Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are to invest $100 into Bond A, which can default with 9% probability. If it defaults, you lose your initial investment. Otherwise,

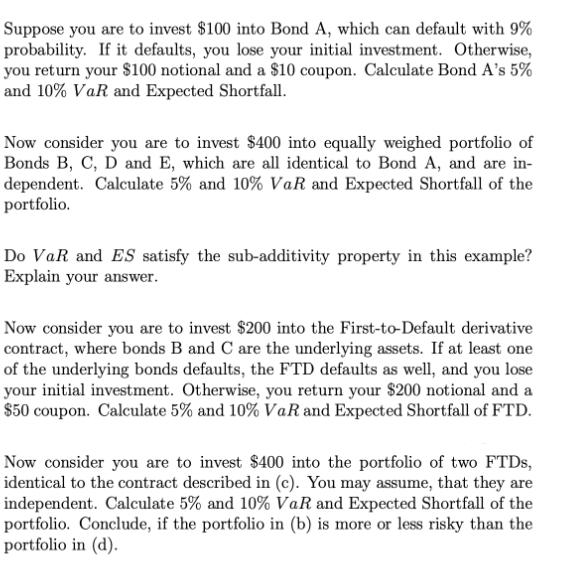

Suppose you are to invest $100 into Bond A, which can default with 9% probability. If it defaults, you lose your initial investment. Otherwise, you return your $100 notional and a $10 coupon. Calculate Bond A's 5% and 10% VaR and Expected Shortfall. Now consider you are to invest $400 into equally weighed portfolio of Bonds B, C, D and E, which are all identical to Bond A, and are in- dependent. Calculate 5% and 10% VaR and Expected Shortfall of the portfolio. Do VaR and ES satisfy the sub-additivity property in this example? Explain your answer. Now consider you are to invest $200 into the First-to-Default derivative contract, where bonds B and C are the underlying assets. If at least one of the underlying bonds defaults, the FTD defaults as well, and you lose your initial investment. Otherwise, you return your $200 notional and a $50 coupon. Calculate 5% and 10% VaR and Expected Shortfall of FTD. Now consider you are to invest $400 into the portfolio of two FTDs, identical to the contract described in (c). You may assume, that they are independent. Calculate 5% and 10% VaR and Expected Shortfall of the portfolio. Conclude, if the portfolio in (b) is more or less risky than the portfolio in (d).

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Bond As 5 VaR is 0 and its 10 VaR is 100 The expected shortfall can be calculated as follows Expec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started