Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you need to have $55,798.00 in an account 15.00 years from today and that the account pays 9.00%. How much do you have to

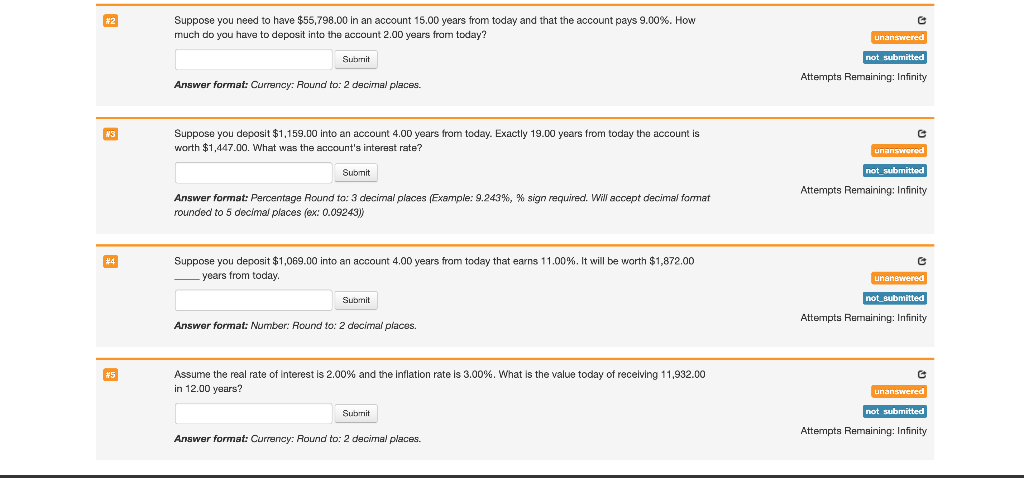

Suppose you need to have $55,798.00 in an account 15.00 years from today and that the account pays 9.00%. How much do you have to deposit into the account 2.00 years from today?

Please write out the formula/ steps to get the answers.

#2 Suppose you need much do you have have $55,798.00 in an account 15.00 years from today and that the account pays 9.00%. How deposit into the account 2.00 years from today? unanswered Submit not submitted Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places. #S Suppose you deposit $1,159.00 into an account 4.00 years from today. Exactly 19.00 years from today the account is worth $1,447.00. What was the account's interest rate? C unanswered not submitted Submit Attempts Remaining: Infinity Answer format: Percentage Round to: 3 decimal places (Example: 9.243%, % sign required. Will accept decimal format rounded to 5 decimal places (ex: 0.09243)) #4 Suppose you deposit $1,069.00 into an account 4.00 years from today that earns 11.00%. It will be worth $1,872.00 years from today. Linanswered not submitted Submit Attempts Remaining: Infinity Answer format: Number: Round to: 2 decimal places. #5 Assume the real rate of interest is 2.00% and the Inflation rate is 3.00%. What is the value today of recelving 11,932.00 in 12.00 years? unanswered not submitted Submit Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started