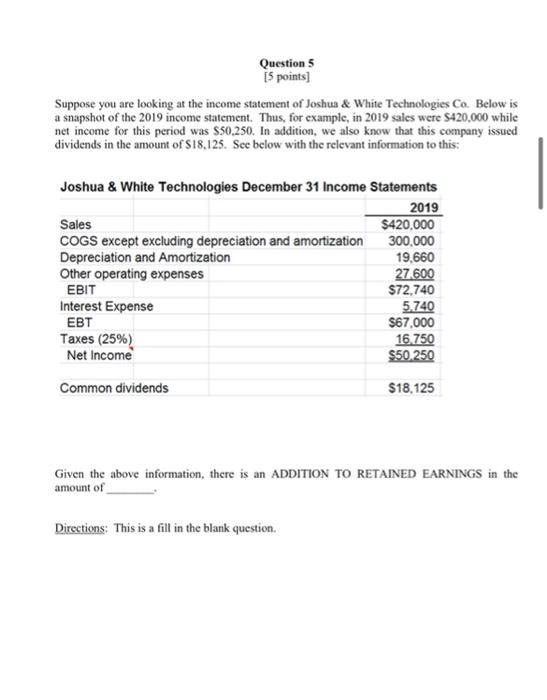

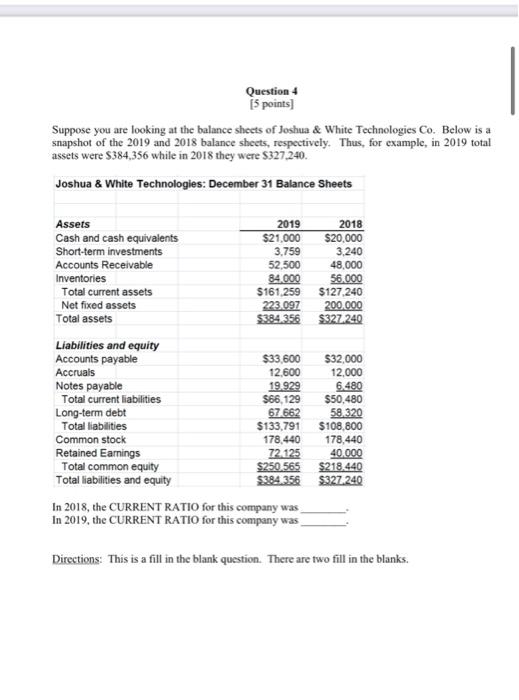

Suppose you are looking at the income statement of Joshua & White Technologies Co. Below is a snapshot of the 2019 income statement. Thus, for example, in 2019 sales were $420,000 while net income for this period was $50,250. In addition, we also know that this company issued dividends in the amount of $18,125. See below with the relevant information to this: Question 5 [5 points] Joshua & White Technologies December 31 Income Statements 2019 $420,000 300,000 19,660 27,600 $72,740 5,740 Sales COGS except excluding depreciation and amortization Depreciation and Amortization Other operating expenses EBIT Interest Expense EBT Taxes (25%) Net Income Common dividends $67,000 16.750 $50,250 $18,125 Given the above information, there is an ADDITION TO RETAINED EARNINGS in the amount of Directions: This is a fill in the blank question. Suppose you are looking at the balance sheets of Joshua & White Technologies Co. Below is a snapshot of the 2019 and 2018 balance sheets, respectively. Thus, for example, in 2019 total assets were $384,356 while in 2018 they were $327,240. Joshua & White Technologies: December 31 Balance Sheets Assets Cash and cash equivalents Short-term investments Accounts Receivable Inventories Total current assets Net fixed assets Total assets Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Question 4 [5 points] Common stock Retained Earnings Total common equity Total liabilities and equity 2019 $21,000 3,759 52,500 84.000 $161,259 223.097 $384.356 19.929 $66,129 67,662 $33,600 $32,000 12,600 12,000 6.480 $50,480 58,320 $133,791 178,440 72.125 $250,565 $384.356 2018 $20,000 3,240 48,000 56.000 In 2018, the CURRENT RATIO for this company was In 2019, the CURRENT RATIO for this company was $127,240 200.000 $327.240 $108,800 178,440 40.000 $218.440 $327.240 Directions: This is a fill in the blank question. There are two fill in the blanks. Question 8 [5 points] Suppose that Northwest Machinery Co. sold a sizeable portion of its plant assets during the 2021 fiscal year. Given only this information, ceteris paribus (everything else is the same), we would expect to see the following in its 2021 statement of cash flows: (a) A cash inflow in its operating activities. (b) A cash outflow in its operating activities. (c) A cash inflow in its investing activities. (d) A cash outflow in its investing activities. (e) A decline in its stock price. Directions: This is a multiple choice