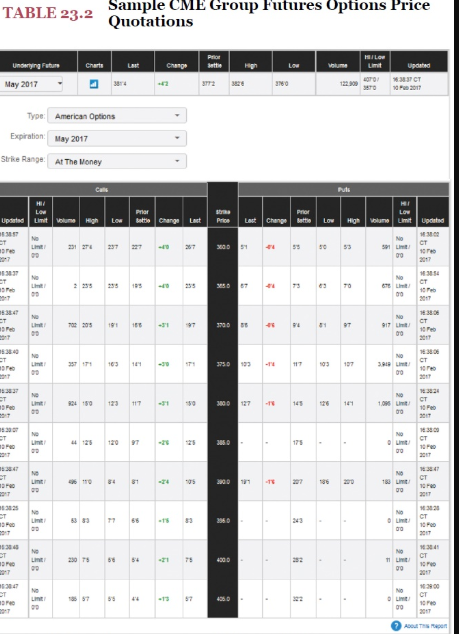

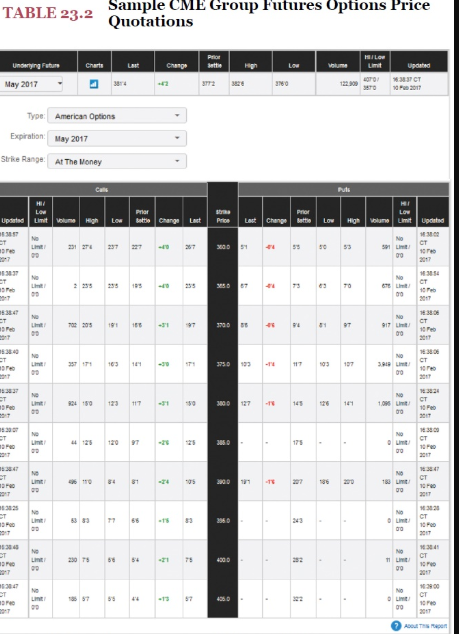

Suppose you purchase the May 2017 put option on corn futures with a strike price of $3.60. Assume your purchase was at the last price. Use Table 23.2 a. How much does your option cost per bushel of corn? (Round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost for one contract? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn futures is $3.41 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $3.81 per bushel at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) per bushel a. Option cost b. Total cost Profit d. Loss c. TABLE 23.2 Sample CME Group Futures Options Price Quotations Charts Change Settie updated Underying Future May 2017 372 300 CT 2011 Type: American Options Expiration : May 2017 Strike Range: At The Money Puls Updated Limit volume Prior Settio Change Last High Pro Last Change Battle Price LOW High Volume Limit Up LOW 37 CT 5 23 24 27 300 00 ET D 39 CT 67 73 es 70 09 T 9 3700 15 OT 017 10 Pro Ne NO 18 3800 CT es 3750 11 90 Ne ET 304 30 23 117 CT 1000 145 41 NO 1.02 Ut 00 T CT 20 3850 175 00 2000 200 NO 150 L CT 10 2017 300 CT -15 2950 43 LI NO ET CT 23075 36 36 -21 75 32 00 NO No LE 000 CT 44 4300 322 ABOUT Suppose you purchase the May 2017 put option on corn futures with a strike price of $3.60. Assume your purchase was at the last price. Use Table 23.2 a. How much does your option cost per bushel of corn? (Round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost for one contract? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn futures is $3.41 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $3.81 per bushel at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) per bushel a. Option cost b. Total cost Profit d. Loss c. TABLE 23.2 Sample CME Group Futures Options Price Quotations Charts Change Settie updated Underying Future May 2017 372 300 CT 2011 Type: American Options Expiration : May 2017 Strike Range: At The Money Puls Updated Limit volume Prior Settio Change Last High Pro Last Change Battle Price LOW High Volume Limit Up LOW 37 CT 5 23 24 27 300 00 ET D 39 CT 67 73 es 70 09 T 9 3700 15 OT 017 10 Pro Ne NO 18 3800 CT es 3750 11 90 Ne ET 304 30 23 117 CT 1000 145 41 NO 1.02 Ut 00 T CT 20 3850 175 00 2000 200 NO 150 L CT 10 2017 300 CT -15 2950 43 LI NO ET CT 23075 36 36 -21 75 32 00 NO No LE 000 CT 44 4300 322 ABOUT