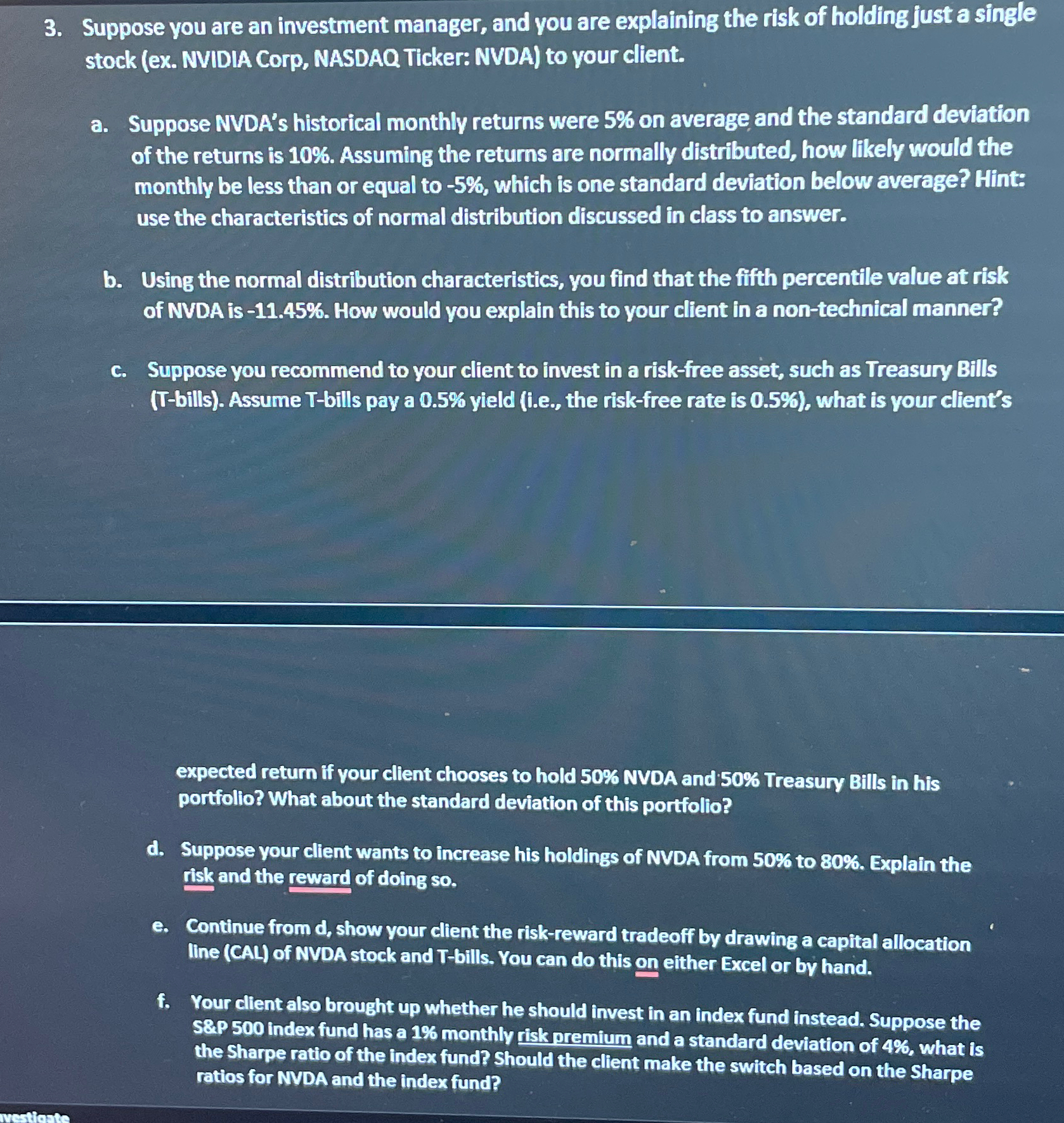

Suppose you are an investment manager, and you are explaining the risk of holding just a single stock ex NVIDIA Corp, NASDAQ. Ticker: NVDA to your client.

a Suppose NVDA's historical monthly returns were on average and the standard deviation of the returns is Assuming the returns are normally distributed, how likely would the monthly be less than or equal to which is one standard deviation below average? Hint: use the characteristics of normal distribution discussed in class to answer.

b Using the normal distribution characteristics, you find that the fifth percentile value at risk of NVDA is How would you explain this to your client in a nontechnical manner?

c Suppose you recommend to your client to invest in a riskfree asset, such as Treasury Bills Tbills Assume Tbills pay a yield ie the riskfree rate is what is your client's

expected return if your client chooses to hold NVDA and Treasury Bills in his portfolio? What about the standard deviation of this portfolio?

d Suppose your client wants to increase his holdings of NVDA from to Explain the risk and the reward of doing so

e Continue from d show your client the riskreward tradeoff by drawing a capital allocation line CAL of NVDA stock and Tbills. You can do this on either Excel or by hand.

f Your client also brought up whether he should invest in an index fund instead. Suppose the S&P index fund has a monthly risk premium and a standard deviation of what is the Sharpe ratio of the index fund? Should the client make the switch based on the Sharpe ratios for NVDA and the index fund?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started