Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you own shares of open-end mutual fund, SPDR. When you decide to sell your SPDR shares, what is the sale price relative to SPDR's

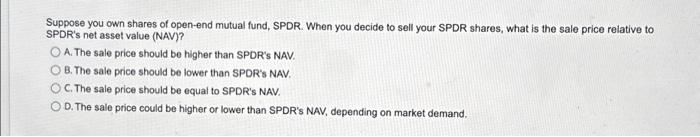

Suppose you own shares of open-end mutual fund, SPDR. When you decide to sell your SPDR shares, what is the sale price relative to SPDR's net asset value (NAV)? A. The sale price should be higher than SPDR's NAV. B. The sale price should be lower than SPDR's NAV. C. The sale price should be equal to SPDR's NAV. O D. The sale price could be higher or lower than SPDR's NAV, depending on market demand.

A property-casualty (PC) insurer reports $430MM losses on fire misurance, $595MM earned premiums, and $95MM loss adjustment expenses. What is the PC insurer's combined ratio?

A. 0.88, indicating that this PC insurer is unprofitable.

B. 1.12, indicating that this PC insurer is unprofitable.

C. 0.88, indicating that this PC insurer is profitable.

D. 1.12, indicating that this PC insurer is profitable.

Which of the following is the primary function of insurance companies (ICs)?

A. ICs provide contracts that assist policyholders to save income for future consumption.

B. ICs protect policyholders from adverse events.

C. ICs generate fees for the banks that sell insurance products.

D. ICs assist in the wealth transfer from the current generation to the next generation.

For insurance companies (ICs), how should unearned premiums be treated on their balance sheets?

A. They should be treated as liabilities, since policyholders who are expected to pay those premiums could file claims in the futu

B. They should be treated as assets, since Is expect to receive those preiums in the future.

O C. They should be treated as assets, since ICs use them to ipvest in other assets such as stocks and bonds.

D. They should be treated as liabilities, since Is are expected to pay those premiums back to policyholders.

Which of the following could cause property-casualty (PC) insurance companies to incur huge underwriting risk?

A. Unexpected increases in policy premiums

B. Unexpected increases in loss rates

C. Unexpected decreases in loss adjustment expenses

D. Unexpected increases in investment yields.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started