Answered step by step

Verified Expert Solution

Question

1 Approved Answer

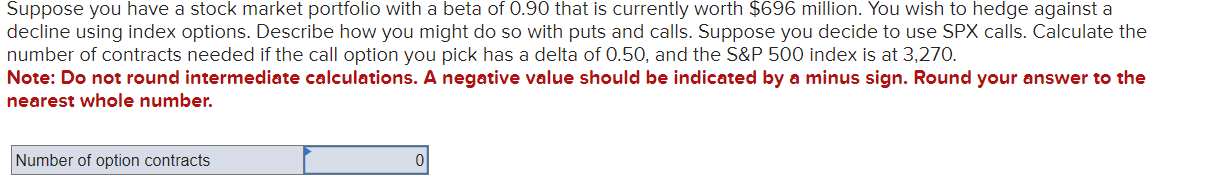

Suppose you have a stock market portfolio with a beta of 0 . 9 0 that is currently worth $ 6 9 6 million. You

Suppose you have a stock market portfolio with a beta of that is currently worth $ million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of and the S&P index is at

Note: Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the nearest whole number.

is wrong Suppose you have a stock market portfolio with a beta of that is currently worth $ million. You wish to hedge against a

decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the

number of contracts needed if the call option you pick has a delta of and the S&P index is at

Note: Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the

nearest whole number.

Number of option contracts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started