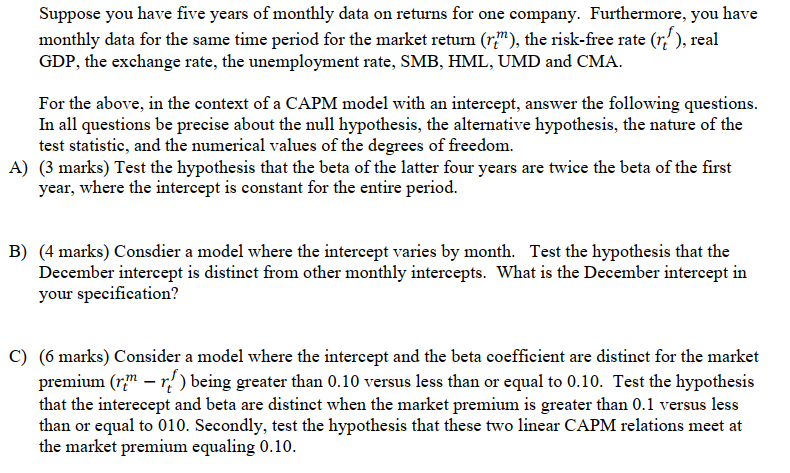

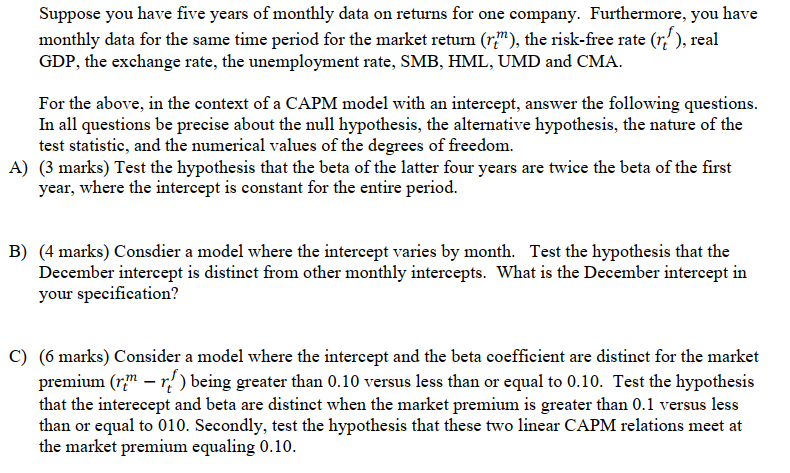

Suppose you have five years of monthly data on returns for one company. Furthermore, you have monthly data for the same time period for the market retum (rm), the risk-free rate (rif), real GDP, the exchange rate, the unemployment rate, SMB, HML, UMD and CMA. For the above, in the context of a CAPM model with an intercept, answer the following questions. In all questions be precise about the null hypothesis, the alternative hypothesis, the nature of the test statistic, and the numerical values of the degrees of freedom. A) (3 marks) Test the hypothesis that the beta of the latter four years are twice the beta of the first year, where the intercept is constant for the entire period. B) (4 marks) Consdier a model where the intercept varies by month. Test the hypothesis that the December intercept is distinct from other monthly intercepts. What is the December intercept in your specification? C) (6 marks) Consider a model where the intercept and the beta coefficient are distinct for the market premium (rm red) being greater than 0.10 versus less than or equal to 0.10. Test the hypothesis that the interecept and beta are distinct when the market premium is greater than 0.1 versus less than or equal to 010. Secondly, test the hypothesis that these two linear CAPM relations meet at the market premium equaling 0.10. Suppose you have five years of monthly data on returns for one company. Furthermore, you have monthly data for the same time period for the market retum (rm), the risk-free rate (rif), real GDP, the exchange rate, the unemployment rate, SMB, HML, UMD and CMA. For the above, in the context of a CAPM model with an intercept, answer the following questions. In all questions be precise about the null hypothesis, the alternative hypothesis, the nature of the test statistic, and the numerical values of the degrees of freedom. A) (3 marks) Test the hypothesis that the beta of the latter four years are twice the beta of the first year, where the intercept is constant for the entire period. B) (4 marks) Consdier a model where the intercept varies by month. Test the hypothesis that the December intercept is distinct from other monthly intercepts. What is the December intercept in your specification? C) (6 marks) Consider a model where the intercept and the beta coefficient are distinct for the market premium (rm red) being greater than 0.10 versus less than or equal to 0.10. Test the hypothesis that the interecept and beta are distinct when the market premium is greater than 0.1 versus less than or equal to 010. Secondly, test the hypothesis that these two linear CAPM relations meet at the market premium equaling 0.10