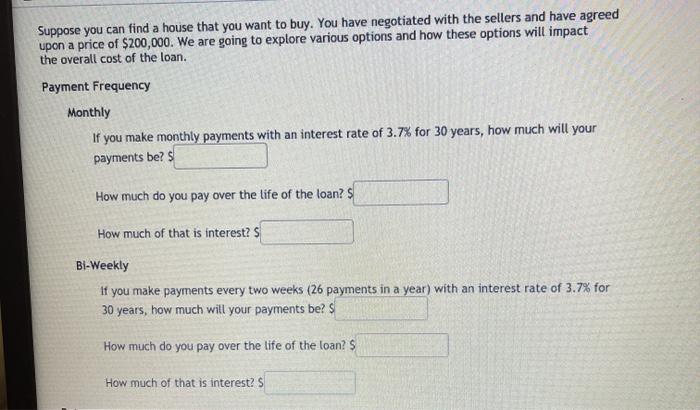

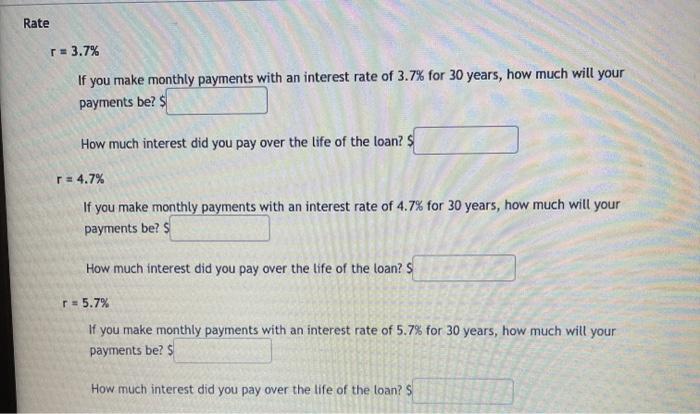

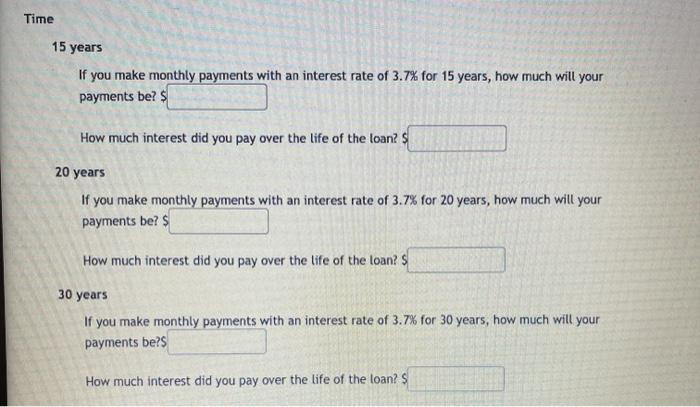

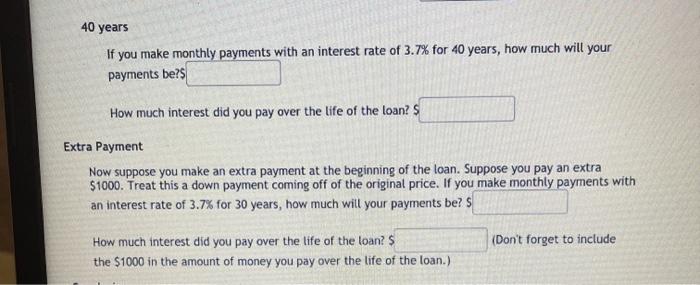

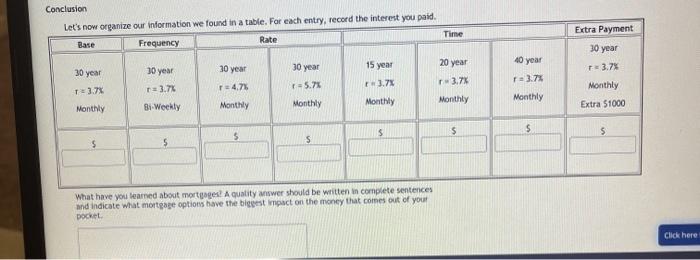

Suppose you can find a house that you want to buy. You have negotiated with the sellers and have agreed upon a price of $200,000. We are going to explore various options and how these options will impact the overall cost of the loan. Payment Frequency Monthly If you make monthly payments with an interest rate of 3.7% for 30 years, how much will your payments be? How much do you pay over the life of the loan? $ How much of that is interest? $ Bi-Weekly if you make payments every two weeks (26 payments in a year) with an interest rate of 3.7% for 30 years, how much will your payments be? S How much do you pay over the life of the loan? How much of that is interest? Rate r = 3.7% If you make monthly payments with an interest rate of 3.7% for 30 years, how much will your payments be? $ How much interest did you pay over the life of the loan? $ r = 4.7% If you make monthly payments with an interest rate of 4.7% for 30 years, how much will your payments be? $ How much interest did you pay over the life of the loan? S r = 5.7% If you make monthly payments with an interest rate of 5.7% for 30 years, how much will your payments be? $ How much interest did you pay over the life of the loan? Time 15 years If you make monthly payments with an interest rate of 3.7% for 15 years, how much will your payments be? $ How much interest did you pay over the life of the loan? $ 20 years If you make monthly payments with an interest rate of 3.7% for 20 years, how much will your payments be? $ How much interest did you pay over the life of the loan? 30 years If you make monthly payments with an interest rate of 3.7% for 30 years, how much will your payments be? How much interest did you pay over the life of the loan? S 40 years If you make monthly payments with an interest rate of 3.7% for 40 years, how much will your payments be? How much interest did you pay over the life of the loan? $ Extra Payment Now suppose you make an extra payment at the beginning of the loan. Suppose you pay an extra $1000. Treat this a down payment coming off of the original price. If you make monthly payments with an interest rate of 3.7% for 30 years, how much will your payments be? S (Don't forget to include How much interest did you pay over the life of the loan? $ the $1000 in the amount of money you pay over the life of the loan.) Conclusion Let's now organize our information we found in a table. For each entry, record the interest you paid. Base Frequency Rate Time Extra Payment 30 year 40 year 20 year 15 year 30 year 30 year 30 year 30 year 3.7% 3.7% 3.7% = 3.7% 13.7 3.7% T=4.7% 5.7 Monthly Monthly Monthly Extra 51000 Monthly Bi-Weekly Monthly Monthly Monthly $ $ $ $ 5 $ 5 S What have you learned about mortgages! A quality answer should be written in complete sentences and indicate what mortgage options have the biggest impact on the money that comes out of you pocket Click here