Answered step by step

Verified Expert Solution

Question

1 Approved Answer

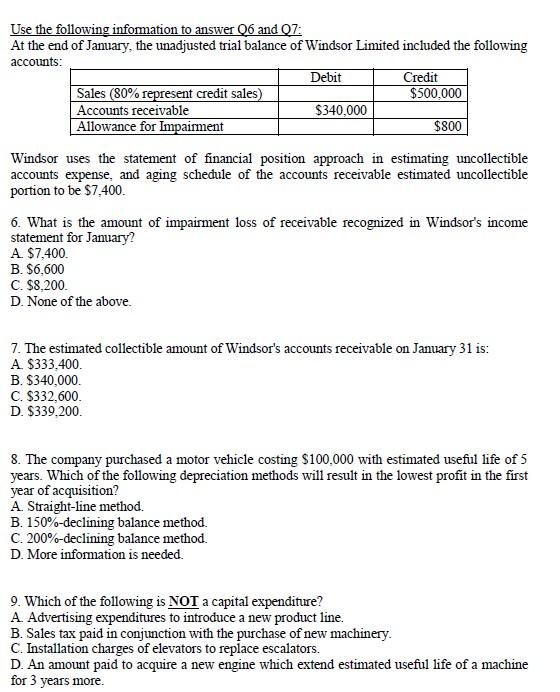

Use the following information to answer Q6 and 07: At the end of January, the unadjusted trial balance of Windsor Limited included the following

Use the following information to answer Q6 and 07: At the end of January, the unadjusted trial balance of Windsor Limited included the following accounts: Debit Sales (80% represent credit sales) Accounts receivable Allowance for Impairment A. $7,400. B. $6,600 Windsor uses the statement of financial position approach in estimating uncollectible accounts expense, and aging schedule of the accounts receivable estimated uncollectible portion to be $7,400. C. $8,200. D. None of the above. $340,000 6. What is the amount of impairment loss of receivable recognized in Windsor's income statement for January? B. $340,000. C. $332,600. D. $339,200. Credit $500,000 $800 7. The estimated collectible amount of Windsor's accounts receivable on January 31 is: A. $333,400. C. 200%-declining balance method. D. More information is needed. 8. The company purchased a motor vehicle costing $100,000 with estimated useful life of 5 years. Which of the following depreciation methods will result in the lowest profit in the first year of acquisition? A. Straight-line method. B. 150%-declining balance method. 9. Which of the following is NOT a capital expenditure? A. Advertising expenditures to introduce a new product line. B. Sales tax paid in conjunction with the purchase of new machinery. C. Installation charges of elevators to replace escalators. D. An amount paid to acquire a new engine which extend estimated useful life of a machine for 3 years more.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

6 Allow ance for impairment Accounts rece ivable Estimated un collect ible accounts 800 340 000 7 40...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started