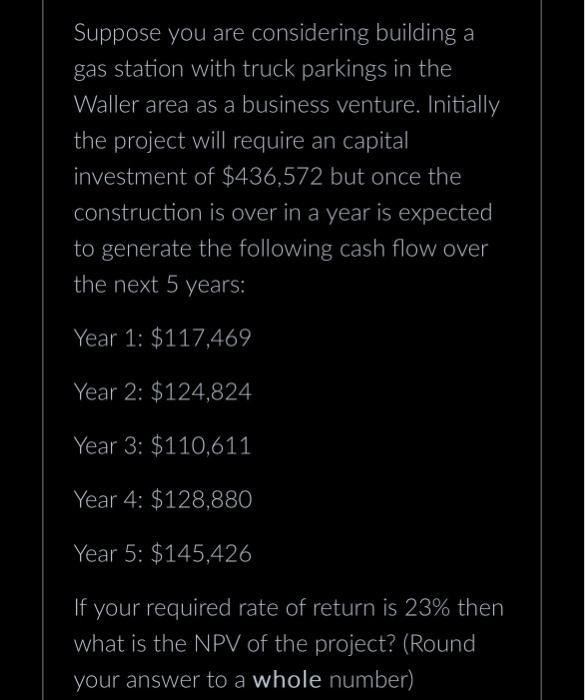

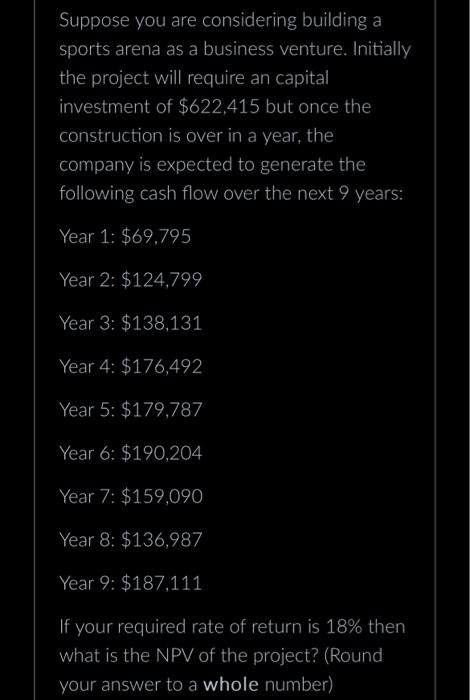

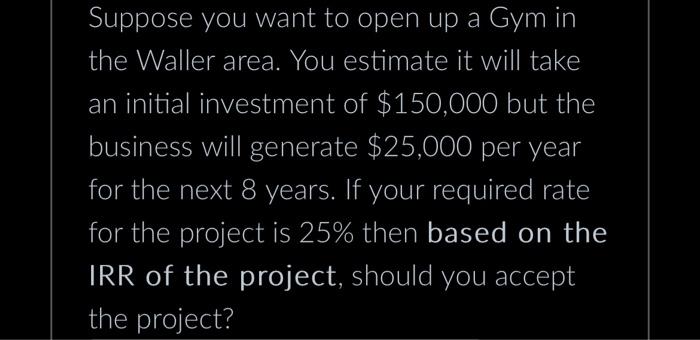

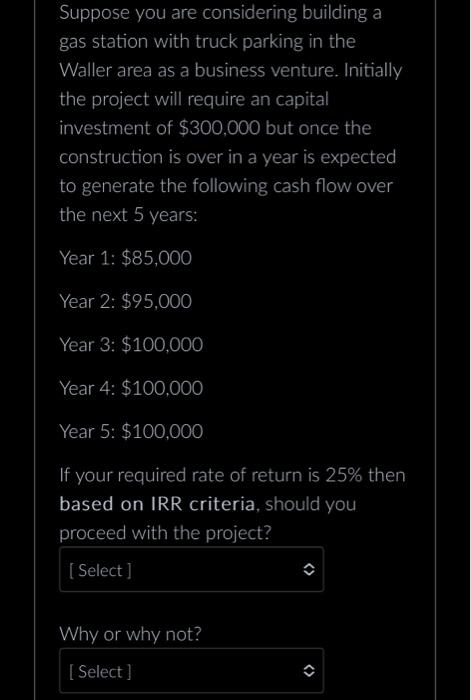

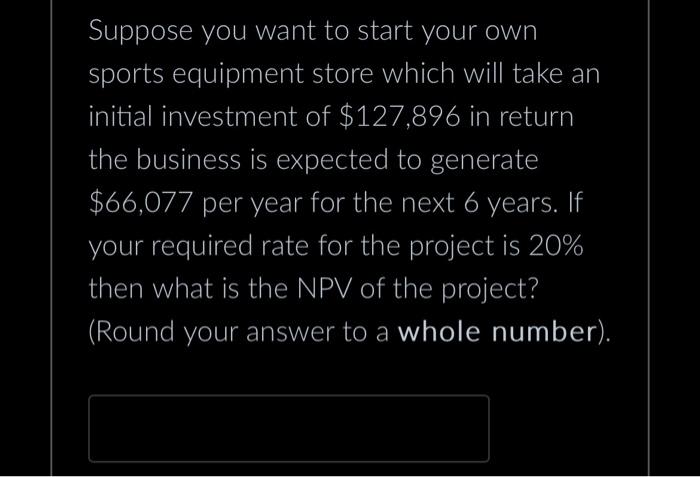

Suppose you are considering building a gas station with truck parkings in the Waller area as a business venture. Initially the project will require an capital investment of $436,572 but once the construction is over in a year is expected to generate the following cash flow over the next 5 years: Year 1: $117,469 Year 2: $124,824 Year 3: $110,611 Year 4: $128,880 Year 5: $145,426 If your required rate of return is 23% then what is the NPV of the project? (Round your answer to a whole number) Suppose you are considering building a sports arena as a business venture. Initially the project will require an capital investment of $622,415 but once the construction is over in a year, the company is expected to generate the following cash flow over the next 9 years: Year 1: $69,795 Year 2: $124,799 Year 3: $138,131 Year 4: $176,492 Year 5: $179,787 Year 6: $190,204 Year 7: $159,090 Year 8: $136,987 Year 9: $187,111 If your required rate of return is 18% then what is the NPV of the proiect? (Round Suppose you want to open up a Gym in the Waller area. You estimate it will take an initial investment of $150,000 but the business will generate $25,000 per year for the next 8 years. If your required rate for the project is 25% then based on the IRR of the project, should you accept the project? Suppose you are considering building a gas station with truck parking in the Waller area as a business venture. Initially the project will require an capital investment of $300,000 but once the construction is over in a year is expected to generate the following cash flow over the next 5 years: Year 1: $85,000 Year 2: $95,000 Year 3: $100,000 Year 4: $100,000 Year 5: $100,000 If your required rate of return is 25% then based on IRR criteria, should you proceed with the project? Why or why not? Suppose you want to start your own sports equipment store which will take an initial investment of $127,896 in return the business is expected to generate $66,077 per year for the next 6 years. If your required rate for the project is 20% then what is the NPV of the project? (Round your answer to a whole number)