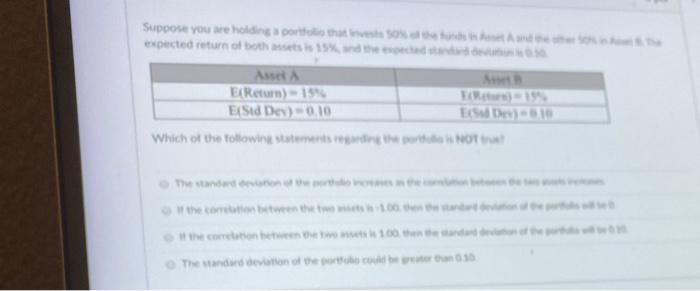

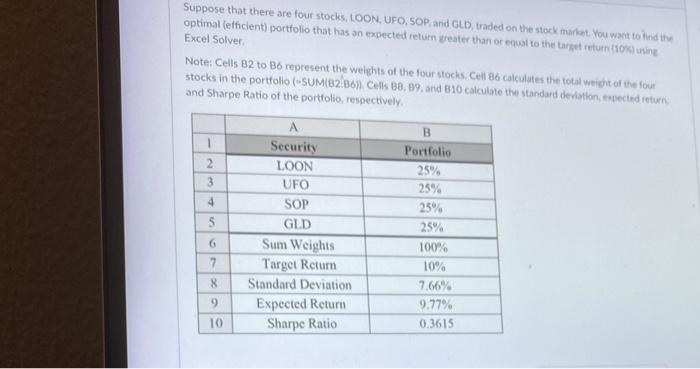

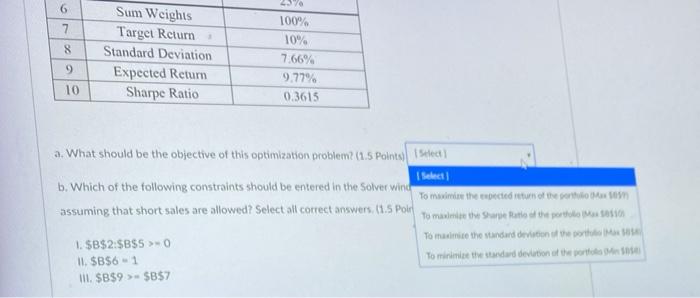

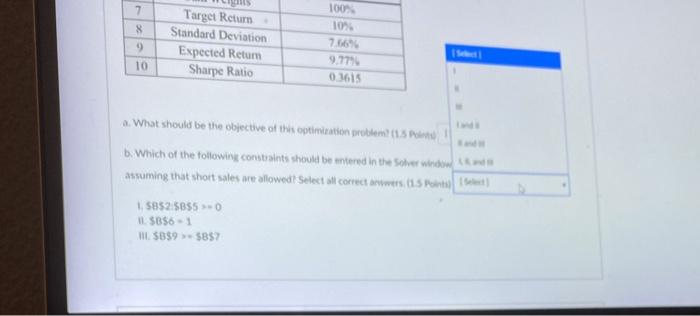

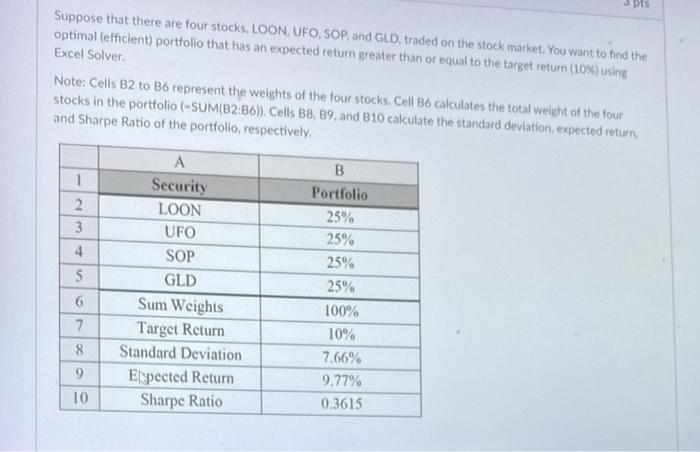

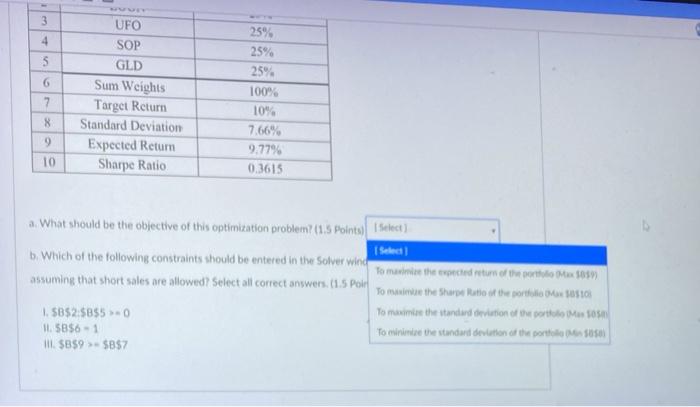

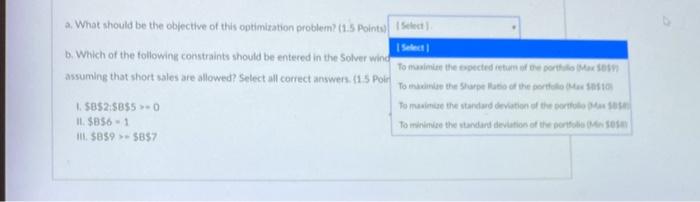

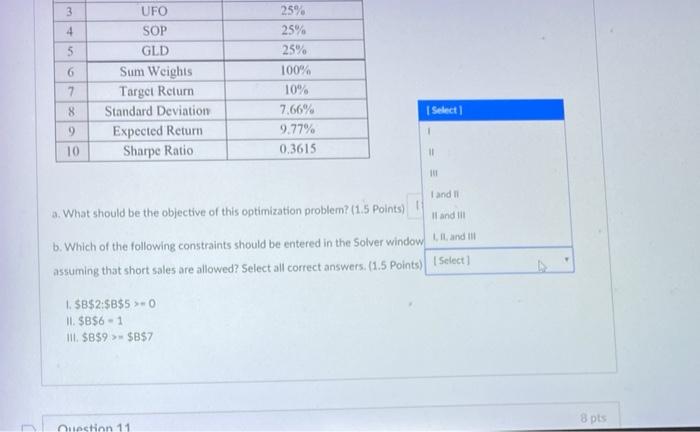

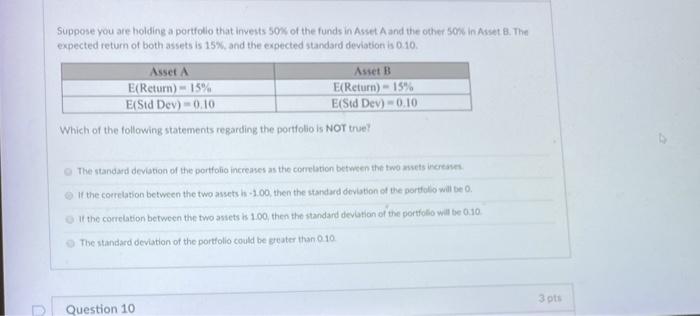

Suppose you holding sports expected return of both sets is 15% Asset E Return) 1994 E Std Des) 0.10 ESD-10 Which of the following statements in the port NOT Suppose that there are four stocks, LOON, UFO.SOP and GLD, traded on the stock market. You want to find the optimal efficient) portfolio that has an expected return greater than or equal to the target return 10%) using Excel Solver Note: Cells B2 to Bo represent the weights of the four stocks. Cell B6 calculates the total weight of the four stocks in the portfolio (-SUM B2:80) Cells 18, 19, and 10 calculate the standard deviation, expected return and Sharpe Ratio of the portfolio, respectively 1 2 3 4 S Security LOON UFO SOP GLD Sum Weights Target Return Standard Deviation Expected Return Sharpe Ratio B Portfolio 25% 25% 25% 25% 100% 10% 7.66% 9,77% 0.3615 6 7 8 9 10 4070 6 7 8 Sum Weights Target Return Standard Deviation Expected Retur Sharpe Ratio 100% 10% 7.66% 9.77% 0.3615 9 10 a. What should be the objective of this optimization problem? (1.5 Points Select Select b. Which of the following constraints should be entered in the Solver wind To maximize the webcted turn of the orom assuming that short sales are allowed? Select all correct answers (1.5 pol to manmar this Sharpe Ratio of the periodo sessen 1. $B$2:$B$ 50 To maximize the standard deviation to the II. $B$6 - 1 To minimize the standard devuton theo II. $B$9>$B$7 7 100 109 8 9 10 Target Return Standard Deviation Expected Return Sharpe Ratio 03615 a. What should be the objective of this optimization problem? b. Which of the following constraints should be entered in the She widow assuming that short sales are allowed! Select a correct bewers. 1. Pote 1.585256550 IL SB561 III. SB595857 PIS Suppose that there are four stocks, LOON, UFO, SOP, and GLD, traded on the stock market. You want to find the optimal (efficient) portfolio that has an expected return greater than or equal to the target return (10%) using Excel Solver Note: Cells B2 to B6 represent the weights of the four stocks. Cell B6 calculates the total weight of the four stocks in the portfolio (SUMB2:B6). Cells BB, B9, and B10 calculate the standard deviation, expected return and Sharpe Ratio of the portfolio, respectively 2 3 4 5 A Security LOON UFO SOP GLD Sum Weights Target Return Standard Deviation Expected Return Sharpe Ratio B Portfolio 25% 25% 25% 25% 100% 10% 7.66% 9.77% 0.3615 6 7 8 9 10 3 25% 4 25% S 6 7 UFO SOP GLD Sum Weights Target Return Standard Deviation Expected Return Sharpe Ratio 8 25% 100% 10%. 7.66% 9.779 0.3615 9 10 a. What should be the objective of this optimization problem? (1.5 points) Select Select b. Which of the following constraints should be entered in tive Solver wind To maximize the expected return of the Max assuming that short sales are allowed? Select all correct answers. (1.5 Polr To me the Shape of the port 10 1.585258550 To maximise the standard deviation of the pool Musto 11.5856-1 To minimize the standard de ton of the possui 1. $859 - $857 a. What should be the objective of this optimization problem? (1.5 Points Select b. Which of the following constraints should be entered in the Solver wind To me the spected to report to Me assuming that short sales are allowed? Select all correct answers. (1.5 Poir To the relatie of the portato Max 1. $B$2:$8550 To mince the standard deviation of the rowe II. $856 - 1 To minimize the standard deviation of the portfolio Maso III. 58595857 3 4 5 6 UFO SOP GLD Sum Weights Target Return Standard Deviation Expected Return Sharpe Ratio 25% 25% 25% 100% 10% 7.66% 9.77% 0.3615 7 8 Select] 9 1 10 11 Tandil Il and lll 3. What should be the objective of this optimization problem? (1.5 points) b. Which of the following constraints should be entered in the Solver window and I assuming that short sales are allowed? Select all correct answers. (1.5 Points) Select) 1. $B$2:$B$5 > 0 II. $B$6 - 1 III. $B$9 > $B$7 8 pts Question 11 Suppose you are holding a portfolio that invests 50% of the funds in Asset A and the others in Asset 8. The expected return of both assets is 15%, and the expected standard deviation is 0.10. Asset A Asset B E{Return) 15% E(Return) - 15% E(Std Dev) -0,10 E(Sid Dev) 0,10 Which of the following statements regarding the portfolio is NOT true! The standard deviation of the portfolio incremes as the correlation between the two sets Vriertes If the correlation between the two sets ha -1.00, then the standard deviation of the portfolio will be 0. it the correlation between the two assets is 1.00, then the standard deviation of the portfolio will be 0.10 The standard deviation of the portfolio could be greater than 0 10 3 pts Question 10