Answered step by step

Verified Expert Solution

Question

1 Approved Answer

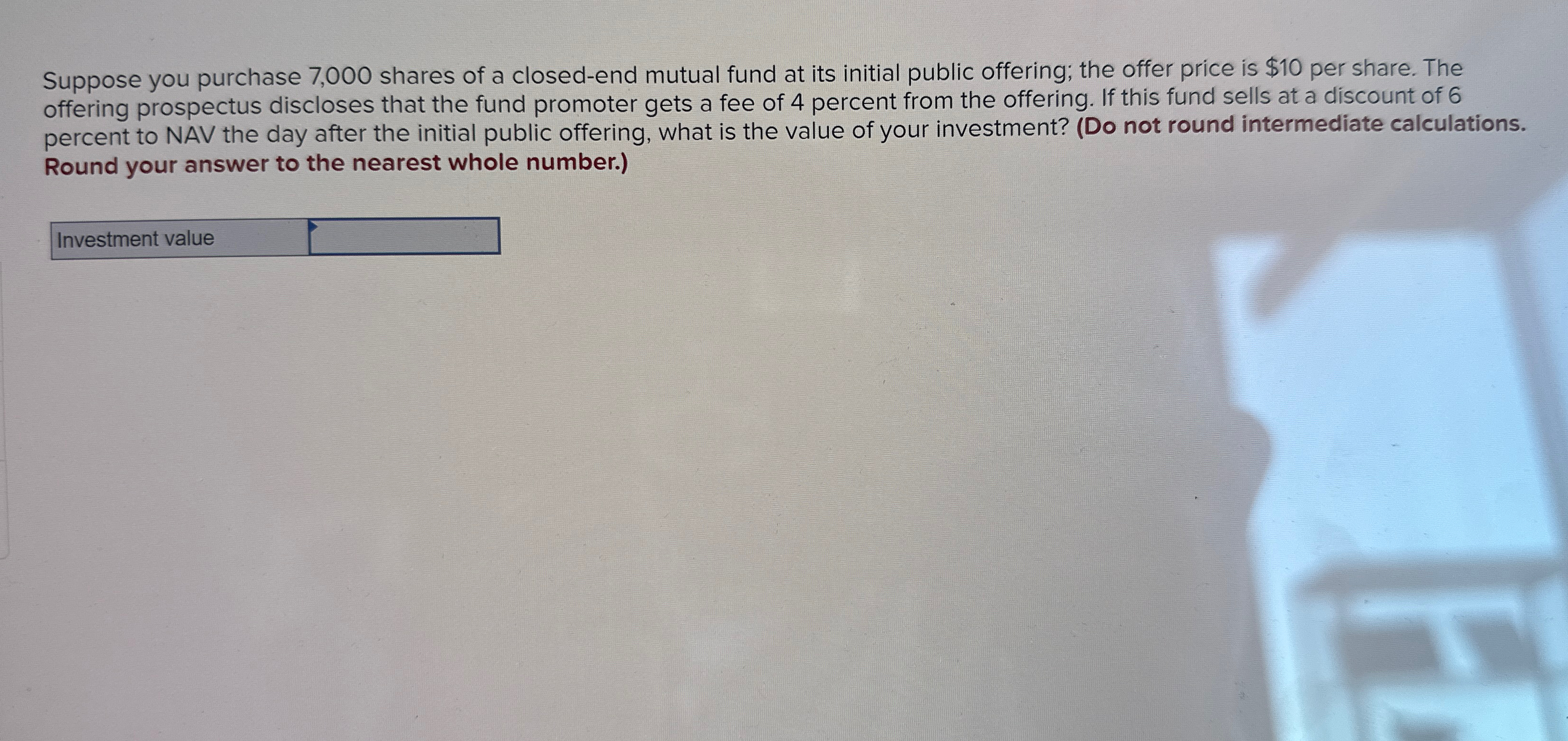

Suppose you purchase 7 , 0 0 0 shares of a closed - end mutual fund at its initial public offering; the offer price is

Suppose you purchase shares of a closedend mutual fund at its initial public offering; the offer price is $ per share. The offering prospectus discloses that the fund promoter gets a fee of percent from the offering. If this fund sells at a discount of percent to NAV the day after the initial public offering, what is the value of your investment? Do not round intermediate calculations. Round your answer to the nearest whole number.

Investment value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started