Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you take out a $101,000, 20-year mortgage loan to buy a condo. The interest rate on the loan is 4%. To keep things

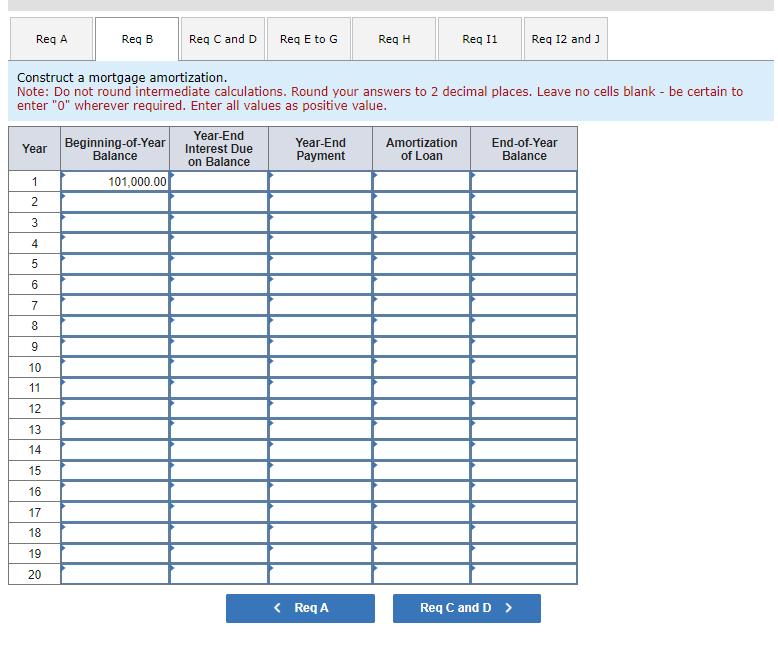

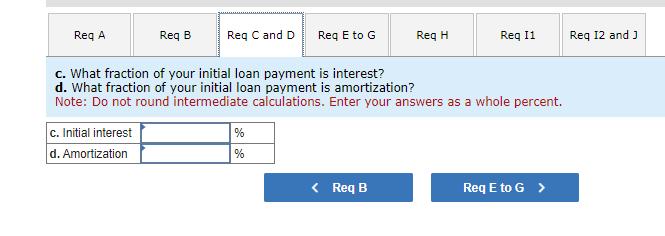

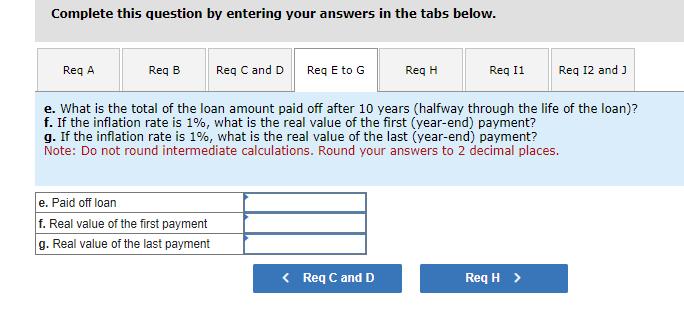

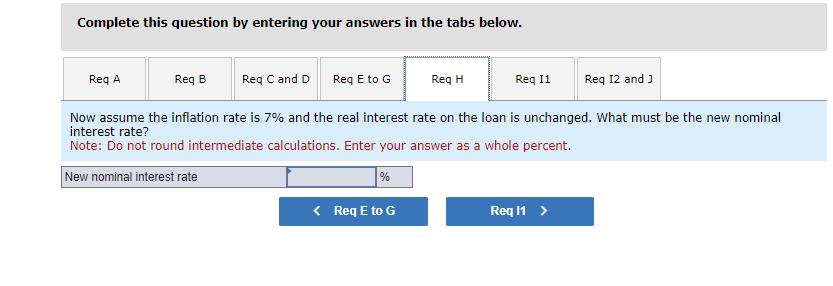

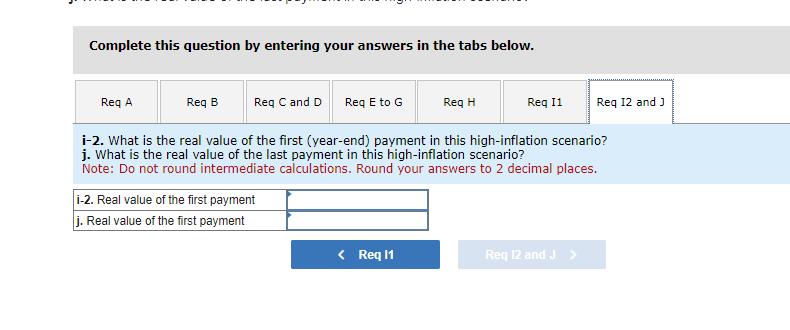

Suppose you take out a $101,000, 20-year mortgage loan to buy a condo. The interest rate on the loan is 4%. To keep things simple, we will assume you make payments on the loan annually at the end of each year. Req A Year 1 N35600 2 9 10 11 12 Construct a mortgage amortization. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required. Enter all values as positive value. 34567892 13 14 15 16 17 18 19 Req B 20 Beginning-of-Year Balance Req C and D 101,000.00 Req E to G Year-End Interest Due on Balance Year-End Payment Req H < Req A Req 11 Amortization of Loan Req 12 and J End-of-Year Balance Req C and D > Req A Req B c. Initial interest d. Amortization Req C and D Req E to G % % c. What fraction of your initial loan payment is interest? d. What fraction of your initial loan payment is amortization? Note: Do not round intermediate calculations. Enter your answers as a whole percent. Req H < Req B Req 11 Req E to G > Req 12 and J Complete this question by entering your answers in the tabs below. Req C and D Req E to G e. What is the total of the loan amount paid off after 10 years (halfway through the life of the loan)? f. If the inflation rate is 1%, what is the real value of the first (year-end) payment? g. If the inflation rate is 1%, what is the real value of the last (year-end) payment? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Req A Req B e. Paid off loan f. Real value of the first payment g. Real value of the last payment Req C and D Req H Req 11 Req H > Req 12 and J Complete this question by entering your answers in the tabs below. Req A Req C and D Req E to G Req H Now assume the inflation rate is 7% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? Note: Do not round intermediate calculations. Enter your answer as a whole percent. New nominal interest rate % Req B < Req E to G Req 11 Req 11 > Req 12 and J Complete this question by entering your answers in the tabs below. Req A Req B Req C and D Req E to G i-2. Real value of the first payment j. Real value of the first payment Req H < Req 11 Req 11 i-2. What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Req 12 and J Req 12 and J

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings for Year 1 BeginningofYear Bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started