Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you expect the stock price of ABC Inc. to go up in the near future. The current market price is $45 per share,

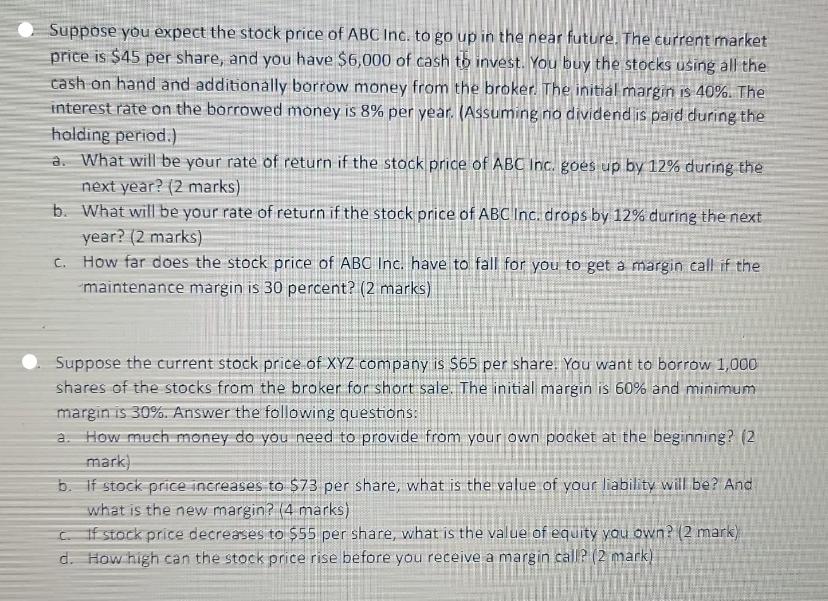

Suppose you expect the stock price of ABC Inc. to go up in the near future. The current market price is $45 per share, and you have $6,000 of cash to invest. You buy the stocks using all the cash on hand and additionally borrow money from the broker. The initial margin is 40%. The interest rate on the borrowed money is 8% per year. (Assuming no dividend is paid during the holding period.) a. What will be your rate of return if the stock price of ABC Inc. goes up by 12% during the next year? (2 marks) b. What will be your rate of return if the stock price of ABC Inc. drops by 12% during the next year? (2 marks) c. How far does the stock price of ABC Inc. have to fall for you to get a margin call if the maintenance margin is 30 percent? (2 marks) Suppose the current stock price of XYZ company is $65 per share. You want to borrow 1,000 shares of the stocks from the broker for short sale. The initial margin is 60% and minimum margin is 30%. Answer the following questions: a. How much money do you need to provide from your own pocket at the beginning? (2 mark) b. If stock price increases to $73 per share, what is the value of your liability will be? And what is the new margin? (4 marks) c. If stock price decreases to $55 per share, what is the value of equity you own? (2 mark) d. How high can the stock price rise before you receive a margin call? (2 mark) S S a.

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Rate of return if ABC stock price increases by 12 Original investment 6000 Number of shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started