Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are bullish on the price of silver, and wish to buy futures contract as you anticipate a major rise in prices. The front-month

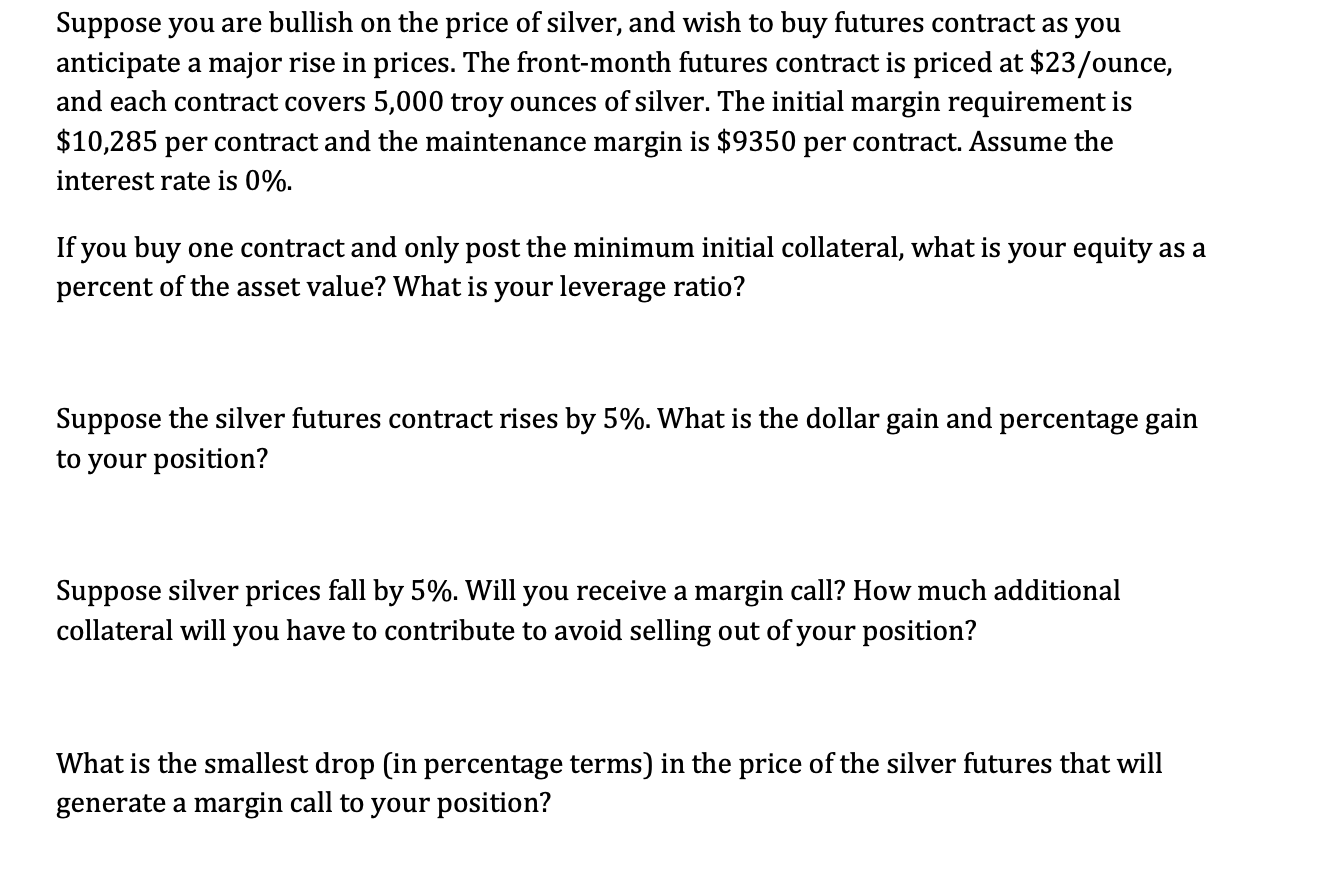

Suppose you are bullish on the price of silver, and wish to buy futures contract as you anticipate a major rise in prices. The front-month futures contract is priced at $23/ ounce, and each contract covers 5,000 troy ounces of silver. The initial margin requirement is $10,285 per contract and the maintenance margin is $9350 per contract. Assume the interest rate is 0%. If you buy one contract and only post the minimum initial collateral, what is your equity as a percent of the asset value? What is your leverage ratio? Suppose the silver futures contract rises by 5%. What is the dollar gain and percentage gain to your position? Suppose silver prices fall by 5%. Will you receive a margin call? How much additional collateral will you have to contribute to avoid selling out of your position? What is the smallest drop (in percentage terms) in the price of the silver futures that will generate a margin call to your position

Suppose you are bullish on the price of silver, and wish to buy futures contract as you anticipate a major rise in prices. The front-month futures contract is priced at $23/ ounce, and each contract covers 5,000 troy ounces of silver. The initial margin requirement is $10,285 per contract and the maintenance margin is $9350 per contract. Assume the interest rate is 0%. If you buy one contract and only post the minimum initial collateral, what is your equity as a percent of the asset value? What is your leverage ratio? Suppose the silver futures contract rises by 5%. What is the dollar gain and percentage gain to your position? Suppose silver prices fall by 5%. Will you receive a margin call? How much additional collateral will you have to contribute to avoid selling out of your position? What is the smallest drop (in percentage terms) in the price of the silver futures that will generate a margin call to your position Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started