Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you invest your money into two stocks in the proportion (w1,w2). If the stocks have risk 1 and 2 and their correlation is ,

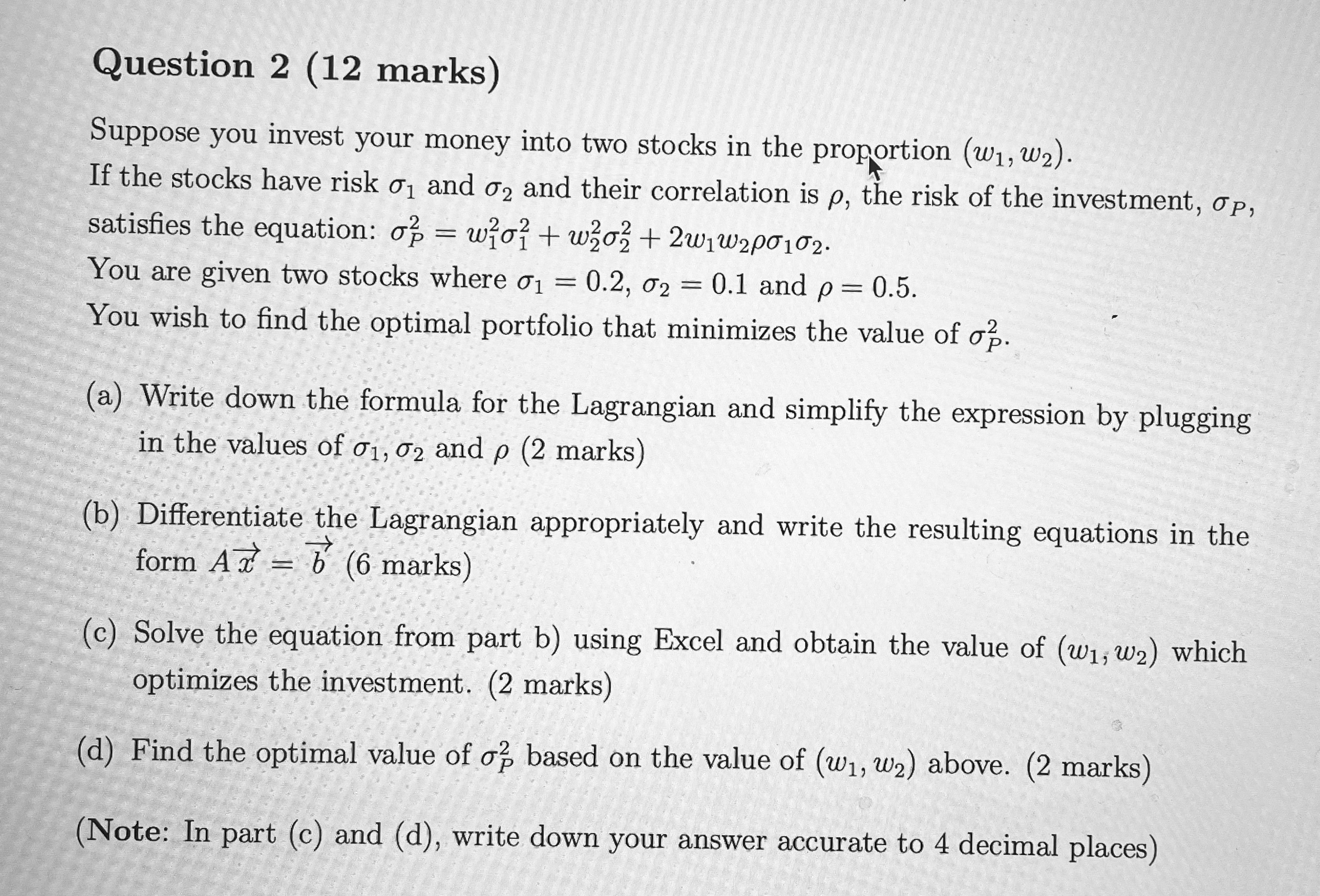

Suppose you invest your money into two stocks in the proportion (w1,w2). If the stocks have risk 1 and 2 and their correlation is , the risk of the investment, P, satisfies the equation: P2=w1212+w2222+2w1w212. You are given two stocks where 1=0.2,2=0.1 and =0.5. You wish to find the optimal portfolio that minimizes the value of P2. (a) Write down the formula for the Lagrangian and simplify the expression by plugging in the values of 1,2 and ( 2 marks) (b) Differentiate the Lagrangian appropriately and write the resulting equations in the form Ax=b (6 marks) (c) Solve the equation from part b) using Excel and obtain the value of (w1,w2) which optimizes the investment. ( 2 marks) (d) Find the optimal value of P2 based on the value of (w1,w2) above. (2 marks) (Note: In part (c) and (d), write down your answer accurate to 4 decimal places)

Suppose you invest your money into two stocks in the proportion (w1,w2). If the stocks have risk 1 and 2 and their correlation is , the risk of the investment, P, satisfies the equation: P2=w1212+w2222+2w1w212. You are given two stocks where 1=0.2,2=0.1 and =0.5. You wish to find the optimal portfolio that minimizes the value of P2. (a) Write down the formula for the Lagrangian and simplify the expression by plugging in the values of 1,2 and ( 2 marks) (b) Differentiate the Lagrangian appropriately and write the resulting equations in the form Ax=b (6 marks) (c) Solve the equation from part b) using Excel and obtain the value of (w1,w2) which optimizes the investment. ( 2 marks) (d) Find the optimal value of P2 based on the value of (w1,w2) above. (2 marks) (Note: In part (c) and (d), write down your answer accurate to 4 decimal places) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started