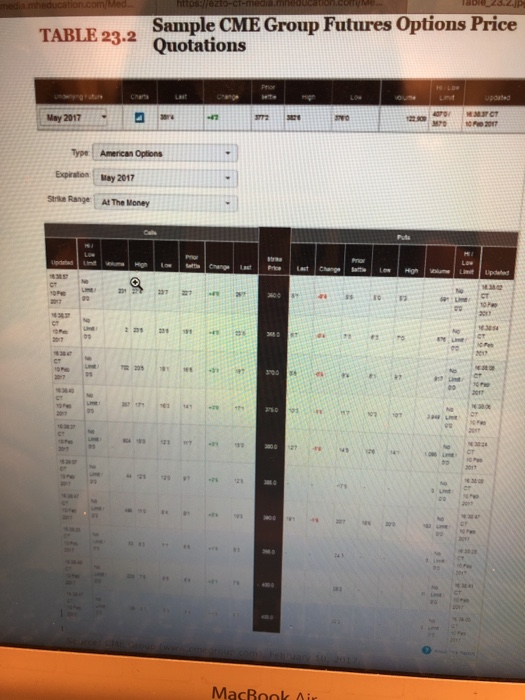

Suppose you purchase the May 2017 put option on corn futures with a strike price of $3.80. Assume your purchase was at the last price. Use Table 23.2 a. How much does your option cost per bushel of corn? (Round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost for one contract? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) C. Suppose the price of corn futures is $3.64 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $4.01 per bushel at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) per bushel Option cost Total cost Profit media meducation.com/Med. httosezio-ct-media.meducation.com TABLE 23.2 Quotations Sample CME Group Futures Options Price Wo A niiniffmaterifii 2017 Type: American Options Expiration May 2017 Range At The Money Updated 18_18_148 uls uls ad: :Is also : xlt : H : : : : : : : : : : : : la !: MacBook Air May 2017 Type: American Options Expiration: May 2017 stre Range: At The Money 31 . Suppose you purchase the May 2017 put option on corn futures with a strike price of $3.80. Assume your purchase was at the last price. Use Table 23.2 a. How much does your option cost per bushel of corn? (Round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost for one contract? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) C. Suppose the price of corn futures is $3.64 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $4.01 per bushel at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) per bushel Option cost Total cost Profit media meducation.com/Med. httosezio-ct-media.meducation.com TABLE 23.2 Quotations Sample CME Group Futures Options Price Wo A niiniffmaterifii 2017 Type: American Options Expiration May 2017 Range At The Money Updated 18_18_148 uls uls ad: :Is also : xlt : H : : : : : : : : : : : : la !: MacBook Air May 2017 Type: American Options Expiration: May 2017 stre Range: At The Money 31