Answered step by step

Verified Expert Solution

Question

1 Approved Answer

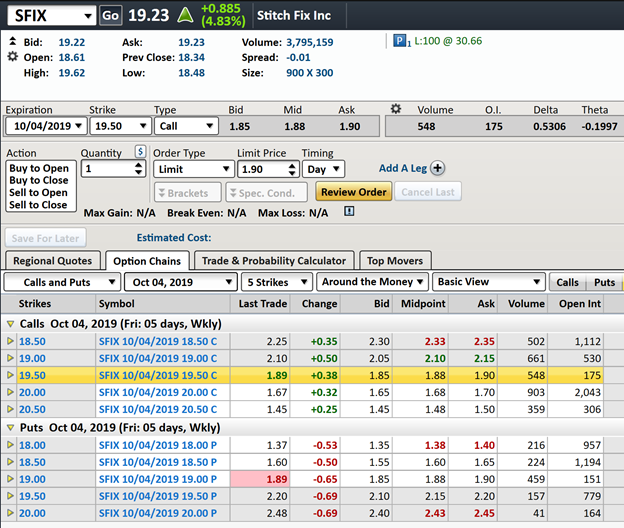

Suppose you buy 3 call option contracts on SFIX. The option expires on Friday, 10/04/2019, the strike price is $19.50 and the premium is $89

- Suppose you buy 3 call option contracts on SFIX. The option expires on Friday, 10/04/2019, the strike price is $19.50 and the premium is $89 per share as seen above. Answer the following questions:

- Calculate the intrinsic value of SFIX 10/04/2019 19.50 C given that the stock price is currently traded at $19.23

- If the stock price is at $18.00 at expiration on 10/04, will this option be exercised? and more importantly, WHY or WHY NOT?

- Calculate the total profit (loss) of this entire trade if the stock price at expiration is $18.00

- Calculate the total profit (loss) of this entire trade is the stock price at expiration is $19.50

- Calculate the total profit (loss) of this entire trade if the stock price at expiration is $21.00

- Calculate the total profit (loss) of this entire trade if the stock price at expiration is $22.50

- Use answer in (C) through (f) to graph the total profit (loss) for a long call on SFIX.

- According to the graph in (g), what is the TOTAL maximum gain and maximum loss of the above long call

- What is the breakeven price in this transaction?

SFIX Go 19.23 A +0.885 (4.83%) Stitch Fix Inc Ask: 19.23 Volume: 3,795,159 Prev Close: 18.34 Spread: -0.01 Low: 18.48 900 X 300 Bid: 19.22 Open: 18.61 High: 19.62 L:100 @ 30.66 Size: Expiration Strike Type Bid Mid Ask Volume 0.1. Delta Theta 10/04/2019 19.50 Call 1.85 1.88 1.90 548 175 0.5306 -0.1997 Action Quantity Order Type Limit Price Timing Buy to Open 9 Limit 1.90 Day Add A Leg + Buy to close Sell to Open Brackets Spec. Cond. Review Order Cancel Last Sell to Close Max Gain: N/A Break Even: N/A Max Loss: N/A Save For Later Estimated Cost: Regional Quotes Option Chains Trade & Probability Calculator | Top Movers Calls and Puts Oct 04, 2019 5 Strikes Around the Money Basic View Calls Puts Strikes Symbol Last Trade Change Bid Midpoint Ask Volume Open Int Calls Oct 04, 2019 (Fri: 05 days, Wkly) 18.50 SFIX 10/04/2019 18.50 C 2.25 +0.35 2.30 2.35 502 1,112 19.00 SFIX 10/04/2019 19.00C 2.10 +0.50 2.05 2.10 2.15 661 530 > 19.50 SFIX 10/04/2019 19.50 C 1.89 +0.38 1.85 1.88 1.90 548 175 20.00 SFIX 10/04/2019 20.00 C 1.67 +0.32 1.65 1.68 1.70 903 2,043 20.50 SFIX 10/04/2019 20.50 C 1.45 +0.25 1.45 1.48 1.50 359 306 Puts Oct 04, 2019 (Fri: 05 days, Wkly) 18.00 SFIX 10/04/2019 18.00 P 1.37 -0.53 1.35 1.38 1.40 216 957 18.50 SFIX 10/04/2019 18.50 P 1.60 -0.50 1.55 1.60 1.65 224 1,194 > 19.00 SFIX 10/04/2019 19.00 P 1.89 -0.65 1.85 1.88 1.90 459 151 19.50 SFIX 10/04/2019 19.50 P 2.20 -0.69 2.10 2.15 2.20 157 779 20.00 SFIX 10/04/2019 20.00 P 2.48 -0.69 2.40 2.43 2.45 41 164 2.33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started