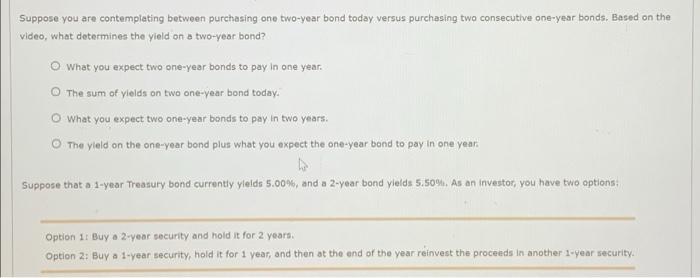

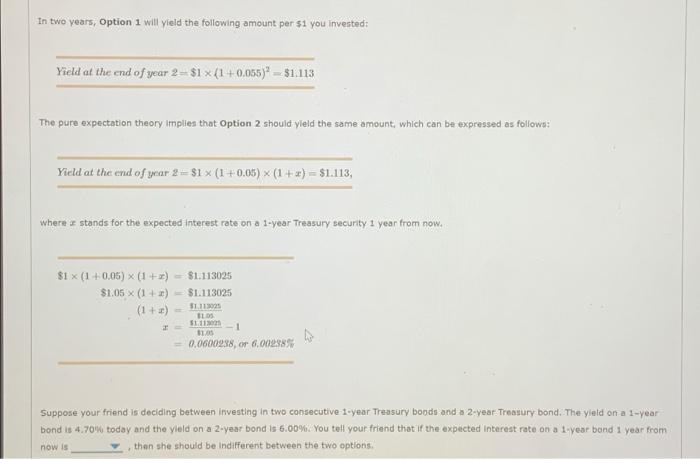

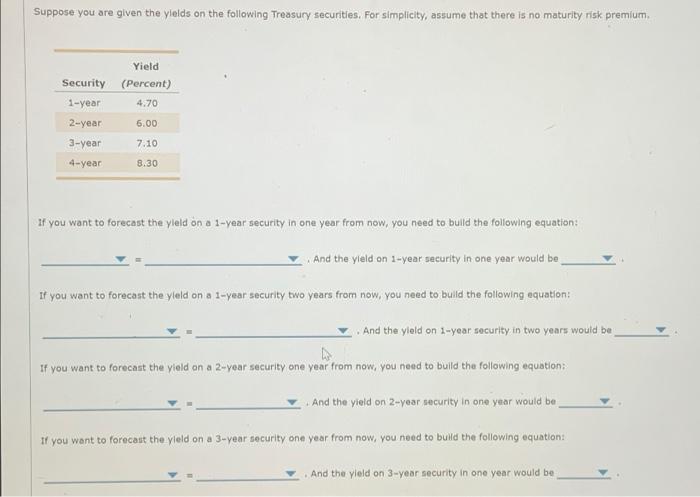

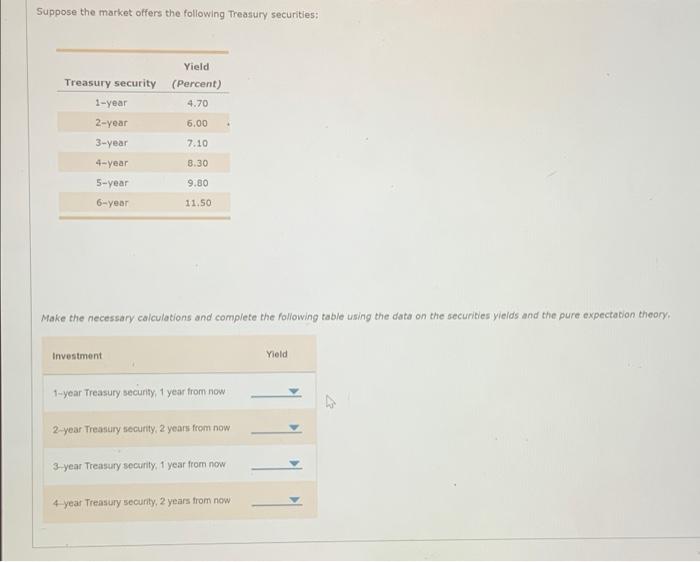

Suppose you are contemplating between purchasing one two-year bond today versus purchasing two consecutive one-year bonds. Based on the video, what determines the yield on a two-year bond? What you expect two one-year bonds to pay in one year. The sum of yields on two one-year bond today. What you expect two one-year bonds to pay in two years. The yield on the one-year bond plus what you expect the one-year bond to pay in one year Do Suppose that a 1-year Treasury bond currently yleldo 5.00%, and a 2-year bond yields 5.50% As an investor, you have two options Option 11 Buy a 2 year security and hold it for 2 years Option 2: Buy a 1-year security, hold it for 1 year, and then at the end of the year reinvest the proceeds in another 1-year security. In two years, Option 1 will yield the following amount per $1 you invested: Yield at the end of year 2=$1 x (1 +0.055)* = $1.113 The pure expectation theory implies that Option 2 should yield the same amount which can be expressed as follows: Yield at the end of year 2= $1 x (1 +0.05) (1 + x) = $1.113, where stands for the expected Interest rate on a 1-year Treasury security 1 year from now. $1 x (1 +0.05) X (1+2) = $1.113025 $1.05 (1) $1.113025 (1+) 51113005 51.11 11.05 = 0.0600988, or 6.00238% Suppose your friend is deciding between investing in two consecutive 1-year Treasury boods and a 2-year: Treasury bond. The yield on a 1-year bond is 4.70% today and the yield on a 2-year bond is 6.00%. You tell your friend that if the expected Interest rate on a 1-year bond 1 year from a then she should be indifferent between the two options, now is Suppose you are given the yields on the following Treasury securities. For simplicity, assume that there is no maturity risk premium Yield Security (Percent) 1-year 4.70 6.00 2-year 3-year 4-year 7.10 8.30 If you want to forecast the yield on a 1-year security in one year from now, you need to build the following equation: And the yield on 1-year security in one year would be If you want to forecast the yield on a 1-year security two years from now, you need to build the following equation: And the yield on 1-year security in two years would be If you want to forecast the yield on a 2-year security one year from now, you need to build the following equation: And the yield on 2-year security in one year would be If you want to forecast the yield on a 3-year security one year from now, you need to build the following equations And the yield on 3-year security in one year would be Suppose the market offers the following Treasury securities: Yield (Percent) 4.70 Treasury security 1-year 2-year 3-year 6.00 7.10 8.30 4-year 5-year 9.80 6-year 11.50 Make the necessary calculations and complete the following table using the data on the securities yields and the pure expectation theory, Investment Yield 1-year Treasury security, 1 year from now 2-year Treasury security, 2 years from now 3.year Treasury security, 1 year from now 4 year Treasury security 2 years from now Suppose you are contemplating between purchasing one two-year bond today versus purchasing two consecutive one-year bonds. Based on the video, what determines the yield on a two-year bond? What you expect two one-year bonds to pay in one year. The sum of yields on two one-year bond today. What you expect two one-year bonds to pay in two years. The yield on the one-year bond plus what you expect the one-year bond to pay in one year Do Suppose that a 1-year Treasury bond currently yleldo 5.00%, and a 2-year bond yields 5.50% As an investor, you have two options Option 11 Buy a 2 year security and hold it for 2 years Option 2: Buy a 1-year security, hold it for 1 year, and then at the end of the year reinvest the proceeds in another 1-year security. In two years, Option 1 will yield the following amount per $1 you invested: Yield at the end of year 2=$1 x (1 +0.055)* = $1.113 The pure expectation theory implies that Option 2 should yield the same amount which can be expressed as follows: Yield at the end of year 2= $1 x (1 +0.05) (1 + x) = $1.113, where stands for the expected Interest rate on a 1-year Treasury security 1 year from now. $1 x (1 +0.05) X (1+2) = $1.113025 $1.05 (1) $1.113025 (1+) 51113005 51.11 11.05 = 0.0600988, or 6.00238% Suppose your friend is deciding between investing in two consecutive 1-year Treasury boods and a 2-year: Treasury bond. The yield on a 1-year bond is 4.70% today and the yield on a 2-year bond is 6.00%. You tell your friend that if the expected Interest rate on a 1-year bond 1 year from a then she should be indifferent between the two options, now is Suppose you are given the yields on the following Treasury securities. For simplicity, assume that there is no maturity risk premium Yield Security (Percent) 1-year 4.70 6.00 2-year 3-year 4-year 7.10 8.30 If you want to forecast the yield on a 1-year security in one year from now, you need to build the following equation: And the yield on 1-year security in one year would be If you want to forecast the yield on a 1-year security two years from now, you need to build the following equation: And the yield on 1-year security in two years would be If you want to forecast the yield on a 2-year security one year from now, you need to build the following equation: And the yield on 2-year security in one year would be If you want to forecast the yield on a 3-year security one year from now, you need to build the following equations And the yield on 3-year security in one year would be Suppose the market offers the following Treasury securities: Yield (Percent) 4.70 Treasury security 1-year 2-year 3-year 6.00 7.10 8.30 4-year 5-year 9.80 6-year 11.50 Make the necessary calculations and complete the following table using the data on the securities yields and the pure expectation theory, Investment Yield 1-year Treasury security, 1 year from now 2-year Treasury security, 2 years from now 3.year Treasury security, 1 year from now 4 year Treasury security 2 years from now