Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are working in the business development group of a large technology firm or a fashion conglomerate and are asked to value a firm

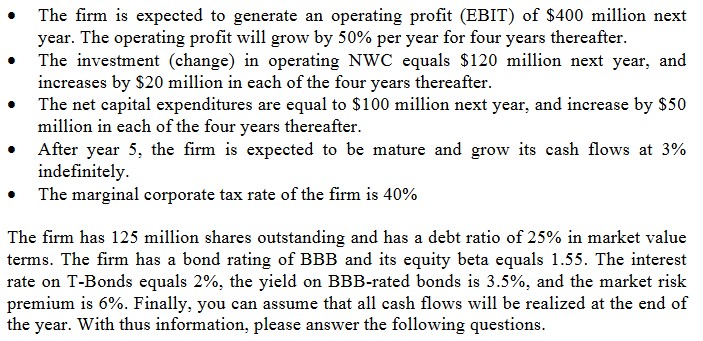

Suppose you are working in the business development group of a large technology

firm or a fashion conglomerate and are asked to value a firm in the context of an acquisition You have collected the following information:

screenshot attached

With thus information, please answer the following questions.

Determine the current cost of capital WACC of the firm. Show all your

calculations.

Explain the determinants of the current equity beta of the target company.

Determine the relevant cash flows for a valuation of the firm for each of the next

years.

The firm is expected to generate an operating profit EBIT of $ million next

year. The operating profit will grow by per year for four years thereafter.

The investment change in operating NWC equals $ million next year, and

increases by $ million in each of the four years thereafter.

The net capital expenditures are equal to $ million next year, and increase by $

million in each of the four years thereafter.

After year the firm is expected to be mature and grow its cash flows at

indefinitely.

The marginal corporate tax rate of the firm is

The firm has million shares outstanding and has a debt ratio of in market value

terms. The firm has a bond rating of BBB and its equity beta equals The interest

rate on TBonds equals the yield on BBBrated bonds is and the market risk

premium is Finally, you can assume that all cash flows will be realized at the end of

the year. With thus information, please answer the following questions.What is the value per share for this firm? Motivate your approach and show your

calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started