Question

Suppose you are told that the average return on investment for a particular class of investments was 7.8% with a standard deviation of 2.3.

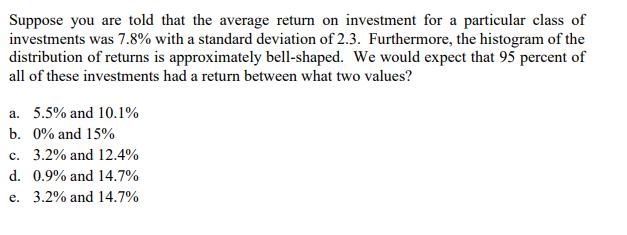

Suppose you are told that the average return on investment for a particular class of investments was 7.8% with a standard deviation of 2.3. Furthermore, the histogram of the distribution of returns is approximately bell-shaped. We would expect that 95 percent of all of these investments had a return between what two values? a. 5.5% and 10.1% b. 0% and 15% c. 3.2% and 12.4% d. 0.9% and 14.7% e. 3.2% and 14.7%

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Since the histogram is bellshaped we can use the empirical rule The empirical rule ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

MIS Essentials

Authors: David M. Kroenke

4th edition

978-0133546590, 133546594, 978-0133807479

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App