Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you created a two-stock portfolio by investing $50,000 in High Tech and $50,000 in Collections. 1.) Calculate the expected return, the standard deviation, the

Suppose you created a two-stock portfolio by investing $50,000 in High Tech and $50,000 in Collections.

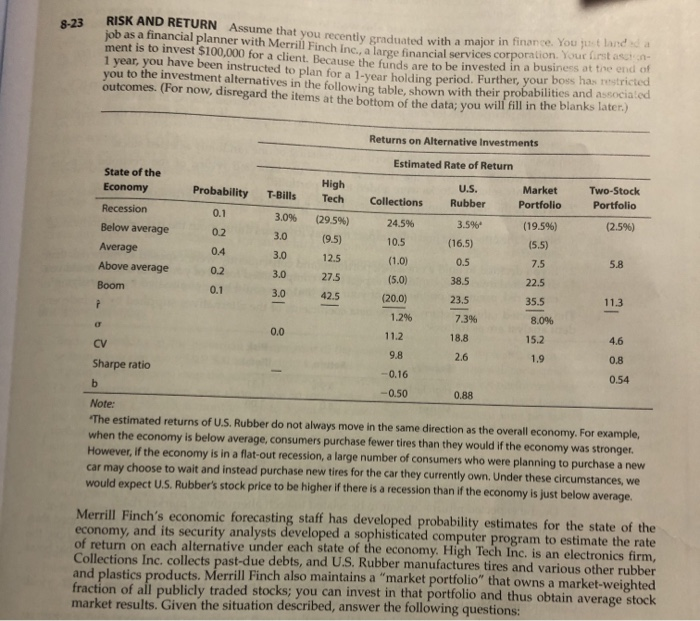

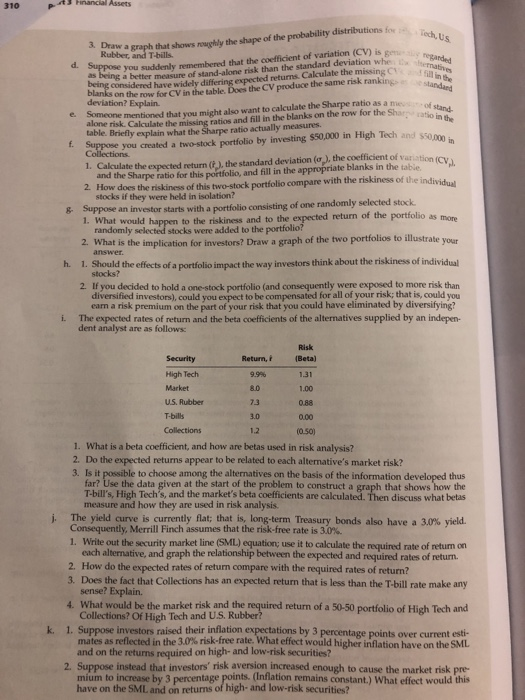

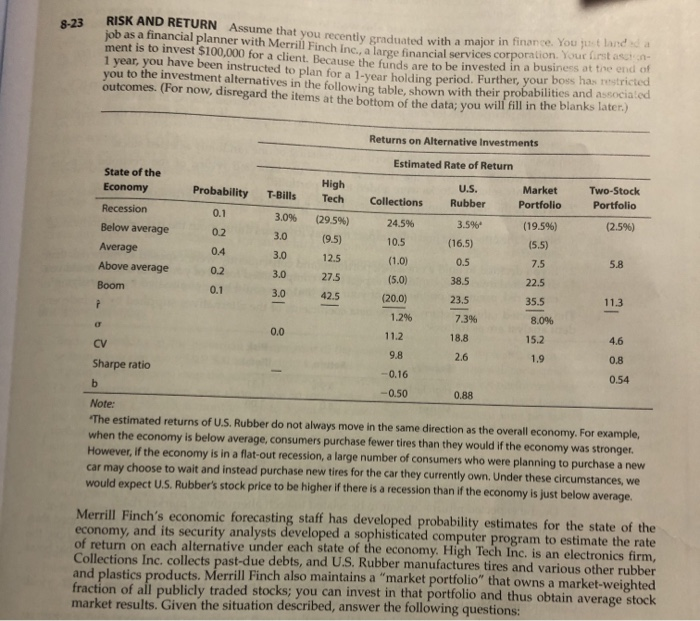

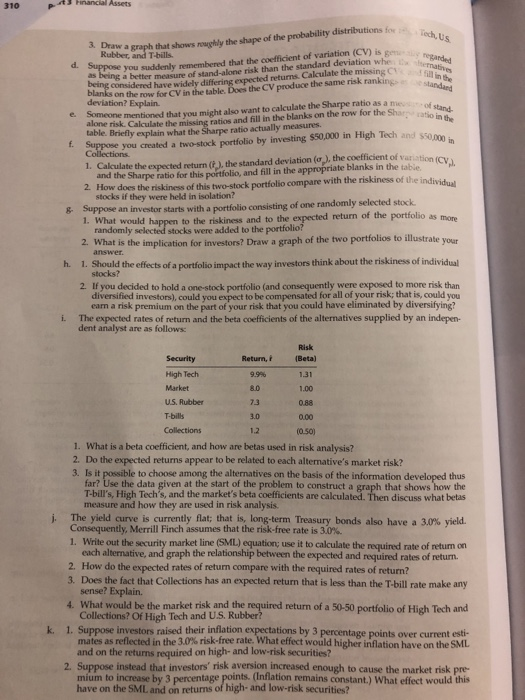

23 RISK AND RETURN Assume that you recently graduated with a major in finance You job as a financial planner with Merrill Finch Inc. large financial services corporation e t ment is to invest $100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Further, your boss has stricted you to the investment alternatives in the following table shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data: vou will fill in the blanks Because the fund you to the invest been instructed to Returns on Alternative Investments Estimated Rate of Return Probability T-Bills U.S. Rubber Market Portfolio Two-Stock Portfolio (2.5%) State of the Economy Recession Below average Average Above average Boom 3.0% 3.0 High Tech (29.5%) (9.5) 12.5 27.5 Collections 24.5% 10.5 (1.0) (19.5%) (5.5) 3.5% (16.5) 0.5 38.5 7.5 5.8 (5.0) 23.5 22.5 35.5 8.04 113 7.3% 18.8 15.2 4.6 1.9 Sharpe ratio 0.54 -0.16 -0.50 0.88 Note: 'The estimated returns of U.S. Rubber do not always move in the same direction as the overall economy. For example, when the economy is below average, consumers purchase fewer tires than they would if the economy was stronger. However, if the economy is in a flat-out recession, a large number of consumers who were planning to purchase a new car may choose to wait and instead purchase new tires for the car they currently own. Under these circumstances, we would expect U.S. Rubber's stock price to be higher if there is a recession than if the economy is just below average. Merrill Finch's economic forecasting staff has developed probability estimates for the state of the economy, and its security analysts developed a sophisticated computer program to estimate the rate of return on each alternative under each state of the economy. High Tech Inc. is an electronics firm, Collections Inc, collects past-due debts, and U.S. Rubber manufactures tires and various other rubber and plastics products. Merrill Finch also maintains a "market portfolio" that owns a market-weighted fraction of all publicly traded stocks: you can invest in that portfolio and thus obtain average stock market results. Given the situation described, answer the following questions: 310 pe hinancial Assets ons for ich. Us standard Chat in the 000 in High Tech and 550.000 in Draw a graph that shows why the shape of the probability distributions to Rubber, and T-bills. is Suppose you suddenly remembered that the coefficient of variation n ded being a better measure of stand-alone risk than the standard deviation whe ng considered have widely differing expected returns. Calculate the missing the anks on the row for CV in the table. Does the CV produce the same risk ranking deviation? Explain. e Someone mentioned that you might also want to calculate the Sharpe ratio as a me n d- alone risk. Calculate the missing ratios and fill in the blanks on the row for the Sha table. Briefly explain what the Sharpe ratio actually measures. Suppose you created a two-stock portfolio by investing $50,000 in High Tech and so Collections. 1. Calculate the expected return the standard deviation ( ), the coefficient of variation and the Sharpe ratio for this portfolio, and fill in the appropriate blanks in the table 2. How does the riskiness of this two-stock portfolio compare with the riskiness of the individu stocks if they were held in isolation? & Suppose an investor starts with a portfolio consisting of one randomly selected stock 1. What would happen to the riskiness and to the expected return of the portfolio asmo randomly selected stocks were added to the portfolio? 2. What is the implication for investors? Draw a graph of the two portfolios to illustrate your answer. h. 1. Should the effects of a portfolio impact the way investors think about the riskiness of individual stocks? 2. If you decided to hold a one-stock portfolio (and consequently were exposed to more risk than diversified investors), could you expect to be compensated for all of your risk; that is, could you eam a risk premium on the part of your risk that you could have eliminated by diversifying? i. The expected rates of return and the beta coefficients of the alternatives supplied by an indepen- dent analyst are as follows: 0.88 12 j. Risk Security Return (Beta) High Tech 9.990 1.31 Market 1.00 US Rubber 73 T-bilis 0.00 Collections (0.50) 1. What is a beta coefficient, and how are betas used in risk analysis? 2. Do the expected returns appear to be related to each alternative's market risk? 3. Is it possible to choose among the alternatives on the basis of the information developed thus far? Use the data given at the start of the problem to construct a graph that shows how the T-bill's, High Tech's, and the market's beta coefficients are calculated. Then discuss what betas measure and how they are used in risk analysis. The yield curve is currently flat; that is, long-term Treasury bonds also have a 3.0% yield. Consequently, Merrill Finch assumes that the risk-free rate is 3.0%. 1. Write out the security market line (SML) equation, use it to calculate the required rate of return on each alternative, and graph the relationship between the expected and required rates of return. 2. How do the expected rates of return compare with the required rates of return? 3. Does the fact that Collections has an expected return that is less than the T-bill rate make any sense? Explain. 4. What would be the market risk and the required return of a 50-50 portfolio of High Tech and Collections? Of High Tech and U.S. Rubber? 1. Suppose investors raised their inflation expectations by 3 percentage points over current esti- mates as reflected in the 3.0% risk-free rate. What effect would higher inflation have on the SML and on the returns required on high- and low-risk securities? 2. Suppose instead that investors' risk aversion increased enough to cause the market risk pre- mium to increase by 3 percentage points. (Inflation remains constant.) What effect would this have on the SML and on returns of high- and low-risk securities? k. 23 RISK AND RETURN Assume that you recently graduated with a major in finance You job as a financial planner with Merrill Finch Inc. large financial services corporation e t ment is to invest $100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Further, your boss has stricted you to the investment alternatives in the following table shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data: vou will fill in the blanks Because the fund you to the invest been instructed to Returns on Alternative Investments Estimated Rate of Return Probability T-Bills U.S. Rubber Market Portfolio Two-Stock Portfolio (2.5%) State of the Economy Recession Below average Average Above average Boom 3.0% 3.0 High Tech (29.5%) (9.5) 12.5 27.5 Collections 24.5% 10.5 (1.0) (19.5%) (5.5) 3.5% (16.5) 0.5 38.5 7.5 5.8 (5.0) 23.5 22.5 35.5 8.04 113 7.3% 18.8 15.2 4.6 1.9 Sharpe ratio 0.54 -0.16 -0.50 0.88 Note: 'The estimated returns of U.S. Rubber do not always move in the same direction as the overall economy. For example, when the economy is below average, consumers purchase fewer tires than they would if the economy was stronger. However, if the economy is in a flat-out recession, a large number of consumers who were planning to purchase a new car may choose to wait and instead purchase new tires for the car they currently own. Under these circumstances, we would expect U.S. Rubber's stock price to be higher if there is a recession than if the economy is just below average. Merrill Finch's economic forecasting staff has developed probability estimates for the state of the economy, and its security analysts developed a sophisticated computer program to estimate the rate of return on each alternative under each state of the economy. High Tech Inc. is an electronics firm, Collections Inc, collects past-due debts, and U.S. Rubber manufactures tires and various other rubber and plastics products. Merrill Finch also maintains a "market portfolio" that owns a market-weighted fraction of all publicly traded stocks: you can invest in that portfolio and thus obtain average stock market results. Given the situation described, answer the following questions: 310 pe hinancial Assets ons for ich. Us standard Chat in the 000 in High Tech and 550.000 in Draw a graph that shows why the shape of the probability distributions to Rubber, and T-bills. is Suppose you suddenly remembered that the coefficient of variation n ded being a better measure of stand-alone risk than the standard deviation whe ng considered have widely differing expected returns. Calculate the missing the anks on the row for CV in the table. Does the CV produce the same risk ranking deviation? Explain. e Someone mentioned that you might also want to calculate the Sharpe ratio as a me n d- alone risk. Calculate the missing ratios and fill in the blanks on the row for the Sha table. Briefly explain what the Sharpe ratio actually measures. Suppose you created a two-stock portfolio by investing $50,000 in High Tech and so Collections. 1. Calculate the expected return the standard deviation ( ), the coefficient of variation and the Sharpe ratio for this portfolio, and fill in the appropriate blanks in the table 2. How does the riskiness of this two-stock portfolio compare with the riskiness of the individu stocks if they were held in isolation? & Suppose an investor starts with a portfolio consisting of one randomly selected stock 1. What would happen to the riskiness and to the expected return of the portfolio asmo randomly selected stocks were added to the portfolio? 2. What is the implication for investors? Draw a graph of the two portfolios to illustrate your answer. h. 1. Should the effects of a portfolio impact the way investors think about the riskiness of individual stocks? 2. If you decided to hold a one-stock portfolio (and consequently were exposed to more risk than diversified investors), could you expect to be compensated for all of your risk; that is, could you eam a risk premium on the part of your risk that you could have eliminated by diversifying? i. The expected rates of return and the beta coefficients of the alternatives supplied by an indepen- dent analyst are as follows: 0.88 12 j. Risk Security Return (Beta) High Tech 9.990 1.31 Market 1.00 US Rubber 73 T-bilis 0.00 Collections (0.50) 1. What is a beta coefficient, and how are betas used in risk analysis? 2. Do the expected returns appear to be related to each alternative's market risk? 3. Is it possible to choose among the alternatives on the basis of the information developed thus far? Use the data given at the start of the problem to construct a graph that shows how the T-bill's, High Tech's, and the market's beta coefficients are calculated. Then discuss what betas measure and how they are used in risk analysis. The yield curve is currently flat; that is, long-term Treasury bonds also have a 3.0% yield. Consequently, Merrill Finch assumes that the risk-free rate is 3.0%. 1. Write out the security market line (SML) equation, use it to calculate the required rate of return on each alternative, and graph the relationship between the expected and required rates of return. 2. How do the expected rates of return compare with the required rates of return? 3. Does the fact that Collections has an expected return that is less than the T-bill rate make any sense? Explain. 4. What would be the market risk and the required return of a 50-50 portfolio of High Tech and Collections? Of High Tech and U.S. Rubber? 1. Suppose investors raised their inflation expectations by 3 percentage points over current esti- mates as reflected in the 3.0% risk-free rate. What effect would higher inflation have on the SML and on the returns required on high- and low-risk securities? 2. Suppose instead that investors' risk aversion increased enough to cause the market risk pre- mium to increase by 3 percentage points. (Inflation remains constant.) What effect would this have on the SML and on returns of high- and low-risk securities? k 1.) Calculate the expected return, the standard deviation, the coefficient of variation, and the Sharpe ratio for this portfolio, and fill in the appropriate blanks in the table.

2.) How does the riskiness of this two-stock portfolio compare with the riskiness of the individual stocks if they were held in isolation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started