Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you decide to do the commercial. To finance the initial cost of $0.1M, you will sell $0.1M worth of the short-term, riskless government

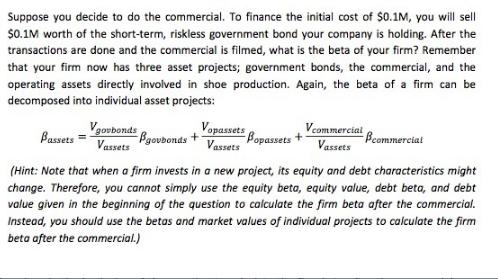

Suppose you decide to do the commercial. To finance the initial cost of $0.1M, you will sell $0.1M worth of the short-term, riskless government bond your company is holding. After the transactions are done and the commercial is filmed, what is the beta of your firm? Remember that your firm now has three asset projects; government bonds, the commercial, and the operating assets directly involved in shoe production. Again, the beta of a firm can be decomposed into individual asset projects: Vgovbonds Bovbonds + Vassets Bassets Vopassets Vassets V commercial Vassets Popassets Bcommercial (Hint: Note that when a firm invests in a new project, its equity and debt characteristics might change. Therefore, you cannot simply use the equity beta, equity value, debt beta, and debt value given in the beginning of the question to calculate the firm beta after the commercial. Instead, you should use the betas and market values of individual projects to calculate the firm beta after the commercial.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating the firms beta after the commercial Market value of each asset Government bonds Vgovbond...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started