Question

Suppose you completed your 12 grade education in Business and accounting with merit scholarship in 2013, then you completed BS ACCOUNTING AND FINANCE degree with

Suppose you completed your 12 grade education in Business and accounting with merit scholarship in 2013,

then you completed BS ACCOUNTING AND FINANCE degree with specialization in FORENSIC

ACCOUNTING in year 2017 and secured 3.75 CGPA. You got a chance to study a semester exchange program

in University of GERMANY. You got award of best Researcher there, moreover you won an Accounting quiz

competition and got $1000 prize money in university. You were a brilliant student with fine academic record.

You have been participating in Extra Curricular activities in your college and university as well. You also were

the prefect of your class and head of hiking club at University .You got advanced certificate in English

Communication and Certificate in Tax accounting and fiduciary accounting. You were Ambassador by university

& Gamble in your university for one year. You have also worked in a volunteer organization for provision of

free education to slum areas. Along with Studies you have been working as a CSR in reputed call center. You

have worked as "Assistant Manager accounts" in a multinational company.

Now you have to apply for the job of "Manager forensic Accounting" in Safe& sound Security company

(Specialized in security and Cybercrimes).Write resume and Cover letter for this job.

You applied for the job in Q2 Manager Forensic Accounting and you were selected. After interview you have

to write follow up letter for that job. Write the necessary point to write the follow up letter.

Two.

Suppose the following information (in thousands of dollars) is available for H.J. Heinz Company?famous for ketchup and other fine food products?for the year ended April 30, 2017.

Prepaid insurance $ 125,765 Buildings $4,033,369

Land 76,193 Cash 373,145

Goodwill 3,982,954 Accounts receivable 1,171,797

Trademarks 757,907 Accumulated depreciation?buildings 2,131,260

Inventory 1,237,613

Prepare the assets section of a classified balance sheet. (List current assets in order of liquidity.)

H.J. Heinz Company

Partial Balance Sheet

For the Year Ended April 30, 2017For the Month Ended April 30, 2017April 30, 2017

(in thousands)

Assets

Stockholders' EquityIntangible AssetsProperty, Plant and EquipmentTotal AssetsTotal Property, Plant and EquipmentTotal Intangible AssetsTotal Current AssetsTotal Long-Term InvestmentsTotal Long-Term LiabilitiesCurrent AssetsTotal LiabilitiesTotal Stockholders' EquityCurrent LiabilitiesLong-Term InvestmentsLong-Term LiabilitiesTotal Liabilities and Stockholders' EquityTotal Current Liabilities

$

Long-Term LiabilitiesTotal AssetsStockholders' EquityTotal LiabilitiesTotal Long-Term LiabilitiesTotal Property, Plant and EquipmentIntangible AssetsTotal Current AssetsLong-Term InvestmentsTotal Current LiabilitiesTotal Intangible AssetsTotal Stockholders' EquityCurrent AssetsTotal Long-Term InvestmentsCurrent LiabilitiesProperty, Plant and EquipmentTotal Liabilities and Stockholders' Equity

$

Total AssetsTotal Stockholders' EquityTotal Liabilities and Stockholders' EquityIntangible AssetsLong-Term InvestmentsTotal LiabilitiesTotal Current AssetsTotal Long-Term InvestmentsTotal Property, Plant and EquipmentCurrent LiabilitiesTotal Long-Term LiabilitiesCurrent AssetsTotal Current LiabilitiesStockholders' EquityTotal Intangible AssetsProperty, Plant and EquipmentLong-Term Liabilities

$

AddLess

:

Property, Plant and EquipmentTotal Current AssetsCurrent AssetsTotal Stockholders' EquityTotal Property, Plant and EquipmentTotal Intangible AssetsCurrent LiabilitiesIntangible AssetsLong-Term InvestmentsTotal LiabilitiesLong-Term LiabilitiesStockholders' EquityTotal Current LiabilitiesTotal Liabilities and Stockholders' EquityTotal AssetsTotal Long-Term InvestmentsTotal Long-Term Liabilities

Current AssetsLong-Term InvestmentsTotal Current LiabilitiesLong-Term LiabilitiesTotal Current AssetsProperty, Plant and EquipmentTotal Property, Plant and EquipmentTotal AssetsCurrent LiabilitiesTotal Intangible AssetsTotal Liabilities and Stockholders' EquityTotal Long-Term InvestmentsIntangible AssetsTotal LiabilitiesStockholders' EquityTotal Long-Term LiabilitiesTotal Stockholders' Equity

Current AssetsTotal Current LiabilitiesTotal Liabilities and Stockholders' EquityTotal Long-Term InvestmentsTotal Property, Plant and EquipmentTotal Long-Term LiabilitiesCurrent LiabilitiesIntangible AssetsTotal Current AssetsTotal Stockholders' EquityLong-Term InvestmentsProperty, Plant and EquipmentTotal AssetsStockholders' EquityLong-Term LiabilitiesTotal Intangible AssetsTotal Liabilities

$

Three.

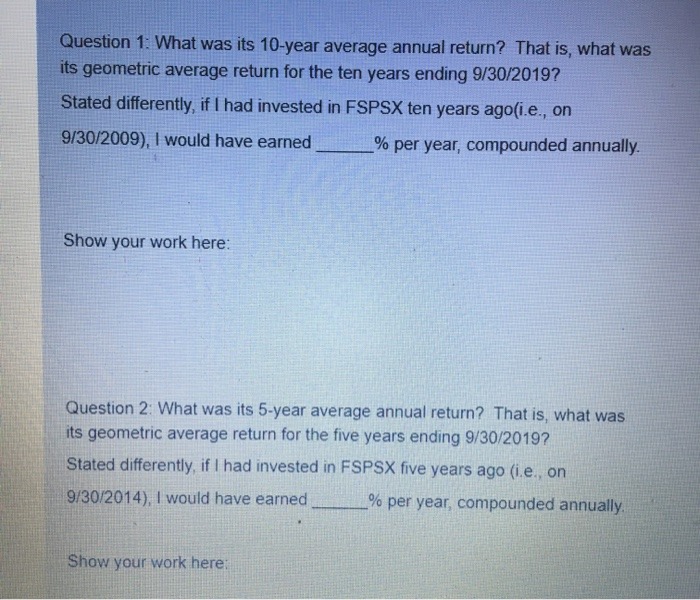

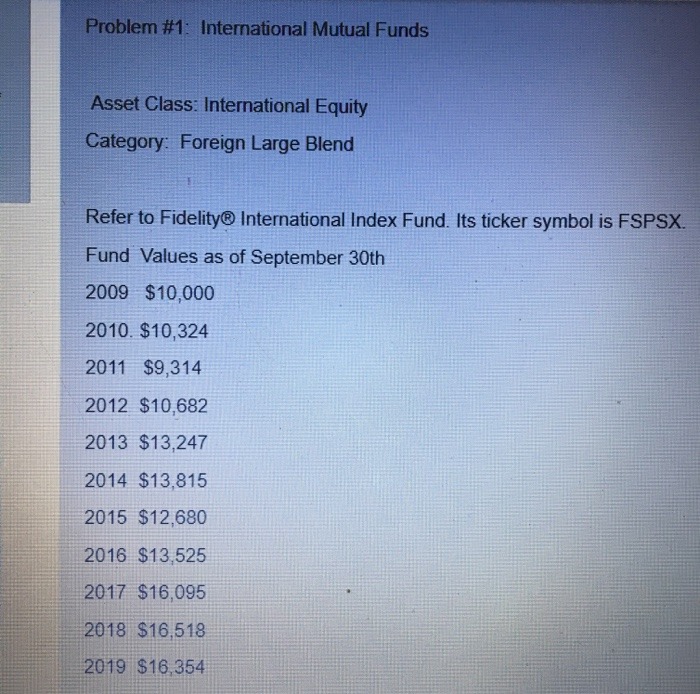

Question 1: What was its 10-year average annual return? That is, what was its geometric average return for the ten years ending 9/30/2019? Stated differently, if I had invested in FSPSX ten years ago(i.e., on 9/30/2009), I would have earned % per year, compounded annually. Show your work here: Question 2: What was its 5-year average annual return? That is, what was its geometric average return for the five years ending 9/30/2019? Stated differently, if I had invested in FSPSX five years ago (i.e., on 9/30/2014), I would have earned % per year, compounded annually. Show your work here:

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this problem 1 The 10year annualized return for FSPSX ending ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started