Question

Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A, 300 of B, and 1000 of

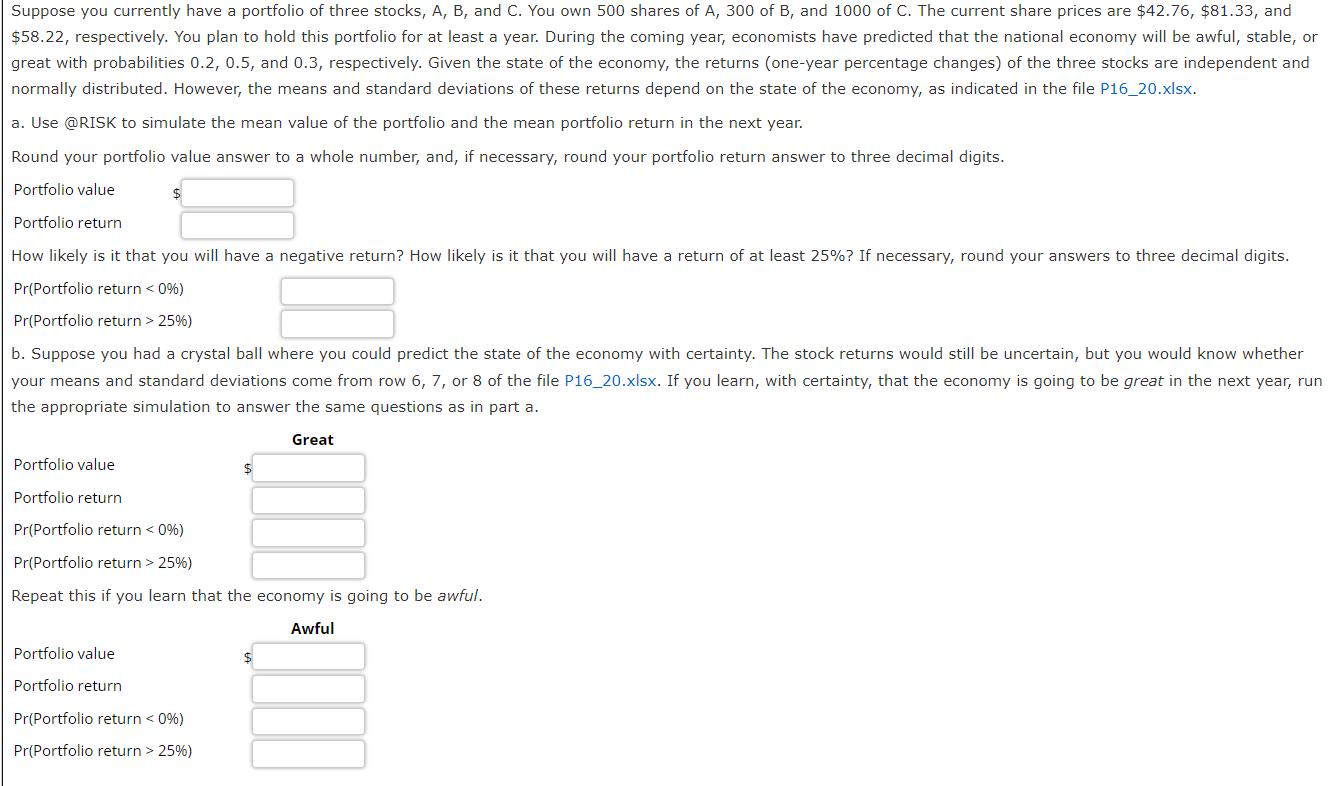

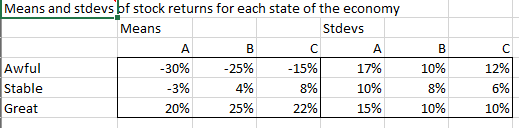

Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A, 300 of B, and 1000 of C. The current share prices are $42.76, $81.33, and $58.22, respectively. You plan to hold this portfolio for at least a year. During the coming year, economists have predicted that the national economy will be awful, stable, or great with probabilities 0.2, 0.5, and 0.3, respectively. Given the state of the economy, the returns (one-year percentage changes) of the three stocks are independent and normally distributed. However, the means and standard deviations of these returns depend on the state of the economy, as indicated in the file P16_20.xlsx.

a. Use @RISK to simulate the mean value of the portfolio and the mean portfolio return in the next year.

Round your portfolio value answer to a whole number, and, if necessary, round your portfolio return answer to three decimal digits.

| Portfolio value | $ |

| Portfolio return |

How likely is it that you will have a negative return? How likely is it that you will have a return of at least 25%? If necessary, round your answers to three decimal digits.

| Pr(Portfolio return | |

| Pr(Portfolio return > 25%) |

b. Suppose you had a crystal ball where you could predict the state of the economy with certainty. The stock returns would still be uncertain, but you would know whether your means and standard deviations come from row 6, 7, or 8 of the file P16_20.xlsx. If you learn, with certainty, that the economy is going to be great in the next year, run the appropriate simulation to answer the same questions as in part a.

| Great | ||

| Portfolio value | $ | |

| Portfolio return | ||

| Pr(Portfolio return | ||

| Pr(Portfolio return > 25%) | ||

Repeat this if you learn that the economy is going to be awful.

| Awful | ||

| Portfolio value | $ | |

| Portfolio return | ||

| Pr(Portfolio return | ||

| Pr(Portfolio return > 25%) | ||

EXCEL DATA FILE:

Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A,300 of B, and 1000 of C. The current share prices are $42.76, $81.33, and $58.22, respectively. You plan to hold this portfolio for at least a year. During the coming year, economists have predicted that the national economy will be awful, stable, or great with probabilities 0.2,0.5, and 0.3 , respectively. Given the state of the economy, the returns (one-year percentage changes) of the the stons are indepent normally distributed. However, the means and standard deviations of these returns depend on the state of the economy, as indicated in the file P16_20.xlsx. a. Use @RISK to simulate the mean value of the portfolio and the mean portfolio return in the next year. Round your portfolio value answer to a whole number, and, if necessary, round your portfolio return answer to three decimal digits. How likely is it that you will have a negative return? How likely is it that you will have a return of at least 25% ? If necessary, round your answers to three decimal digits. b. Suppose you had a crystal ball where you could predict the state of the economy with certainty. The stock returns would still be uncertain, but you would know whether your means and standard deviations come from row 6,7 , or 8 of the file P16_20.xlsx. If you learn, with certainty, that the economy is going to be great in the next year, run the appropriate simulation to answer the same questions as in part a. Repeat this if you learn that the economy is going to be awful. Means and stdevs bf stock returns for each state of the economy

Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A,300 of B, and 1000 of C. The current share prices are $42.76, $81.33, and $58.22, respectively. You plan to hold this portfolio for at least a year. During the coming year, economists have predicted that the national economy will be awful, stable, or great with probabilities 0.2,0.5, and 0.3 , respectively. Given the state of the economy, the returns (one-year percentage changes) of the the stons are indepent normally distributed. However, the means and standard deviations of these returns depend on the state of the economy, as indicated in the file P16_20.xlsx. a. Use @RISK to simulate the mean value of the portfolio and the mean portfolio return in the next year. Round your portfolio value answer to a whole number, and, if necessary, round your portfolio return answer to three decimal digits. How likely is it that you will have a negative return? How likely is it that you will have a return of at least 25% ? If necessary, round your answers to three decimal digits. b. Suppose you had a crystal ball where you could predict the state of the economy with certainty. The stock returns would still be uncertain, but you would know whether your means and standard deviations come from row 6,7 , or 8 of the file P16_20.xlsx. If you learn, with certainty, that the economy is going to be great in the next year, run the appropriate simulation to answer the same questions as in part a. Repeat this if you learn that the economy is going to be awful. Means and stdevs bf stock returns for each state of the economy Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started