Question

Suppose you have been assigned to the audit team for the Household Supply Stores, Incorporated for the period ending December 31, 2018. As with all

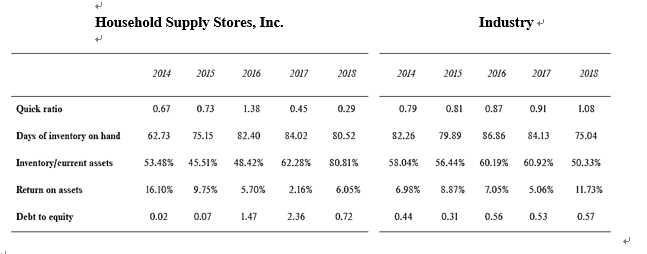

Suppose you have been assigned to the audit team for the Household Supply Stores, Incorporated for the period ending December 31, 2018. As with all audit engagements, among the initial procedures are to analyze the entitys financial data by reviewing trends in significant ratios and comparing the entitys performance with its industry so that the team can better understand the business and can determine where to concentrate the audit efforts. Further suppose one of your audit team performed analytical procedures by calculating the following ratios and obtaining related industry data for Household Supply Stores.

Required: Provide a report of your analysis of the data in the above table as follows:

For each ratio, describe how the ratio is calculated and its significance in understanding the business. (For example, what are the components of the numerator and the denominator of the Quick ratio and what is the significance of the calculated value of the ratio?)

a. Provide at least two specific risks the ratio and /or the historical patterns may present in the audit. For example, a declining quick ratio may indicate an increasing risk that Household Supply will not be able to pay its liabilities in a timely manner.

b. Provide at least two plausible explanations for why Household Supplys ratios or historical patterns differ from those of the industry.

t Household Supply Stores, Inc. Industry t 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Quick ratio 0.67 0.73 1.38 0.45 0.29 0.79 0.81 0.87 0.91 1.OS Days of inventory on hand 62.73 75.15 82.40 84.02 80.52 82.26 79.89 86.86 84.13 75.04 Inventory/current assets 53.48% 45.51% 48.42% 62.28% SO.SI% 58.04% 56.44% 60.19% 60.92% 50.33% Return on assets 16.10% 9.75% 5.70% 2.16% 6.05% 6.98% 8.87% 7.05% 5.06% 11.73% Debt to equity 0.02 0.07 1.47 2.36 0.72 0.44 0.31 0.56 0.53 0.57Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started