Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adam works as a financial analyst with General Motors. He was asked by his boss to evaluate two potential projects. The initial cost of

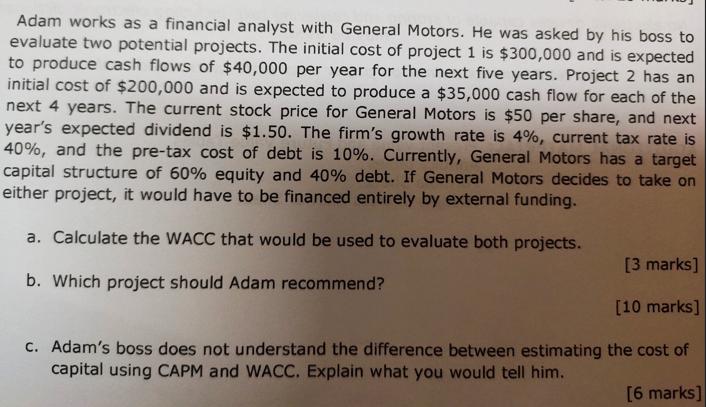

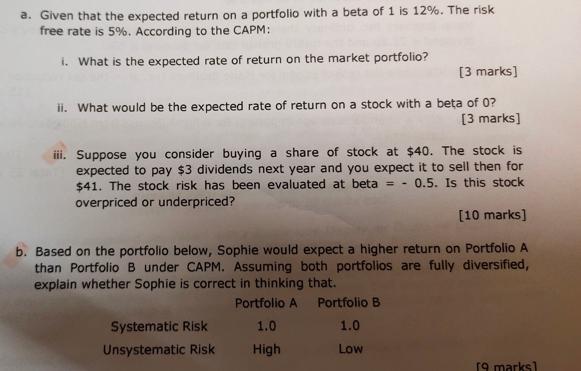

Adam works as a financial analyst with General Motors. He was asked by his boss to evaluate two potential projects. The initial cost of project 1 is $300,000 and is expected to produce cash flows of $40,000 per year for the next five years. Project 2 has an initial cost of $200,000 and is expected to produce a $35,000 cash flow for each of the next 4 years. The current stock price for General Motors is $50 per share, and next year's expected dividend is $1.50. The firm's growth rate is 4%, current tax rate is 40%, and the pre-tax cost of debt is 10%. Currently, General Motors has a target capital structure of 60% equity and 40% debt. If General Motors decides to take on either project, it would have to be financed entirely by external funding. a. Calculate the WACC that would be used to evaluate both projects. b. Which project should Adam recommend? c. Adam's boss does not understand the difference between estimating capital using CAPM and WACC. Explain what you would tell him. [3 marks] [10 marks] the cost of [6 marks] a. Given that the expected return on a portfolio with a beta of 1 is 12%. The risk free rate is 5%. According to the CAPM: i. What is the expected rate of return on the market portfolio? [3 marks] ii. What would be the expected rate of return on a stock with a beta of 0? [3 marks] iii. Suppose you consider buying a share of stock at $40. The stock is expected to pay $3 dividends next year and you expect it to sell then for $41. The stock risk has been evaluated at beta = - 0.5. Is this stock overpriced or underpriced? [10 marks] b. Based on the portfolio below, Sophie would expect a higher return on Portfolio A than Portfolio B under CAPM. Assuming both portfolios are fully diversified, explain whether Sophie is correct in thinking that. Portfolio A 1.0 High Systematic Risk Unsystematic Risk Portfolio B 1.0 Low 19 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To evaluate the projects using WACC 1 Cost of equity Rate of return on market portfolio BetaRate o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started