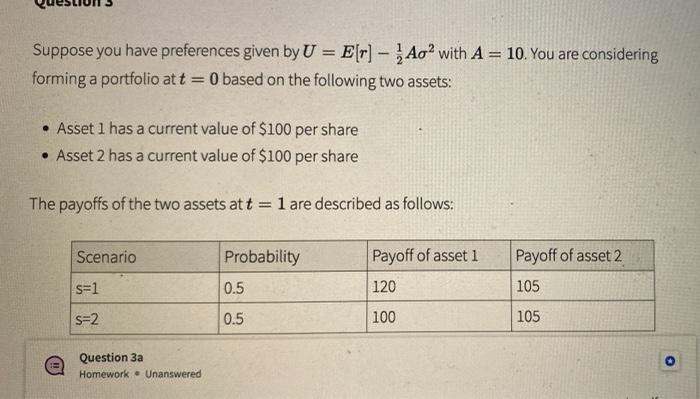

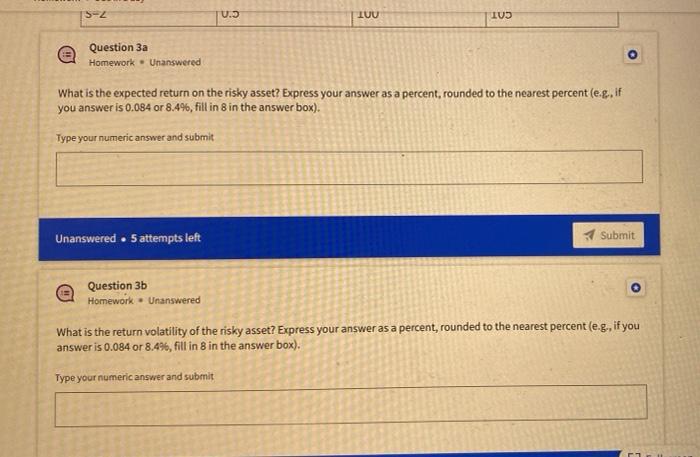

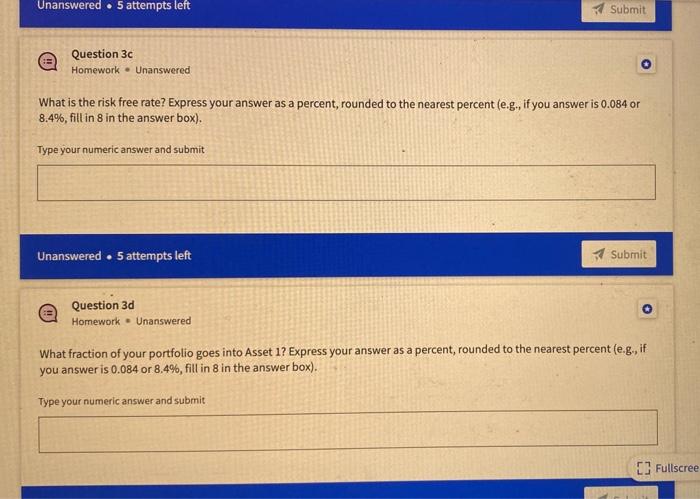

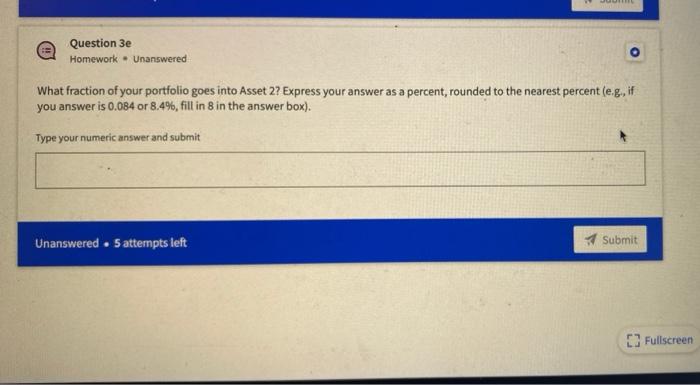

- Suppose you have preferences given by U = E[r] - Ao2 with A = 10. You are considering forming a portfolio att = 0 based on the following two assets: Asset 1 has a current value of $100 per share Asset 2 has a current value of $100 per share The payoffs of the two assets at t = 1 are described as follows: Scenario Payoff of asset 1 Payoff of asset 2 Probability 0.5 s=1 120 105 s=2 0.5 100 105 Question 3a Homework Unanswered 52 U. TUU IUS Question 3a Homework - Unanswered o What is the expected return on the risky asset? Express your answer as a percent, rounded to the nearest percent (eg, if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit Unanswered . 5 attempts left Submit Question 3 Homework. Unanswered What is the return volatility of the risky asset? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit Unanswered. 5 attempts left Submit Question 3 Homework. Unanswered What is the risk free rate? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit Unanswered . 5 attempts left Submit Question 3d Homework. Unanswered What fraction of your portfolio goes into Asset 1? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit [ Fullscree Question 3e Homework - Unanswered What fraction of your portfolio goes into Asset 2? Express your answer as a percent, rounded to the nearest percent (eg, if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit Unanswered . 5 attempts left Submit [ Fullscreen - Suppose you have preferences given by U = E[r] - Ao2 with A = 10. You are considering forming a portfolio att = 0 based on the following two assets: Asset 1 has a current value of $100 per share Asset 2 has a current value of $100 per share The payoffs of the two assets at t = 1 are described as follows: Scenario Payoff of asset 1 Payoff of asset 2 Probability 0.5 s=1 120 105 s=2 0.5 100 105 Question 3a Homework Unanswered 52 U. TUU IUS Question 3a Homework - Unanswered o What is the expected return on the risky asset? Express your answer as a percent, rounded to the nearest percent (eg, if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit Unanswered . 5 attempts left Submit Question 3 Homework. Unanswered What is the return volatility of the risky asset? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit Unanswered. 5 attempts left Submit Question 3 Homework. Unanswered What is the risk free rate? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit Unanswered . 5 attempts left Submit Question 3d Homework. Unanswered What fraction of your portfolio goes into Asset 1? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit [ Fullscree Question 3e Homework - Unanswered What fraction of your portfolio goes into Asset 2? Express your answer as a percent, rounded to the nearest percent (eg, if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your numeric answer and submit Unanswered . 5 attempts left Submit [ Fullscreen