Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you invest $10,000 in each of two mutual funds from the same family. Fund A: 2% font end load; annual expense ratio of 1%;

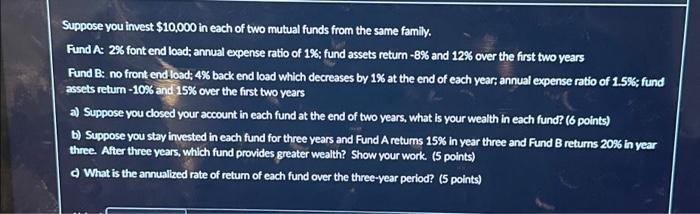

Suppose you invest $10,000 in each of two mutual funds from the same family. Fund A: 2% font end load; annual expense ratio of 1%; fund assets return -8% and 12% over the first two years Fund B: no front end load; 4% back end load which decreases by 1% at the end of each year; annual expense ratio of 1.5%; fund assets return -10% and 15% over the first two years a) Suppose you closed your account in each fund at the end of two years, what is your wealth in each fund? (6 points) b) Suppose you stay invested in each fund for three years and Fund A returns 15% in year three and Fund B returns 20% in year three. After three years, which fund provides greater wealth? Show your work. (5 points) c) What is the annualized rate of return of each fund over the three-year period? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started