Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you have decided to advise Sultan Corporation to invest the amount in a financial portfolio and are puzzled between two portfolios, A and

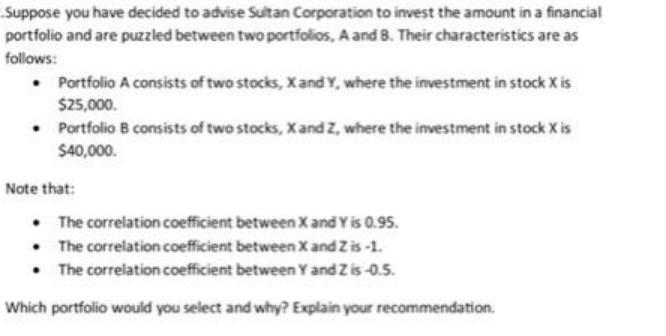

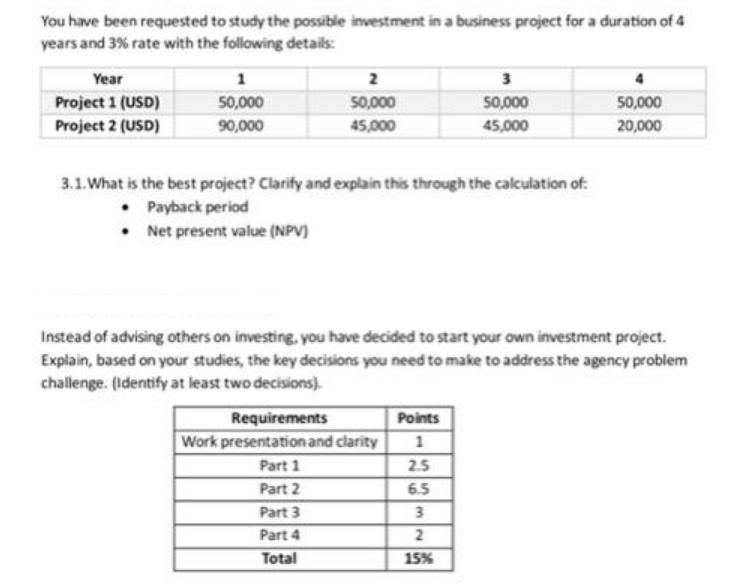

Suppose you have decided to advise Sultan Corporation to invest the amount in a financial portfolio and are puzzled between two portfolios, A and 8. Their characteristics are as follows: Portfolio A consists of two stocks, X and Y, where the investment in stock X is $25,000. Portfolio B consists of two stocks, X and Z, where the investment in stock X is $40,000. Note that: The correlation coefficient between X and Y is 0.95. The correlation coefficient between X and Z is -1. The correlation coefficient between Y and Z is-0.5. Which portfolio would you select and why? Explain your recommendation. You have been requested to study the possible investment in a business project for a duration of 4 years and 3% rate with the following details: Year Project 1 (USD) Project 2 (USD) 50,000 90,000 50,000 45,000 3.1. What is the best project? Clarify and explain this through the calculation of: Payback period Net present value (NPV) Requirements Work presentation and clarity Part 1 Part 2 Part 3 Part 4 Total 50,000 45,000 Instead of advising others on investing, you have decided to start your own investment project. Explain, based on your studies, the key decisions you need to make to address the agency problem challenge. (Identify at least two decisions). Points 2.5 6.5 3 2 15% 50,000 20,000

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started