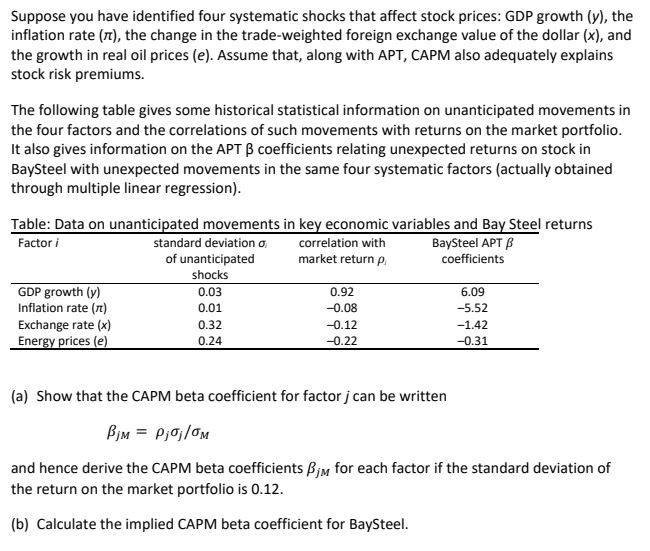

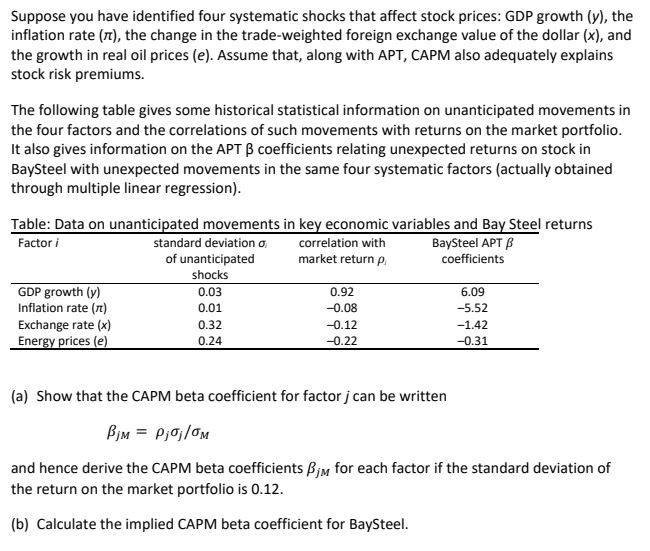

Suppose you have identified four systematic shocks that affect stock prices: GDP growth (y), the inflation rate (r), the change in the trade-weighted foreign exchange value of the dollar (x), and the growth in real oil prices (e). Assume that, along with APT, CAPM also adequately explains stock risk premiums. The following table gives some historical statistical information on unanticipated movements in the four factors and the correlations of such movements with returns on the market portfolio. It also gives information on the APT B coefficients relating unexpected returns on stock in BaySteel with unexpected movements in the same four systematic factors (actually obtained through multiple linear regression). Table: Data on unanticipated movements in key economic variables and Bay Steel returns Factori standard deviation o c orrelation with BaySteel APT B of unanticipated market return p. coefficients shocks GDP growth (y) 0.03 0.92 6.09 Inflation rate (7) 0.01 -0.08 -5.52 Exchange rate (x) 0.32 -0.12 -1.42 Energy prices (e) 0.24 -0.22 -0.31 (a) Show that the CAPM beta coefficient for factor can be written BiM = p; OM and hence derive the CAPM beta coefficients Bim for each factor if the standard deviation of the return on the market portfolio is 0.12. (b) Calculate the implied CAPM beta coefficient for BaySteel. Suppose you have identified four systematic shocks that affect stock prices: GDP growth (y), the inflation rate (r), the change in the trade-weighted foreign exchange value of the dollar (x), and the growth in real oil prices (e). Assume that, along with APT, CAPM also adequately explains stock risk premiums. The following table gives some historical statistical information on unanticipated movements in the four factors and the correlations of such movements with returns on the market portfolio. It also gives information on the APT B coefficients relating unexpected returns on stock in BaySteel with unexpected movements in the same four systematic factors (actually obtained through multiple linear regression). Table: Data on unanticipated movements in key economic variables and Bay Steel returns Factori standard deviation o c orrelation with BaySteel APT B of unanticipated market return p. coefficients shocks GDP growth (y) 0.03 0.92 6.09 Inflation rate (7) 0.01 -0.08 -5.52 Exchange rate (x) 0.32 -0.12 -1.42 Energy prices (e) 0.24 -0.22 -0.31 (a) Show that the CAPM beta coefficient for factor can be written BiM = p; OM and hence derive the CAPM beta coefficients Bim for each factor if the standard deviation of the return on the market portfolio is 0.12. (b) Calculate the implied CAPM beta coefficient for BaySteel