Question

Suppose you have just bought a 10-year, 5% semiannual coupon bond with a $1,000 face value. Your purchasing price of the bond implies that

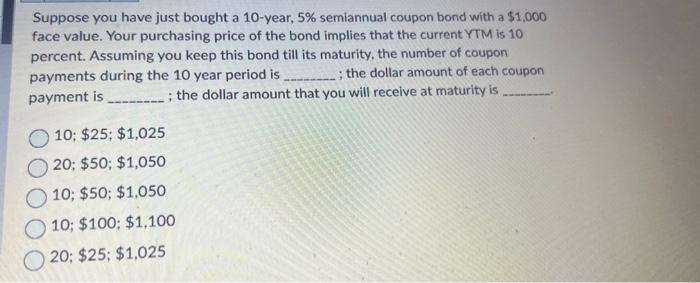

Suppose you have just bought a 10-year, 5% semiannual coupon bond with a $1,000 face value. Your purchasing price of the bond implies that the current YTM is 10 percent. Assuming you keep this bond till its maturity, the number of coupon payments during the 10 year period is ; the dollar amount of each coupon payment is ; the dollar amount that you will receive at maturity is 10; $25; $1,025 20; $50; $1,050 10; $50; $1,050 10; $100; $1,100 20; $25; $1,025

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is 20 50 1050 Here are the reasons for each part of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Financial Management

Authors: James Van Horne, John Wachowicz

13th Revised Edition

978-0273713630, 273713639

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App