Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you run a 1st price auction and players valuations are private and drawn independently from Uniform[0,100]. Assume every player shades his bid by

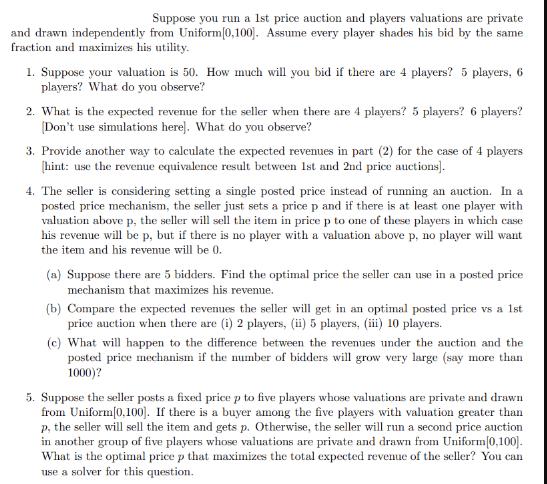

Suppose you run a 1st price auction and players valuations are private and drawn independently from Uniform[0,100]. Assume every player shades his bid by the same fraction and maximizes his utility. 1. Suppose your valuation is 50. How much will you bid if there are 4 players? 5 players, 6 players? What do you observe? 2. What is the expected revenue for the seller when there are 4 players? 5 players? 6 players? [Don't use simulations here]. What do you observe? 3. Provide another way to calculate the expected revenues in part (2) for the case of 4 players [hint: use the revenue equivalence result between 1st and 2nd price auctions]. 4. The seller is considering setting a single posted price instead of running an auction. In a posted price mechanism, the seller just sets a price p and if there is at least one player with valuation above p, the seller will sell the item in price p to one of these players in which case his revenue will be p, but if there is no player with a valuation above p. no player will want the item and his revenue will be 0. (a) Suppose there are 5 bidders. Find the optimal price the seller can use in a posted price mechanism that maximizes his revenue. (b) Compare the expected revenues the seller will get in an optimal posted price vs a 1st price auction when there are (i) 2 players, (ii) 5 players, (iii) 10 players. (c) What will happen to the difference between the revenues under the auction and the posted price mechanism if the number of bidders will grow very large (say more than 1000)? 5. Suppose the seller posts a fixed price p to five players whose valuations are private and drawn from Uniform[0.100]. If there is a buyer among the five players with valuation greater than p, the seller will sell the item and gets p. Otherwise, the seller will run a second price auction in another group of five players whose valuations are private and drawn from Uniform(0,100]. What is the optimal price p that maximizes the total expected revenue of the seller? You can use a solver for this question.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 In a 1st price auction each player shades their bid by the same fraction Lets assume that the shading factor is denoted by s The bid of a player with a valuation of 50 can be calculated as follows F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started