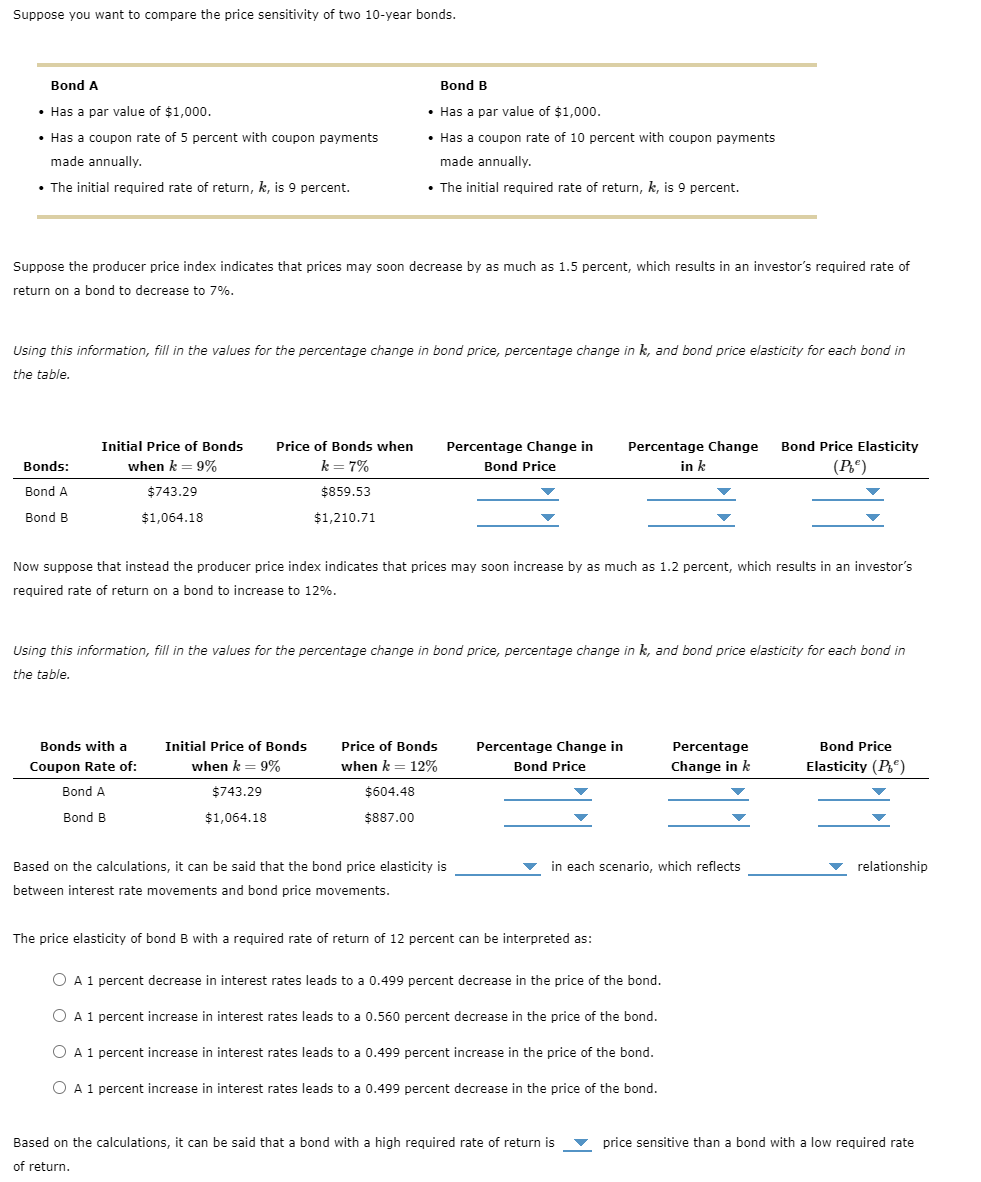

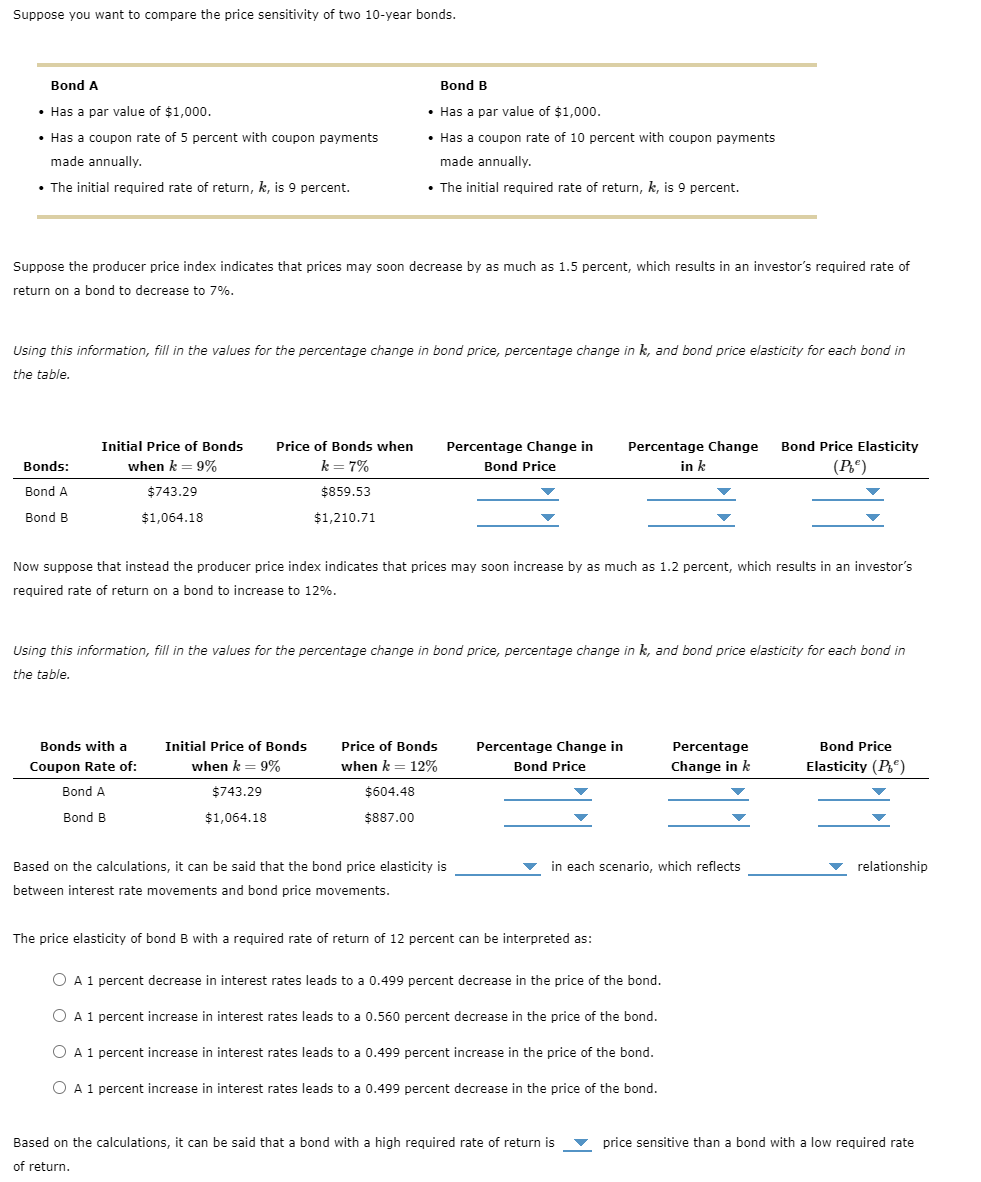

Suppose you want to compare the price sensitivity of two 10-year bonds. Bond A Bond B Has a par value of $1,000. Has a par value of $1,000. Has coupon rate of 5 percent with coupon payments made annually. The initial required rate of return, k, is 9 percent. Has a coupon rate of 10 percent with coupon payments made annually. The initial required rate of return, k, is 9 percent. Suppose the producer price index indicates that prices may soon decrease by as much as 1.5 percent, which results in an investor's required rate of return on a bond to decrease to 7%. Using this information, fill in the values for the percentage change in bond price, percentage change in k, and bond price elasticity for each bond in the table. Initial Price of Bonds when k=9% Price of Bonds when k= 7% Percentage Change in Bond Price Percentage Change in k Bond Price Elasticity (P.) Bonds: Bond A $743.29 $859.53 Bond B $1,064.18 $1,210.71 Now suppose that instead the producer price index indicates that prices may soon increase by as much as 1.2 percent, which results in an investor's required rate of return on a bond to increase to 12%. Using this information, fill in the values for the percentage change in bond price, percentage change in k, and bond price elasticity for each bond in the table. Bonds with a Coupon Rate of: Initial Price of Bonds when k=9% Price of Bonds when k=12% Percentage Change in Bond Price Percentage Change in k Bond Price Elasticity (P) Bond A $743.29 $604.48 Bond B $1,064.18 $887.00 in each scenario, which reflects relationship Based on the calculations, it can be said that the bond price elasticity is between interest rate movements and bond price movements. The price elasticity of bond with a required rate of return of 12 percent can be interpreted as: O A 1 percent decrease in interest rates leads to a 0.499 percent decrease in the price of the bond. O A 1 percent increase in interest rates leads to a 0.560 percent decrease in the price of the bond. O A 1 percent increase in interest rates leads to a 0.499 percent increase in the price of the bond. O A 1 percent increase in interest rates leads to a 0.499 percent decrease in the price of the bond. Based on the calculations, it can be said that a bond with a high required rate of return is of return. price sensitive than a bond with a low required rate