Question

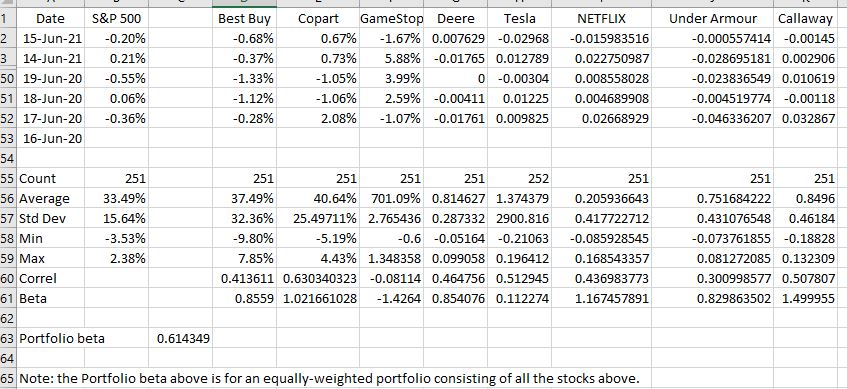

Review this spreadsheet and answer the following questions: a.The portfolio beta calculated is 0.61. Explain how the calculated beta would change if your company were

Review this spreadsheet and answer the following questions:

a.The portfolio beta calculated is 0.61. Explain how the calculated beta would change if your company were dropped from the portfolio and we recalculated beta. If you company is not included in the spreadsheet, explain how the calculated beta would change if your company were added to the portfolio and we recalculated beta.

b.Assume that the risk-free interest rate is currently -1% and the market risk (rM) is 9%. Show calculations for the required return (ri) on your company's stock.

c.Explain how your required return in b would change if the risk-free rate rose to 1%

d.Explain how your required return in b would change if the market risk (rM) dropped to 6%.

1 Date S&P 500 -0.20% 2 15-Jun-21 3 14-Jun-21 0.21% 50 19-Jun-20 -0.55% 51 18-Jun-20 0.06% 52 17-Jun-20 -0.36% 53 16-Jun-20 54 55 Count 56 Average 57 Std Dev 58 Min 251 33.49% 15.64% -3.53% 2.38% Best Buy -0.68% -0.37% -1.33% -1.12% -0.28% 0.614349 Copart GameStop Deere Tesla 0.67% -1.67% 0.007629 -0.02968 0.73% 5.88% -0.01765 0.012789 -1.05% 3.99% 0 -0.00304 -1.06% 2.59% -0.00411 0.01225 -1.07% -0.01761 0.009825 2.08% NETFLIX -0.015983516 0.022750987 0.008558028 0.004689908 0.02668929 251 251 251 252 37.49% 32.36% 251 40.64% 701.09% 0.814627 1.374379 0.205936643 25.49711% 2.765436 0.287332 2900.816 0.417722712 -0.6 -0.05164 -0.21063 -0.085928545 7.85% 4.43% 1.348358 0.099058 0.196412 0.168543357 0.413611 0.630340323 -0.08114 0.464756 0.512945 0.436983773 0.8559 1.021661028 -1.4264 0.854076 0.112274 1.167457891 -9.80% -5.19% 251 59 Max 60 Correl 61 Beta 62 63 Portfolio beta 64 65 Note: the Portfolio beta above is for an equally-weighted portfolio consisting of all the stocks above. Under Armour Callaway -0.000557414 -0.00145 -0.028695181 0.002906 -0.023836549 0.010619 -0.004519774 -0.00118 -0.046336207 0.032867 251 251 0.751684222 0.8496 0.431076548 0.46184 -0.073761855 -0.18828 0.081272085 0.132309 0.300998577 0.507807 0.829863502 1.499955

Step by Step Solution

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing the Portfolio Beta and Required Return a Impact of Removing or Adding a Company on Portfolio Beta Removing your company If your company is i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started