Answered step by step

Verified Expert Solution

Question

1 Approved Answer

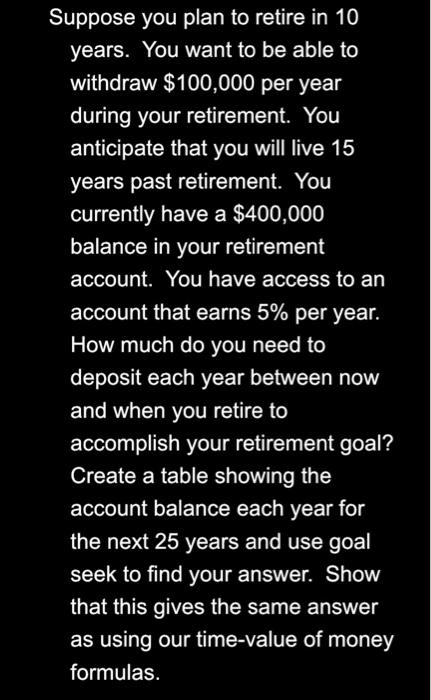

Suppose you plan to retire in 10 years. You want to be able to withdraw $100,000 per year during your retirement. You anticipate that you

Suppose you plan to retire in 10 years. You want to be able to withdraw $100,000 per year during your retirement. You anticipate that you will live 15 years past retirement. You currently have a $400,000 balance in your retirement account. You have access to an account that earns 5% per year. How much do you need to deposit each year between now and when you retire to accomplish your retirement goal? Create a table showing the account balance each year for the next 25 years and use goal seek to find your answer. Show that this gives the same answer as using our time-value of money formulas.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started