Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you have been hired as a consultant by Stevens Steel. Stevens Steel has prepared the following estimates for a long-term project it is

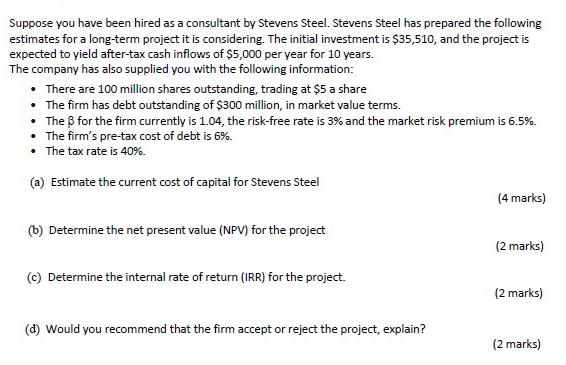

Suppose you have been hired as a consultant by Stevens Steel. Stevens Steel has prepared the following estimates for a long-term project it is considering. The initial investment is $35,510, and the project is expected to yield after-tax cash inflows of $5,000 per year for 10 years. The company has also supplied you with the following information: There are 100 million shares outstanding, trading at $5 a share The firm has debt outstanding of $300 million, in market value terms. The for the firm currently is 1.04, the risk-free rate is 3% and the market risk premium is 6.5%. The firm's pre-tax cost of debt is 6%. The tax rate is 40%. (a) Estimate the current cost of capital for Stevens Steel (b) Determine the net present value (NPV) for the project (c) Determine the internal rate of return (IRR) for the project. (4 marks) (2 marks) (2 marks) (d) Would you recommend that the firm accept or reject the project, explain? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To estimate the current cost of capital for Stevens Steel we can use the Capital Asset Pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started