Question

Suppose you take out a $106,000, 20-year mortgage loan to buy a condo. The interest rate on the loan is 6%. To keep things simple,

Suppose you take out a $106,000, 20-year mortgage loan to buy a condo. The interest rate on the loan is 6%. To keep things simple, we will assume you make payments on the loan annually at the end of each year.

f. If the inflation rate is 2%, what is the real value of the first (year-end) payment?

g. If the inflation rate is 2%, what is the real value of the last (year-end) payment?

h. Now assume the inflation rate is 8% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate?

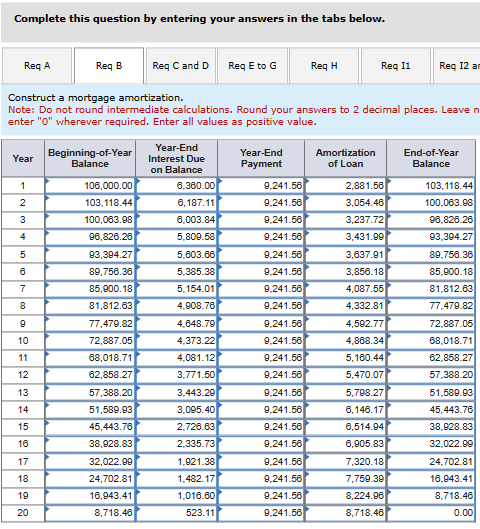

i-1. Recompute the amortization table.

i-1. Recompute the amortization table.

i-2. What is the real value of the first (year-end) payment in this high-inflation scenario?

j. What is the real value of the last payment in this high-inflation scenario?

Complete this question by entering your answers in the tabs below. Construct a mortgage amortization. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Leave enter "0" wherever required. Enter all values as positive valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started