Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you purchase the May 2017 call option on corn futures with a strike price of $4.00. Assume you purchased the option at the last

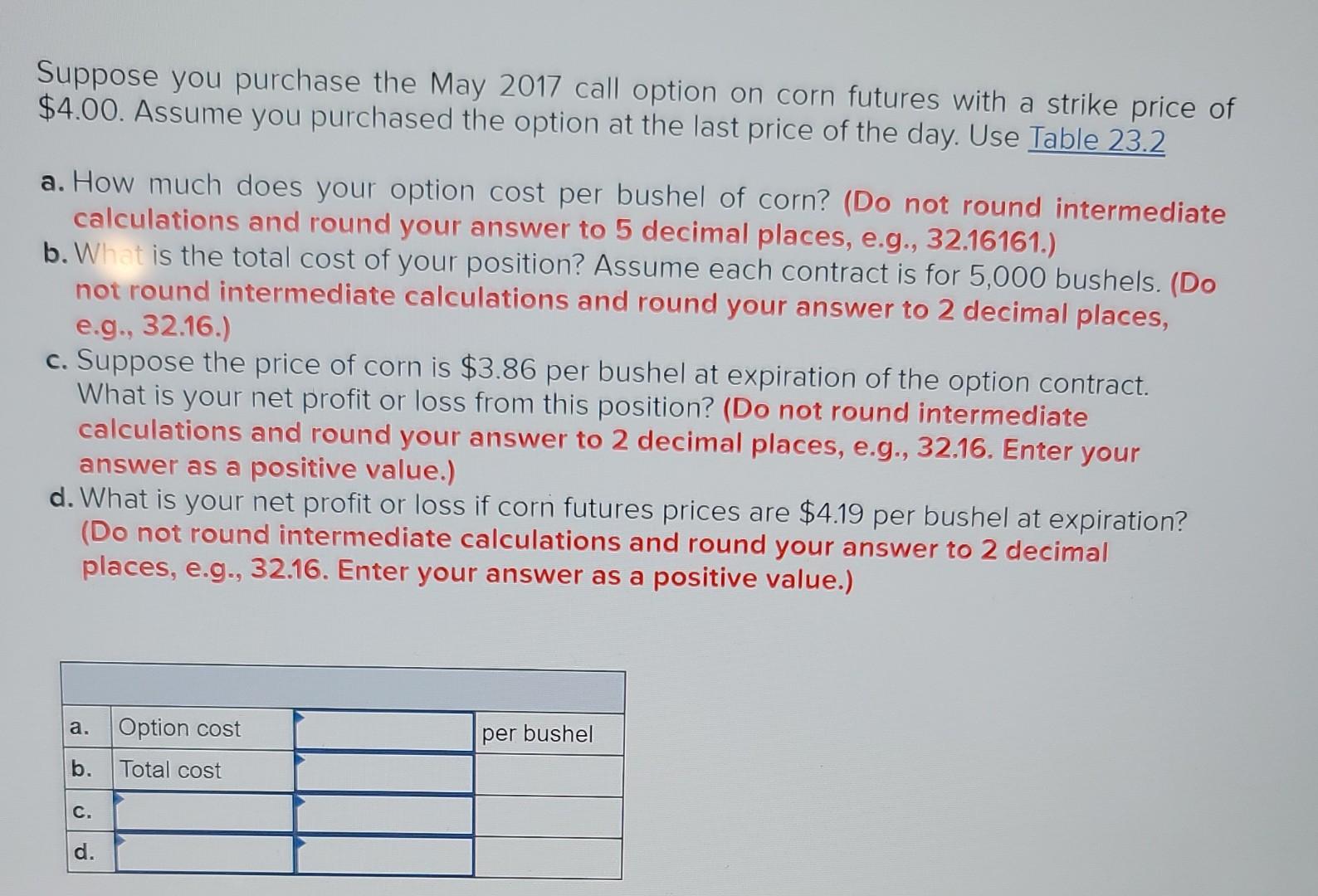

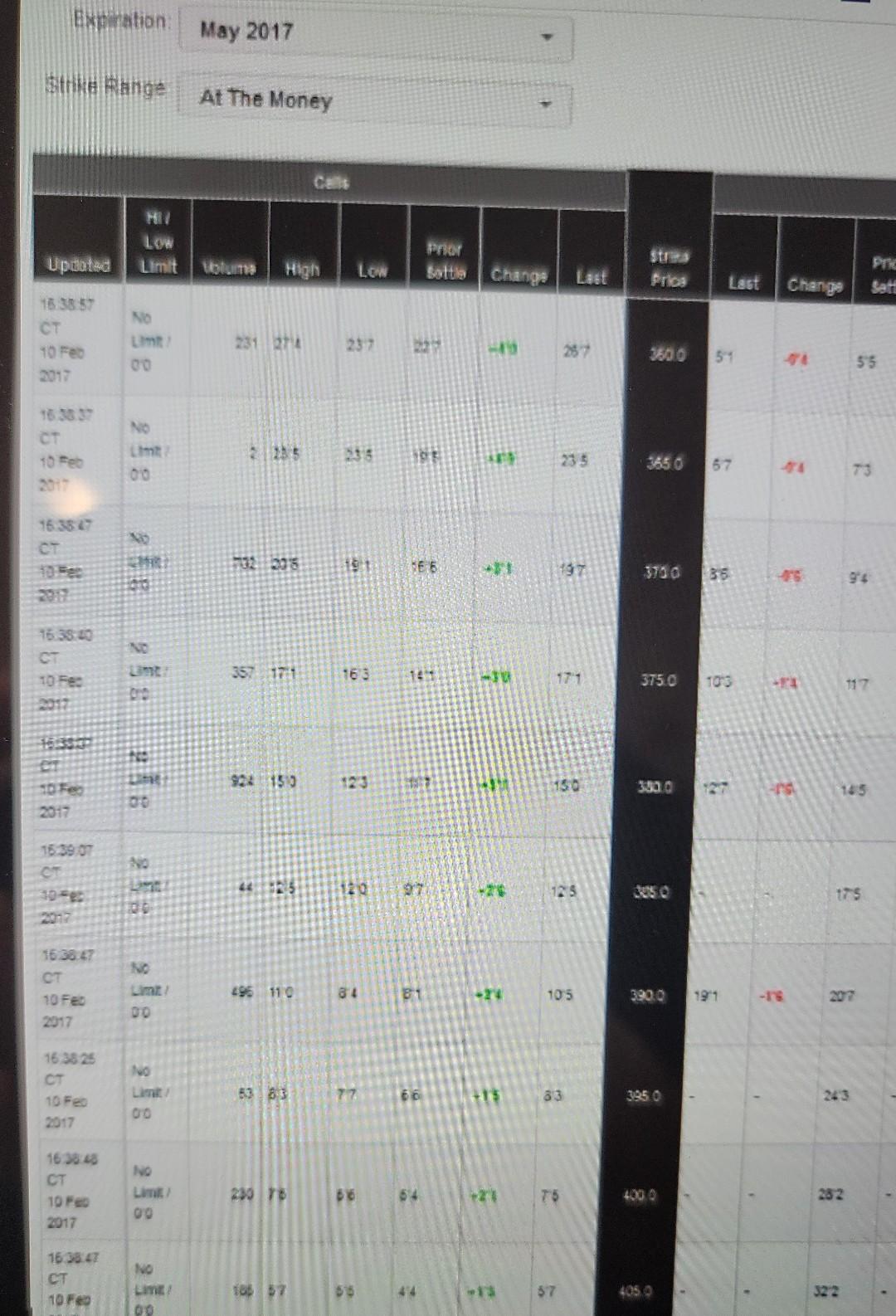

Suppose you purchase the May 2017 call option on corn futures with a strike price of $4.00. Assume you purchased the option at the last price of the day. Use Table 23.2 a. How much does your option cost per bushel of corn? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn is $3.86 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) d. What is your net profit or loss if corn futures prices are $4.19 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) a. Option cost per bushel b. Total cost C. d. Eation May 2017 the Range At The Money Cans Upoated Limit totum PAT sottile Pre High LOW Change Last Prics Last Change No 15 38 57 10 Feb 2017 231 27 36000 51 00 55 NO CT 10 Feb 25 ot mt 00 3650 67 73 16.38 CT 32 338 19 366 3700 35 5 94 1638.00 35171 163 wu 3750 TOP3 -14 117 10 Fe 2017 924 150 150 3000 185 2017 10 16.09.07 50 2012 365 120 97 105 1050 175 16.36 E7 CT 10 Fe 2017 296 110 84 81 -24 105 39020 191 -18 00 NO 16.38 25 CT 10 Feo 2017 53 B3 77 66 15 33 3950 243 00 16 38 40 CT 10 Fe 2017 NO Limi 00 230 15 08 $4 75 282 163847 10 Feo NO LE 10 57 57 405

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started